Oct 14, 2022 4:00 PM EDT VOO Dividend Information VOO has a dividend yield of 1.77% and paid $5.81 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Sep 28, 2022.

| Ex-Dividend Date | Payout Date | % Change |

|---|---|---|

| 2022-06-29 | 2022-07-05 | 4.22% |

| 2022-03-24 | 2022-03-29 | -10.37% |

| 2021-12-21 | 2021-12-27 | 17.20% |

| 2021-09-29 | 2021-10-04 | -1.87% |

When does Vanguard’s Voo stock go ex-dividend?

Vanguard’s VOO went ex-dividend the 29 th of June with a dividend of $1.432 per share. Vanguard does not release their ex-div dates and distribution dates until just a few days before they happen, so the future dates below are just estimates.

Do IVV and VOO hold dividends until the payout date?

IVV and VOO reinvest dividends into their constituent stocks until the payout date arrives. SPY is restricted by its Unit Investment Trust legal structure to hold dividends in cash until they are paid out. SPY is the largest ETF in the world, currently with $370 billion in assets under management.

What are the next dividend dates for Spy Spy Voo IVV?

Next 2021 SPY, VOO, IVV Ex-Dividend Dates and Estimated Dividends Ticker Next Ex-dividend Next Pay Date June Dividend September Dividend SPY 17-Sept-2021 29-Oct-2021 1.376 1.428 IVV 24-Sept-2021 30-Sep-2021 1.225 1.43 (est) VOO 27-June-2021 (est) 1-Oct-2021 (est) 1.333 1.37 (est)

When is the next Vanguard S&P 500 ETF dividend?

The next Vanguard S&P 500 ETF dividend is expected to go ex in 2 months and to be paid in 2 months . The previous Vanguard S&P 500 ETF dividend was 143.21c and it went ex 1 month ago and it was paid 1 month ago . There are typically 4 dividends per year (excluding specials), and the dividend cover is approximately 1.0.

What is Vanguard S&P 500 ETF's dividend yield?

When did Vanguard S&P 500 ETF last increase or decrease its dividend?

About this website

How many times a year does VOO pay dividends?

VOO Dividend Information VOO has a dividend yield of 1.74% and paid $5.81 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Sep 28, 2022.

Is VOO compounded annually?

In the last 10 Years, the Vanguard S&P 500 (VOO) ETF obtained a 11.66% compound annual return, with a 14.33% standard deviation. In 2021, the ETF granted a 1.59% dividend yield.

What is the dividend growth rate of VOO?

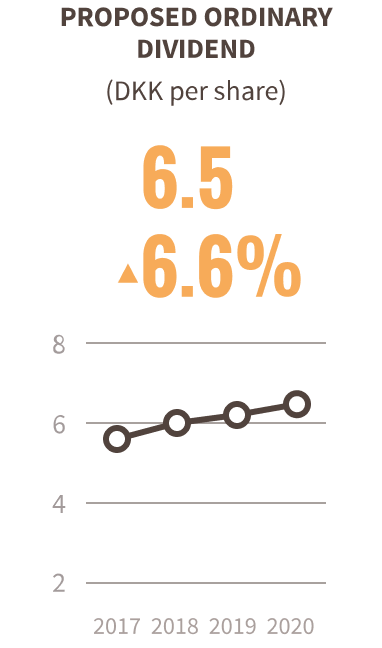

VOO Dividend GradeVOODividend Growth Rate 5Y (CAGR)5.33%Dividend Growth Rate 10Y (CAGR)8.44%Consecutive Years of Dividend Growth1 YearConsecutive Years of Dividend Payments11 Years3 more rows

What is the ex date for dividends?

The ex-dividend date for stocks is usually set one business day before the record date. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend.

What is the 10 year average return on VOO?

11.66Month-End Average Annual Total Returns And Risks As of 09/30/2022AverageNAV ReturnBeta1 Year-15.521.00%3 Year+8.121.00%5 Year+9.201.00%10 Year+11.661.00%2 more rows

Is VOO good for retirement?

Vanguard S&P 500 ETF (VOO) A great backbone for your retirement portfolio is the Vanguard S&P 500 ETF (VOO -2.25%). It tracks the S&P 500 index, a collection of 500 of the largest publicly traded corporations in the U.S., representing about 80% of the domestic stock market.

Will VOO ever split?

The split for VOO took place on October 24, 2013. This was a 1 for 2 reverse split, meaning for each 2 shares of VOO owned pre-split, the shareholder now owned 1 share. For example, a 1000 share position pre-split, became a 500 share position following the split....VOO Split History TableDateRatio10/24/20131 for 2

Is Spy or VOO better?

While VOO has an expense ratio of 0.03%, SPY is 0.0945%. That means VOO has an annual advantage of 0.0645% on the expense ratio, which makes up slightly more than half the difference in annual performance.

What ETF pays the highest dividend?

25 high-dividend ETFsSymbolETF nameAnnual dividend yieldVOOVanguard S&P 500 ETF1.24%VTIVanguard Total Stock Market ETF1.19%ITOTiShares Core S&P Total U.S. Stock Market ETF1.17%XLKTechnology Select Sector SPDR Fund0.67%21 more rows•Oct 5, 2022

How long do you need to hold stock for dividend?

If you buy a stock one day before the ex-dividend, you will get the dividend. If you buy on the ex-dividend date or any day after, you won't get the dividend. Conversely, if you want to sell a stock and still get a dividend that has been declared, you need to hang onto it until the ex-dividend day.

Which stock has the highest dividend?

Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks.

When should I expect my dividend?

Dividends are usually paid quarterly, but other schedules are also possible. Special dividends are one-time payments that should not be counted on to reoccur.

What is the annual rate of return on VOO?

Vanguard S&P 500 ETFNYSE Arca:VOOMarket Return % (as of 09/30/2022)NAV Return % (as of 09/30/2022)Year-to-date-23.91%-23.90%1-Year-15.48%-15.52%3-Year+8.12%+8.12%5-Year+9.20%+9.20%5 more rows

Do all ETFs have compound interest?

Assets like stocks, mutual funds, and ETFs also accrue interest, which is why investment accounts experience compound interest.

What is the average interest rate of VOO?

The VOO ETF pays a market-like distribution yield of 1.6%.

Is VOO good long term?

What history has shown us is that the markets always bounce back. VOO tracks the S&P almost identically. The average annual returns over the previous 10 years have been 14.6%, and since VOO's inception, it has returned an average annual return of 15.33%.

What is Vanguard S&P 500 ETF's dividend yield?

The current dividend yield for Vanguard S&P 500 ETF is 1.46%. Learn more on VOO's dividend yield history.

How much is Vanguard S&P 500 ETF's annual dividend?

The annual dividend for VOO shares is $5.65. Learn more on VOO's annual dividend history.

How often does Vanguard S&P 500 ETF pay dividends?

Vanguard S&P 500 ETF pays Quarterly dividends to shareholders.

When was Vanguard S&P 500 ETF's most recent dividend payment?

Vanguard S&P 500 ETF's most recent Quarterly dividend payment of $1.53 per share was made to shareholders on Monday, December 27, 2021.

When did Vanguard S&P 500 ETF last increase or decrease its dividend?

The most recent change in the company's dividend was an increase of $0.22 on Friday, December 17, 2021.

VOO Dividend History, Dates & Yield | Stock Analysis

VOO News. 3 minutes ago - 5 Most-Loved ETFs at the Onset of Q4 - Zacks Investment Research 2 hours ago - 2 Magnificent Index Funds That Could Make You a Stock Market Millionaire - The Motley Fool 3 days ago - Here's Why 54% of My Portfolio Is in This Top Index Fund - The Motley Fool 4 days ago - 7 Stocks for Beginners to Buy Now - InvestorPlace

Dividend History | VOO Vanguard S&P 500 Etf Payout Date

Dividend History | Yields, dates, complete payout history and stock information

VOO Dividend Yield - YCharts

The dividend yield measures the ratio of dividends paid / share price. Companies with a higher dividend yield tend to have a business model that allows them to pay out more dividends from net income like real estate and consumer defensive stocks.

S&P 500 ETF Vanguard's (VOO) 47 Dividends From 2010-2022 ... - Netcials

Here is your answer: S&P 500 ETF Vanguard (VOO) paid a dividend of 1.469 per share on Sep 28, 2022. Assume, you had bought 1000$ worth of shares before one year on Sep 28, 2021.. The closing price during Sep 28, 2021 was 400.14. For 1000$ you would have purchased 2 number of shares.

Vanguard S&P 500 ETF (VOO) Dividend History | Nasdaq

To add symbols: Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

Vanguard S&P 500 ETF (VOO) Dividend Yield | Seeking Alpha

Vanguard S&P 500 ETF (VOO) dividend yield: annual payout, 4 year average yield, yield chart and 10 year yield history.

What is Vanguard S&P 500 ETF's dividend yield?

The current dividend yield for Vanguard S&P 500 ETF (NYSEARCA:VOO) is 1.38%. Learn more

When did Vanguard S&P 500 ETF last increase or decrease its dividend?

The most recent change in Vanguard S&P 500 ETF's dividend was an increase of $0.22 on Friday, December 17, 2021.

What is dividend uptrend rating?

A stock’s Dividend Uptrend rating is dependent on the company’s price-to-earnings (P/E) ratio to evaluate whether or not a stock’s dividend is likely to trend upward. If a stock is valued near, or slightly below the market average, research has shown that the market expects the stock’s dividend to increase.

What does relative strength mean in dividend stocks?

The relative strength of a dividend stock indicates whether the stock is uptrending or not. The major determining factor in this rating is whether the stock is trading close to its 52-week-high.

What is dividend reliability?

Dividend Reliability. A stock’s dividend reliability is determined by a healthy payout ratio that is higher than other stocks. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future.

What is a stock's earnings growth rating?

A stock’s Earnings Growth rating evaluates a company’s expected EPS for the current financial year and compares it to next financial year’s expected EPS. Stocks with single-digit growth estimates will have a higher rating than others, as our research has shown that well-established dividend-paying companies have modest earnings growth estimates.

What is a Standard and Poor's 500 index fund?

The fund employs an indexing investment approach designed to track the performance of the Standard & Poor's 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

What is turnover in mutual funds?

Turnover provides investors a proxy for the trading fees incurred by mutual fund managers who frequently adjust position allocations. Higher turnover means higher trading fees.

Is a high dividend yield risky?

If a stock’s yield is above or near the market average then it will be rated higher within this parameter. High dividend yields (usually over 10%) should be considered extremely risky, while low dividend yields (1% or less) are simply not very beneficial to long-term investors. Dividend Reliability.

What is the largest ETF in the world?

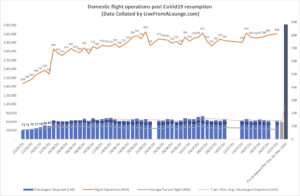

SPY is the largest ETF in the world, currently with $337 billion in assets under management. The next two largest ETFs that track the S&P 500 are iShare’s IVV and Vanguard’s VOO—currently with $238 billion and $192 billion in assets respectively. The table below summarizes dividend information for SPY, IVV, and VOO.

When will SPY pay dividends in 2021?

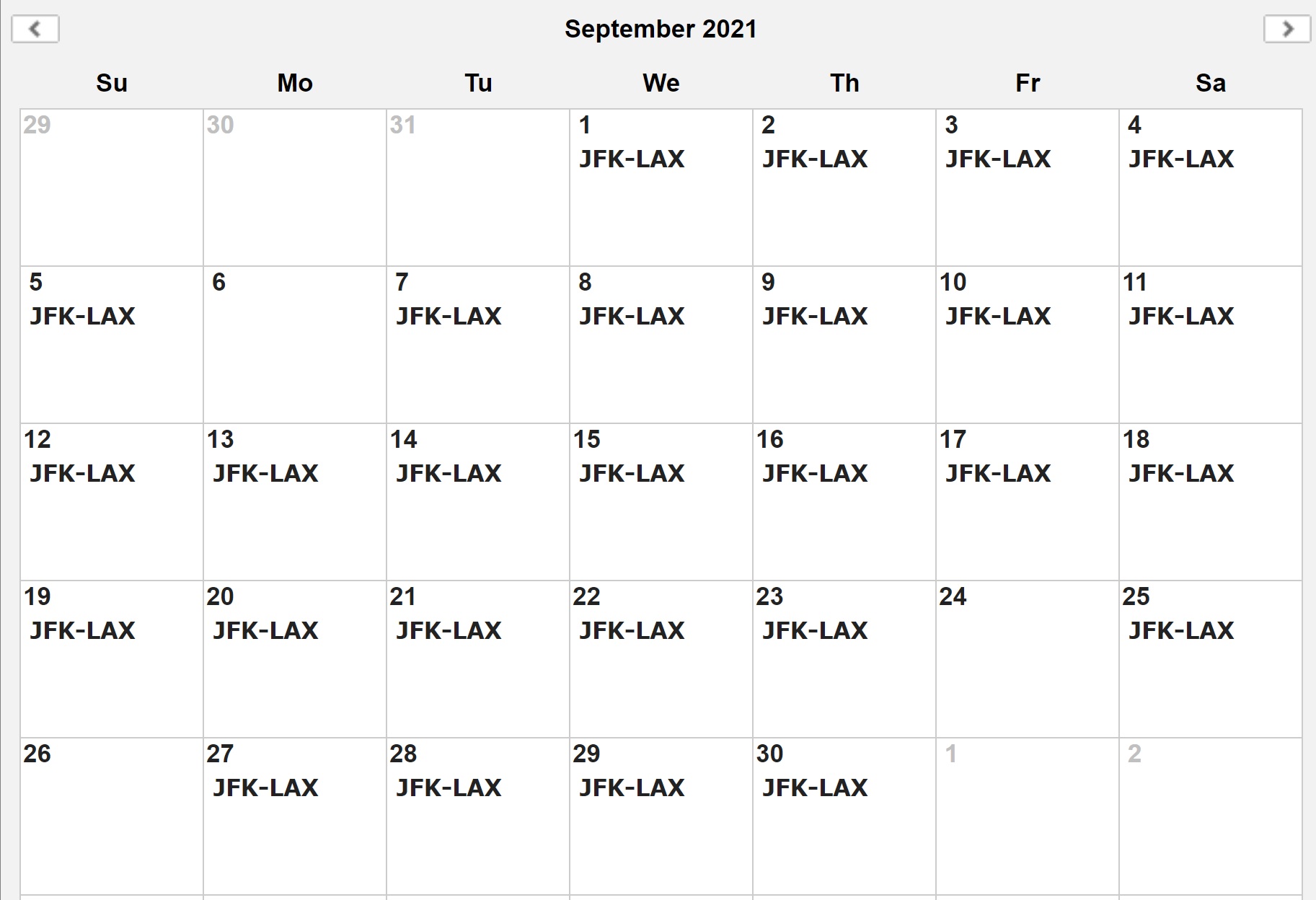

SPY went ex-dividend Friday, September 17 th, 2021 with a dividend of $1.428 per share. SPY’s next distribution payout will be on October 29 th, 2021—yes the SPDR folks take their time delivering the dividend. iShares’ IVV, one of the other two big S&P 500 ETFs, went ex-dividend on the 24 th of September with a dividend of $1.693 per share . Vanguard’s VOO went ex-dividend on the 29 th of September with a dividend of $1.308 per share. Vanguard does not release their ex-div dates and distribution dates until just a few days before they happen, so the future dates below are just estimates. VOO and IVV are much faster to distribute the dividends—both payout within a week of their ex-dividend dates. IVV and VOO reinvest dividends into their constituent stocks until the payout date arrives. SPY is restricted by its Unit Investment Trust legal structure to hold dividends in cash until they are paid out.

When do you have to buy stock to get dividends?

1.2625. 1.333. You only have to buy a stock or ETF the day prior to its ex-dividend date to be eligible for the dividend . You can sell on the ex-dividend date if you want and still collect the dividend when the distribution/pay date arrives.

Does Vanguard have an ex dividend date?

Vanguard only publishes ex-dividend dates a few days prior to the event itself, so future dates for VOO are just estimates. Reference data for SPY and IVV dividends can be found here. You only have to buy a stock or ETF the day prior to its ex-dividend date to be eligible for the dividend. You can sell on the ex-dividend date if you want ...

Does Vanguard release ex-div?

Vanguard does not release their ex-div dates and distribution dates until just a few days before they happen, so the future dates below are just estimates. VOO and IVV are much faster to distribute the dividends—both payout within a week of their ex-dividend dates.

What is Vanguard S&P 500 ETF's dividend yield?

The current dividend yield for Vanguard S&P 500 ETF (NYSEARCA:VOO) is 1.38%. Learn more

When did Vanguard S&P 500 ETF last increase or decrease its dividend?

The most recent change in Vanguard S&P 500 ETF's dividend was an increase of $0.22 on Friday, December 17, 2021.