| Ex/EFF DATE | TYPE | PAYMENT DATE |

|---|---|---|

| 03/03/2022 | CASH | 03/11/2022 |

| 02/03/2022 | CASH | 02/11/2022 |

| 12/30/2021 | CASH | 01/07/2022 |

| 11/03/2021 | CASH | 11/12/2021 |

Is SDIV a good buy?

While SDIV’s income stream looks impressive, a deeper dive shows real cause for concern. The fund focuses almost exclusively on dividend yield when choosing stocks to buy, which is why its performance has been poor. In fact, we can use three similarly high-yielding CEFs to show where SDIV falls short.

What is the difference between dividend and proposed dividend?

On the other hand, A Dividend payable is the dividend paid to the shareholders, finalized in annual general meetings. A proposed dividend is a dividend that is to get distributed to the shareholders of the company, which is due in a financial year for a specific year.

What is interim dividend and final dividend?

Interim Dividend is declared before the finalisation of accounts of the company. In contrast, final dividend is announced after the preparation of company’s financial statements. The interim dividend can be cancelled, with the consent of all shareholders, whereas once the final dividend is declared, it cannot be reversed.

Does stock dividend increase shareholders wealth?

Though taxed as income, dividends do not provide income nor do they provide Total Return. So I suppose that you want something more substantial than that?. If anything, dividends might DECREASE shareholder wealth. The stock exchanges reduce share price by the EXACT amount of the dividend on the ex-dividend date.

How often does SDIV pay dividends?

every monthSDIV has a dividend yield of 16.00% and paid $1.20 per share in the past year. The dividend is paid every month and the last ex-dividend date was Oct 5, 2022.

Is SDIV a good dividend stock?

High Income Potential SDIV accesses 100 of the highest dividend paying equities around the world, potentially increasing a portfolio's yield.

Is SDIV a good long term investment?

However, not every high-yielding dividend security is a wise investment. Many high-yielding securities are quite risky, such as SDIV. Although SDIV paid high dividends over the years, its total returns remained in the negative double-digit range.

Is SDIV a REIT?

Global X SuperDividend ETF | REIT Profile SDIV makes distributions on a monthly basis and has made distributions each month for over eight years. Investing in equities from around the globe can help diversify both geographic and interest rate exposure.

Is SDIV a dividend trap?

SDIV Is A Dividend Yield Trap.

Will SDIV go up?

Given the current short-term trend, the ETF is expected to fall -11.25% during the next 3 months and, with a 90% probability hold a price between $6.63 and $7.82 at the end of this 3-month period.

Why does Sdiv keep dropping?

Very few CEFs cut their dividends during the COVID-19 selloff in March, and more are beginning to increase their payouts now that the market is recovering. Meanwhile, SDIV's payouts are dropping because it cannot adapt to the pandemic.

What ETF pays monthly dividends?

The Best Monthly Dividend ETFsGlobal X SuperDividend ETF. Global X SuperDividend ETF. ... Global X SuperDividend U.S. ETF. Global X Super Dividend ETF. ... Invesco Preferred ETF. Invesco Preferred ETF. ... Invesco KBW High Dividend Yield Financial ETF. ... iShares Preferred and Income Securities ETF.

Is JEPI a good ETF?

The JEPI ETF seems like the best of both worlds, offering a 10.6% dividend yield and downside protection in a bear market. However, there's no free lunch here; the benefits come with a drawback. Investors should be aware that JEPI is likely to underperform significantly during the next bull market.

What are SDIV holdings?

SDIV Top 10 HoldingsBW LPG Ltd. 1.94%Petroleo Brasileiro SA Pfd 1.72%CPFL Energia S.A. 1.72%Imperial Brands PLC 1.69%Omega Healthcare Investors, Inc. 1.67%Yuexiu Property Co., Ltd. 1.60%Unipar Carbocloro SA Pfd Class B 1.52%Diversified Energy Company PLC 1.52%More items...•

What is SPYD dividend?

SPYD has a dividend yield of 4.31% and paid $1.60 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Sep 16, 2022.

How is dividend yield calculated?

Dividend yield equals the annual dividend per share divided by the stock's price per share.

What ETF pays monthly dividends?

The Best Monthly Dividend ETFsGlobal X SuperDividend ETF. Global X SuperDividend ETF. ... Global X SuperDividend U.S. ETF. Global X Super Dividend ETF. ... Invesco Preferred ETF. Invesco Preferred ETF. ... Invesco KBW High Dividend Yield Financial ETF. ... iShares Preferred and Income Securities ETF.

Is Kbwd a good buy?

Invesco KBW High Dividend Yield Financial ETF holds a Zacks ETF Rank of 2 (Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, KBWD is a great option for investors seeking exposure to the Financials ETFs segment of the market.

Is JEPI a good ETF?

The JEPI ETF seems like the best of both worlds, offering a 10.6% dividend yield and downside protection in a bear market. However, there's no free lunch here; the benefits come with a drawback. Investors should be aware that JEPI is likely to underperform significantly during the next bull market.

Is Div A Good Investment?

Dividend investing can be a great investment strategy. Dividend stocks have historically outperformed the S&P 500 with less volatility. That's because dividend stocks provide two sources of return: regular income from dividend payments and capital appreciation of the stock price. This total return can add up over time.

What is Global X SuperDividend ETF's dividend yield?

The current dividend yield for Global X SuperDividend ETF is 13.06%. Learn more on SDIV's dividend yield history.

How much is Global X SuperDividend ETF's annual dividend?

The annual dividend for SDIV shares is $1.20. Learn more on SDIV's annual dividend history.

How often does Global X SuperDividend ETF pay dividends?

Global X SuperDividend ETF pays monthly dividends to shareholders.

When was Global X SuperDividend ETF's most recent dividend payment?

Global X SuperDividend ETF's most recent monthly dividend payment of $0.1222 per share was made to shareholders on Thursday, February 13, 2020.

When did Global X SuperDividend ETF last increase or decrease its dividend?

The most recent change in the company's dividend was a decrease of $0.0030 on Wednesday, December 4, 2019.

How much is Global X SuperDividend ETF's annual dividend?

The annual dividend for Global X SuperDividend ETF (NYSEARCA:SDIV) is $1.12. Learn more

What is the dividend yield of Global X Superdividend ETF?

Global X SuperDividend ETF pays an annual dividend of $0.97 per share, with a dividend yield of 7.00%. SDIV's most recent monthly dividend payment was made to shareholders of record on Thursday, February 13.

When was Global X SuperDividend ETF's most recent dividend payment?

Global X SuperDividend ETF's most recent monthly dividend payment of $0.1222 per share was made to shareholders on Thursday, February 13, 2020.

When did Global X SuperDividend ETF last increase or decrease its dividend?

The most recent change in Global X SuperDividend ETF's dividend was a decrease of $0.0030 on Wednesday, December 4, 2019.

What is dividend uptrend rating?

A stock’s Dividend Uptrend rating is dependent on the company’s price-to-earnings (P/E) ratio to evaluate whether or not a stock’s dividend is likely to trend upward. If a stock is valued near, or slightly below the market average, research has shown that the market expects the stock’s dividend to increase.

What does relative strength mean in dividend stocks?

The relative strength of a dividend stock indicates whether the stock is uptrending or not. The major determining factor in this rating is whether the stock is trading close to its 52-week-high.

What is turnover in mutual funds?

Turnover provides investors a proxy for the trading fees incurred by mutual fund managers who frequently adjust position allocations. Higher turnover means higher trading fees.

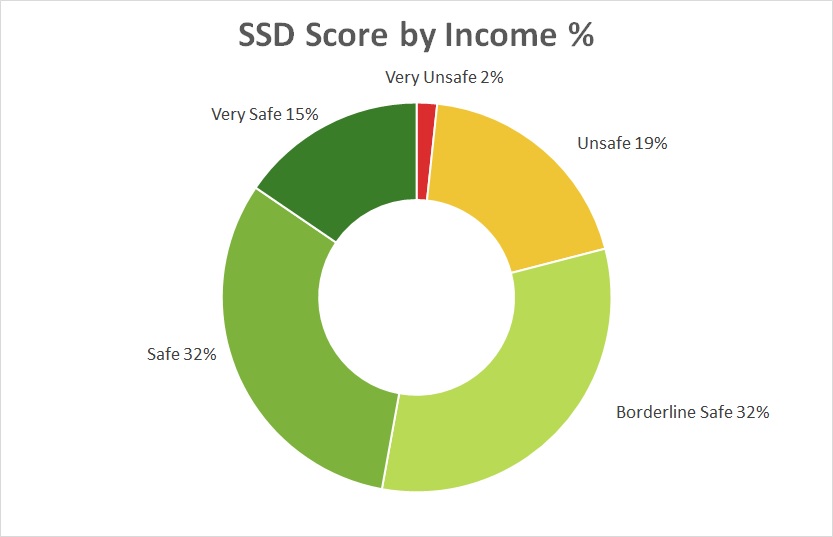

Is a high dividend yield risky?

If a stock’s yield is above or near the market average then it will be rated higher within this parameter. High dividend yields (usually over 10%) should be considered extremely risky, while low dividend yields (1% or less) are simply not very beneficial to long-term investors. Dividend Reliability.