| Declare Date | Ex-Div Date | Adj. Amount |

|---|---|---|

| 3/25/2022 | 3/28/2022 | 0.0413 |

| 3/25/2022 | 3/28/2022 | 0.9519 |

| 12/28/2021 | 12/29/2021 | 0.3038 |

| 12/28/2021 | 12/29/2021 | 1.3862 |

When does Vanguard pay dividends?

The majority of Vanguard exchange-traded funds (ETFs) pay dividends on a quarterly or annual basis. Vanguard ETFs focus on a single sector of the stock market or the fixed-income market. Vanguard fund investments in equities or bonds generally yield dividends or interest, which Vanguard distributes as dividends to its shareholders in order to maintain its investment company tax status.

When is voo next ex dividend date?

Vanguard S&P 500 ETF's next ex-dividend date is projected to be between 28-Jun - 30-Jun. The next dividend for VOO is projected to be between 1.3329 - 1.4333. About VOO's dividend: Number of times Vanguard S&P 500 ETF has decreased the dividend in the last 3 years:7

When does Vym pay dividends?

VYM does not make monthly dividend payments. It pays dividends on a quarterly basis, or 4 times per year. Which months does it pay? You might ask. If you are trying to plan your dividend income calendar. Based on my experience, the stock’s dividends are paid during March, June, September, and December.

What is dividend date and ex-dividend date?

Both dates determine whether a stockholder earns the dividend but come at different points in the timeline. Different sources determine the two dates. The ex-dividend date comes from a stock exchange's rules, whereas the company itself chooses the record date. Therefore, the former depends on the latter.

How often are Vanguard dividends paid?

Most Vanguard exchange-traded funds (ETFs) pay dividends on a regular basis, typically once a quarter or year.

Is Next paying a dividend in 2022?

Eventually, the (relatively) good times returned and the company has now pledged to resume regular dividends in 2022.

What companies are in the Vanguard Dividend Growth Fund?

Top 10 HoldingsUnitedHealth Group Inc. 4.05%Colgate-Palmolive Co. 3.73%TJX Companies Inc. 3.70%Northrop Grumman Corp. 3.49%Honeywell International Inc. 3.01%McDonald's Corp. 2.94%Johnson & Johnson. 2.92%Procter & Gamble Co. 2.90%More items...•

Which Vanguard fund pays highest dividends?

Best Vanguard Funds for DividendsVanguard Utilities Index Adm (VUIAX) focuses on stocks in the utilities sector, which is highly sought for its high dividends. ... Vanguard High Dividend Yield Index (VHYAX) is ideal for investors looking for income now with high yields for stocks.More items...•

What is dividend record date 2022?

In order to determine the entitlement of the investors for the second interim dividend for the year 2022, if any, the record date would be November 1, 2022, the company said.

What is the next shell dividend?

Shell's next quarterly payment date is on Sep 18, 2022, when Shell shareholders who owned SHEL shares before Aug 10, 2022 received a dividend payment of $0.5 per share.

What is the best dividend growth fund?

Vanguard Dividend Appreciation ETF (ticker: VIG)Vanguard Dividend Appreciation ETF (ticker: VIG) ... Schwab U.S. Dividend Equity ETF (SCHD) ... iShares Core Dividend Growth ETF (DGRO) ... First Trust Value Line Dividend Index Fund (FVD) ... Global X SuperDividend ETF (SDIV) ... Alerian MLP ETF (AMLP) ... Vanguard Real Estate ETF (VNQ)

What Vanguard ETF pay monthly dividends?

The 5 ETFs that pay high dividends from Vanguard's line up of dividend funds are:High Dividend Yield ETF (VYM)Dividend Appreciation ETF (VIG)International High Dividend Yield ETF (VYMI)Utilities ETF (VPU)Real Estate ETF (VNQ)

Which is better VIG or VYM?

VYM – Performance Backtest. In short, VIG has handily beaten VYM on every metric since inception – higher return, lower volatility, smaller drawdowns, and considerably higher risk-adjusted return (Sharpe).

Is Vwinx a good buy now?

Is VWINX a Good Investment? VWINX is a high-quality mutual fund that consistently outperforms its benchmark. It is a conservative income-focused fund, making it most suitable for long-term investors seeking regular income and only modest capital gains.

Is Vanguard Wellesley a good buy now?

VWINX holds a Zacks Mutual Fund Rank of 1 (Strong Buy), which is based on nine forecasting factors like size, cost, and past performance.

Is Kbwd a good buy?

Invesco KBW High Dividend Yield Financial ETF holds a Zacks ETF Rank of 2 (Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, KBWD is a great option for investors seeking exposure to the Financials ETFs segment of the market.

Which company gives highest dividend in 2022?

10 Best Highest Dividend Paying Stocks in India 2022SL No.Company NamePE Ratio1Coal India Limited11.242Indian Oil Corporation Limited5.743Rural Electrification Corporation Limited2.44Power Finance Corporation Limited2.766 more rows•Oct 3, 2022

How do I find my next dividend date?

The Declaration Date Dividend declarations often accompany earnings announcements. Existing shareholders receive the declaration information directly from the company, usually by a notice in the mail. Investing information websites regularly publish upcoming ex-dividend dates, along with the amount of the dividend.

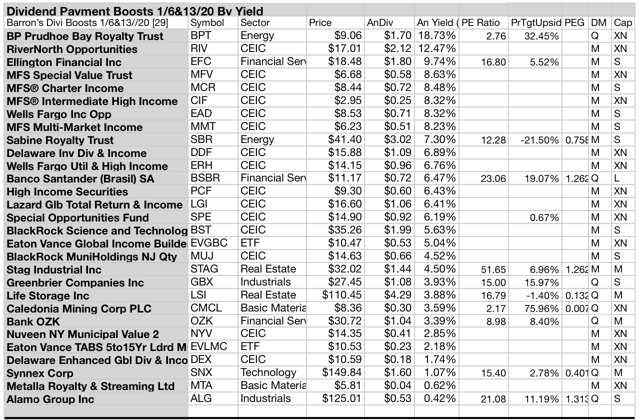

What stock pays the highest monthly dividend?

Table Of ContentsHigh-Yield Monthly Dividend Stock #4: Ellington Financial (EFC)High-Yield Monthly Dividend Stock #3: AGNC Investment Corporation (AGNC)High-Yield Monthly Dividend Stock #2: Broadmark Realty Capital (BMRK)High-Yield Monthly Dividend Stock #1: ARMOUR Residential REIT (ARR)More items...•

What is the best dividend stock of all time?

Best Dividend Stocks of All TimeWalmart Inc. (NYSE:WMT) ... The Kroger Co. (NYSE:KR) ... Colgate-Palmolive Company (NYSE:CL) Dividend Yield as of July 19: 2.42% ... The Procter & Gamble Company (NYSE:PG) Dividend Yield as of July 19: 2.55% ... Johnson & Johnson (NYSE:JNJ) Dividend Yield as of July 19: 2.59%

About VDIGX

The Vanguard Dividend Growth fund is designed to provide income through investments in dividend-focused companies across all industries. It concentrates on high-quality companies that can grow dividends over time. As of December 20, 2021, the fund has assets totaling almost $52.95 billion invested in 48 different holdings.

Rankings

U.S. News evaluated 1,228 Large Blend Funds. Our list highlights the top-rated funds for long-term investors based on the ratings of leading fund industry researchers.

Investment Strategy

The fund looks for companies that are likely to increase dividends, but whose stocks are trading at reasonable prices. This is not a high-yield strategy; rather, the manager looks for companies with the best opportunities to steadily raise dividends over time.

Role in Portfolio

Morningstar calls the fund a "core" holding. An investor with a balanced, long-term portfolio who seeks exposure to dividend-growing companies may want to consider this fund.

Management

Donald Kilbride manages the fund through subadvisor Wellington Management. He took the reins in 2006.

Performance

The fund has returned 18.77 percent over the past year, 16.02 percent over the past three years, 15.54 percent over the past five years and 14.01 percent over the past decade.

Risk

All stocks funds have risk. One of the fund’s particular risks is that returns from dividend-payers will lag the overall market in any given period.

Will VDIGX outperform in future?

Get our overall rating based on a fundamental assessment of the pillars below.

Look past this fund's recent slump

Vanguard Dividend Growth's key attributes remain intact and so does its Morningstar Analyst Rating of Gold.