How do I file a Utah State tax return?

You may also electronically file your Utah tax return through a tax preparer or using online tax software, and pay your taxes instantly using direct debit or a credit card (an additional credit card fee may apply). 7. If you filled out physical tax return forms, mail your completed Utah income tax return to the Utah no later then December 31st.

When does the IRS start accepting tax returns for 2022?

The IRS will begin accepting tax returns on January 24, 2022. 1 During the peak of tax filing season, it may take slightly longer for the IRS to process tax returns. Traditionally, the busy season begins around late March and lasts through April 15.

How do I get a transient room tax refund in Utah?

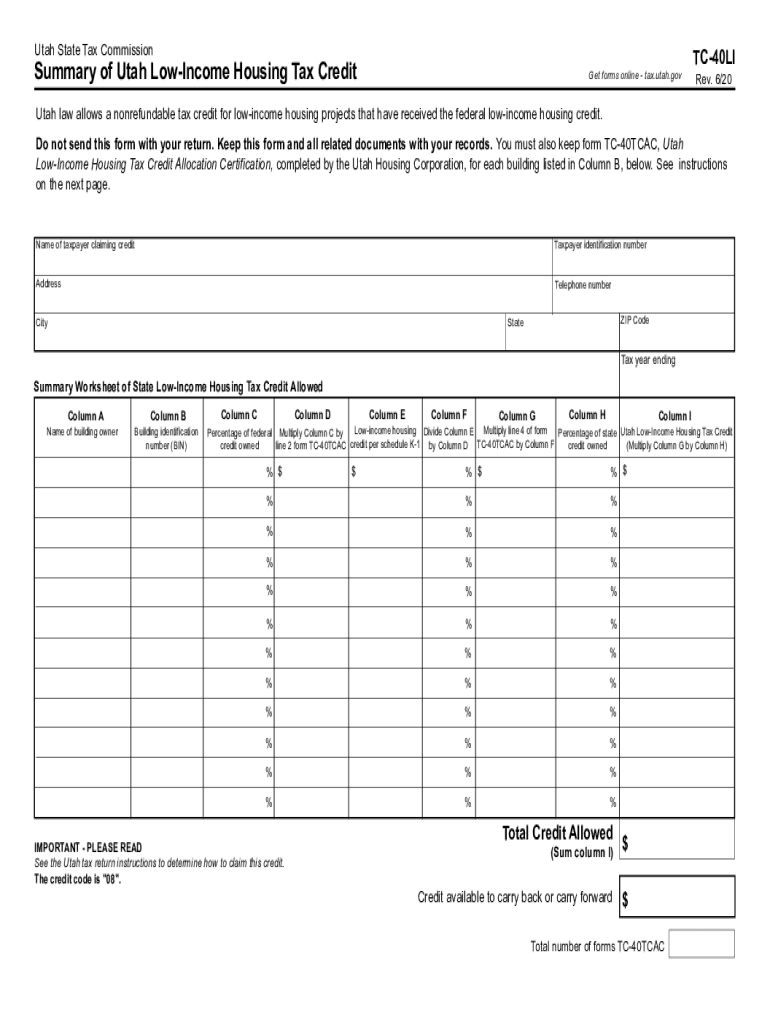

This form is provided by the Utah Housing Corporation if you qualify. Go to utahhousingcorp.org Transient Room Tax Refund Booklet for Governments. This coupon is not available online. See Pub 70 for more information. Utah State Business and Tax Registration.

Where can i e-file my taxes for 2023?

By January 2023, you can e-file here at Taxpert.com: Don't get TurboCharged or TurboTaxed in 2023 when you can e-file up to 60% less than popular tax preparation platforms. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available.

When can I expect my Utah State Tax Refund?

If you filed electronically, allow 60 days to process your return and refund request. If you filed on paper, allow 90 days to process your return and refund request.

How soon will tax refunds be issued 2022?

2022 IRS refund schedule chartDate taxes acceptedDirect deposit sentPaper check mailedFeb. 15 – Feb. 21Feb. 28March 7Feb. 22 – Feb. 28March 7March 14March 1 – March 7March 14March 21March 8 – March 14March 21March 2823 more rows

How long does it take for state tax refund direct deposit 2022?

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive.

What is the earliest you can get your tax refund?

Now, with a free IRS e-file, you can get your refund in as little as 8 days from when you file, if you elect for direct deposit. The IRS will begin accepting tax returns on January 24, 2022. That's about 3 weeks earlier than last year.

What day of the week does IRS deposit refunds 2022?

They now issue refunds every business day, Monday through Friday (except holidays). Due to changes in the IRS auditing system, they no longer release a full schedule as they did in previous years.

Why are 2022 refunds taking so long?

Is There a Delay on 2022 Tax Refunds? Last year, many taxpayers ended up waiting longer than the usual 21 days — some as long as eight weeks — to receive their refunds as the IRS was dealing with the backlog of returns caused by the COVID-19 pandemic. The IRS is still working through this backlog of 2020 tax returns.

Why has my refund been accepted but not approved?

An incomplete return, an inaccurate return, an amended return, tax fraud, claiming tax credits, owing certain debts for which the government can take part or all of your refund, and sending your refund to the wrong bank due to an incorrect routing number are all reasons that a tax refund can be delayed.

How long does it take for IRS to approve refund after it is accepted?

The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it's possible your tax return may require additional review and take longer.