When will Vanguard pay dividends?

The majority of Vanguard exchange-traded funds (ETFs) pay dividends on a quarterly or annual basis. Vanguard ETFs focus on a single sector of the stock market or the fixed-income market.

Does Vanguard 500 pay dividends?

Yes, S&P 500 ETF Vanguard (VOO) has paid dividends. In this post, you will find the past dividend dates and payouts. You will also find an interesting calculation before going deep into the report. What will be your payout if you had invested 1000$ one year before the last dividend date?

Do Vanguard funds pay dividends?

Vanguard International High Dividend Yield ETF (VYMI) VYMI focuses on non-U.S.-based dividend stocks with above-average dividend yield s. The fund is an excellent way to diversify an investment portfolio. Having nearly 1,000 stocks that pay dividends from across the globe. It represents a great list of international companies.

When does Vym pay dividends?

VYM does not make monthly dividend payments. It pays dividends on a quarterly basis, or 4 times per year. Which months does it pay? You might ask. If you are trying to plan your dividend income calendar. Based on my experience, the stock’s dividends are paid during March, June, September, and December.

When will Vanguard funds be distributed?

Does Vanguard fund have dividends?

Is Vanguard a dividend?

About this website

How often are dividends paid Vanguard?

Most Vanguard exchange-traded funds (ETFs) pay dividends on a regular basis, typically once a quarter or year.

What is the ex date for dividends?

Ex-dividend date: This is the cutoff date to decide who gets the next dividend payment. If you own the stock one business day before the ex-dividend date, you get the payment. If somebody else owns the stock on that date, they get the payment.

Where can I see dividends on Vanguard?

How can I keep track of transactions? You can view the dividend reinvestment status of the securities in your account online at vanguard.com or in the Holdings section of your regular Vanguard Brokerage statement. Reinvestment transactions will be reported in the Activity section on your regular brokerage statement.

How often does Vanguard Vtsax pay dividends?

QuarterlyDividend Payout HistoryDeclare DateEx-Div DateFrequency9/24/20209/24/2020Quarterly6/23/20206/24/2020Quarterly3/24/20203/25/2020Quarterly12/20/201912/23/2019Quarterly74 more rows

How long do you need to hold stock for dividend?

Briefly, in order to be eligible for payment of stock dividends, you must buy the stock (or already own it) at least two days before the date of record and still own the shares at the close of trading one business day before the ex-date.

Is it better to buy before or after ex-dividend date?

If you buy stocks one day or more before their ex-dividend date, you will still get the dividend. That's when a stock is said to trade cum-dividend. If you buy on the ex-dividend date or later, you won't get the dividend. The ex-dividend date is in place to allow pending stock trades to settle.

Which Vanguard funds pay the highest dividends?

8 top dividend index fundsFundDividend YieldRisk LevelVanguard High Dividend Yield ETF (NYSEMKT:VYM)2.36%Below AverageVanguard Dividend Appreciation Index ETF (NYSEMKT:VIG)1.79%Below AverageiShares Core Dividend Growth ETF (NYSEMKT:DGRO)2.03%Below AverageVanguard Real Estate ETF (NYSEMKT:VNQ)2.30%Average5 more rows

What is the highest dividend paying Vanguard ETF?

Vanguard Dividend ETFs Paying The Highest DividendsHigh Dividend Yield ETF (VYM)Dividend Appreciation ETF (VIG)International High Dividend Yield ETF (VYMI)Utilities ETF (VPU)Real Estate ETF (VNQ)

Is Vanguard good for dividends?

Therefore, the best Vanguard funds for dividends can be smart investment choices for almost any type of investor. Combined with their low costs, the yields and performance of Vanguard dividend funds make them some of the best to buy on the market.

Should I invest Vanguard High dividend yield?

Vanguard High Dividend Yield ETF holds a Zacks ETF Rank of 1 (Strong Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, VYM is an excellent option for investors seeking exposure to the Style Box - Large Cap Value segment of the market.

What Vanguard ETF pay monthly dividends?

Some of the most popular such dividend ETFs include:Vanguard Dividend Appreciation ETF (VIG)Fidelity International High Dividend ETF (FIDI)iShare Core High Dividend ETF (HDV)SPDR S&P Global Dividend ETF (WDIV)Schwab U.S. Equity Dividend ETF (SCHD)

Which is better Vtsax or VOO?

VTSAX and VOO are very similar investments. Since VTSAX is an admiral share fund, it offers very low expense ratios and the ability to purchase fractional shares. VTSAX also offers more diversification since it holds about 7 times more stocks. VOO did slightly outperform VTSAX.

Can I get dividend if I buy on ex-date?

The ex-dividend date for stocks is usually set one business day before the record date. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend.

Will I get dividend if I buy on record date?

However, investors who purchase shares on the record date will not be entitled to receive dividends, as it takes T+2 days, i.e. 2 business days for stocks to be delivered and reflected in company shareholders' records. Although sequentially ex-dividend day comes before the record date, it is set based on the latter.

Do I get dividend if I sell after ex-date?

If shares are sold on or after the ex-dividend date, they will still receive the dividend. When you purchase shares, your name does not automatically get added to the record book—this takes about three days from the transaction date.

Do I get dividend if I sell on record date?

But the company also gives a record date that is a week or two before the payment date. Only the shareholders of record in the company books on the record date will get the dividend. The ex-dividend date is at least one business day before the record date, which gives the company time to update its records.

2022 Dividend schedule - The Vanguard Group

1 2022 Dividend schedule VANGUARD FUND CUSIP TICKER 2022 RECORD DATE 2022 REINVEST AND/OR EX-DIVIDEND DATE 2022 PAYABLE DATE 500 Index Admiral™ Shares 922908710 VFIAX 3/22/22 3/23/22 3/24/22 6/27/22 6/28/22 6/29/22

Tax information for Vanguard funds | Vanguard

Any taxable income and/or realized capital gains that were greater than the amounts distributed in December 2021 will be distributed in March 2022 as "supplemental" income dividends or capital gains distributions.

2021 Dividend schedule - The Vanguard Group

2021 Dividend schedule Vanguard fund CUSIP Ticker 2021 record date 2021 reinvest and/or ex-dividend e dat 2021 payable date 500 Index Admiral™ Shares 922908710 VFIAX 3/24/21 3/25/21 3/26/21 6/25/21 6/28/21 6/29/21

Estimated year-end distributions - The Vanguard Group

Estimated capital gains Vanguard fund Ticker 2021 declaration date/record date 2021 reinvest/ ex-dividend date 2021 payable date Estimated QDI Net

Vanguard Financial Advisor Services | Vanguard Advisors

We would like to show you a description here but the site won’t allow us.

Vanguard Financial Advisor Services | Vanguard Advisors

We would like to show you a description here but the site won’t allow us.

When will Vanguard funds be distributed?

The remaining taxable income or gains will be distributed in March 2021 as "supplemental" income dividends or capital gains distributions.

Does Vanguard fund have dividends?

These Vanguard funds had ordinary income (i.e., dividend income plus short-term capital gains, if any) that qualifies for the intercorporate dividends-received deduction for corporations.

Is Vanguard a dividend?

These Vanguard funds had ordinary income (i.e., dividend income plus short-term capital gains, if any) in 2021 that may qualify as interest dividends under section 163 (j).

What are dividends?

Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will pay the dividend to the fund, and it will then be passed on to you through a fund dividend.

What are qualified dividends?

Dividends can be "qualified" for special tax treatment. (Those that aren't are called "nonqualified.") Most payments from the common stock of U.S. corporations are qualified as long as you hold the investment for more than 60 days.

What's the tax rate on dividends?

Qualified dividends are subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income.*

Get more from Vanguard. Call 1-800-962-5028 to speak with an investment professional

Get more from Vanguard. Call 1-800-962-5028 to speak with an investment professional.

Investor Education

Vanguard funds not held in a brokerage account are held by The Vanguard Group, Inc., and are not protected by SIPC. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

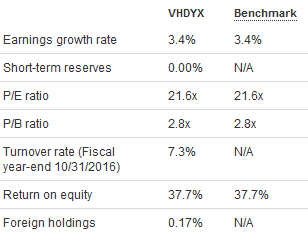

Fund Description

The fund employs an indexing investment approach designed to track the performance of the FTSE High Dividend Yield Index, which consists of common stocks of companies that pay dividends that generally are higher than average.

William Coleman

William A. Coleman, CFA, Portfolio Manager at Vanguard. He has worked in investment management since joining Vanguard in 2006 and has co-managed the Conservative Allocation and Moderate Allocation Portfolios since 2013. Education: B.S., King’s College; M.S., Saint Joseph’s University.

When will Vanguard funds be distributed?

The remaining taxable income or gains will be distributed in March 2021 as "supplemental" income dividends or capital gains distributions.

Does Vanguard fund have dividends?

These Vanguard funds had ordinary income (i.e., dividend income plus short-term capital gains, if any) that qualifies for the intercorporate dividends-received deduction for corporations.

Is Vanguard a dividend?

These Vanguard funds had ordinary income (i.e., dividend income plus short-term capital gains, if any) in 2021 that may qualify as interest dividends under section 163 (j).