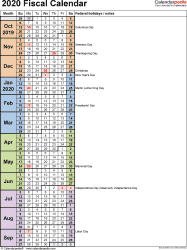

When will I be paid for work received after the due date?

Anything received after the due date will be paid on the following pay date. Work Schedules are due within 3 business days after the completion of the pay period for PTO and other tracking Pay Period.

When are work schedules due?

Work Schedules are due within 3 business days after the completion of the pay period for PTO and other tracking Pay Period.

Does this calendar apply to all salary employees?

This calendar applies to all salary employees. *Tentative dates, Subject to change based upon CCS Holiday closing dates. Due dates indicated above are applicable to payment requisitions and other payments outside of an employee’s regular salary.

How does 15th and 30th payroll work?

Two months during the year, employees receive three paychecks in a month. On the other hand, a semimonthly pay schedule means employees receive 24 paychecks per year. Semimonthly means that you pay employees two times per month on specific dates (e.g., the 15th and 30th of the month).

What are the semi-monthly pay periods for 2022?

Semimonthly pay Employers who choose this schedule can either pay their employees on the first and 15th of the month or on the 16th and last day of the month. Semimonthly pay has 24 pay periods and is most often used with salaried workers.

What is the formula for semi-monthly pay?

If you are paid in part based on how many days are in each month then divide your annual salary by 365 (or 366 on leap years) & then multiply that number by the number of days in the month to calculate monthly salary. Divide that number by 2 and you have the semi-monthly salary.

How do you calculate semi-monthly pay hours?

What can I expect my semi-monthly paychecks to include? The semi-monthly base salary is calculated by taking your annual salary and dividing that by 24, which represents 12 months times 2 pay dates each month. The semi-monthly base salary represents 86.67 hours of pay.

How does 1st and 15th payroll work?

If you're on a semimonthly pay schedule, you will receive a paycheck twice each month. One check will come in the middle of the month, and the other will arrive at the end of that month or the beginning of the next. Typical semimonthly pay schedules are the 1st and the 15th, or the 15th and the last day of the month.

How does a semi-monthly payroll work?

A semi-monthly pay schedule means pay checks are distributed two times a month, usually on fixed dates such as the 1st and 15th, or the 15th and 30th. However, they may not necessarily fall on the same day of the week, and you would end up paying your employees 24 times in a year instead of 26.

How do you calculate semi weekly pay?

How to Calculate Semi-Monthly Pay Based on Bi-Weekly SalaryMultiply gross pay for one bi-weekly pay period by 26 to get the annual salary.Divide the annual salary by 24 to get the gross pay for one semi-monthly period.

How many weeks are in a semi-monthly pay period?

2.16667 weeksDefinition of Semimonthly Payroll Semimonthly payroll refers to paydays that occur 24 times per year (12 months in a year multiplied by 2 paydays per month = 24 paydays). With 52 weeks in a year and 12 months in a year, each semimonthly pay period will have on average 2.16667 weeks per semimonthly payday.

How many hours is semi-monthly?

The difference is that full-time biweekly salaried employees will be paid for 80 hours each payday. Full-time semi-monthly employees will receive 86.67 hours of pay per paycheck. The hourly difference occurs because of the distinction in the number of paychecks the employees will receive.

How does overtime work when paid semi monthly?

Count the total number of hours for every other workweek in the pay period. Any employee who has worked more than 40 hours in any seven-day workweek is owed overtime at a rate of 1.5 times his or her regular rate of pay, according to federal law.

How do you calculate monthly payroll hours?

With full-time employees, you should assume one employee will work a 40 hour workweek. A quick and easy method of calculating monthly hours is to multiply 40 hours per week by 4 weeks, yielding 160 hours for the month. The other method will provide the average number of work hours in a month.

What is time and a half for $20 an hour?

$30 anAssume an employee earns $20 hourly during a 40-hour work week. Their time and a half pay would be $20 x 1.5 for a total of $30 an hour.

Excel Facts

MATCH uses -1 to find larger value (lookup table must be sorted ZA). XLOOKUP uses 1 to find values greater and does not need to be sorted.

Similar threads

Simple (I thought) loop, compare, copy and paste question from a somewhat VBA newbie.....