How do you fill out Schedule C?

The Schedule C Process: An Overview

- The process for completing Schedule C begins with gathering information.

- Complete the form, adding information and doing the calculations.

- This process will give you a net income or loss amount for your business. ...

How to enter Schedule C?

- If you have multiple Schedule C forms and multiple 1099-M/1099-NEC forms, make sure you enter the correct MFC (Multi-form Code). ...

- Go to the first Schedule C created from your 99M/99N screens and enter in the profession, business code and name of the business

- Delete the additional Schedules C that were generated incorrectly by the 99M/99N screen (s).

Where do I enter Schedule C?

To add a Schedule C so your 1099-NEC can be linked:

- Open or continue your return in TurboTax

- In the Search box type schedule c and click the Jump to link in the search results.

- Answer Yes to Did you have any self-employment income or expenses?

- Follow the onscreen instructions.

What is 1040 form Schedule C?

The 1040 Schedule C tax form is a tool for sole proprietors to ensure they don’t pay too much or too little in taxes. The form considers the income they make along with the expenses that it took to make that income.

What is TAs service?

What is the new limitation on excess business losses?

What happens if someone steals your SSN?

How to get a copy of my tax return?

What is the purpose of a 1040-C?

How much is the AMT exemption?

What is the maximum amount of income that will be taxed in 2021?

See 4 more

About this website

Where can I get Schedule C forms?

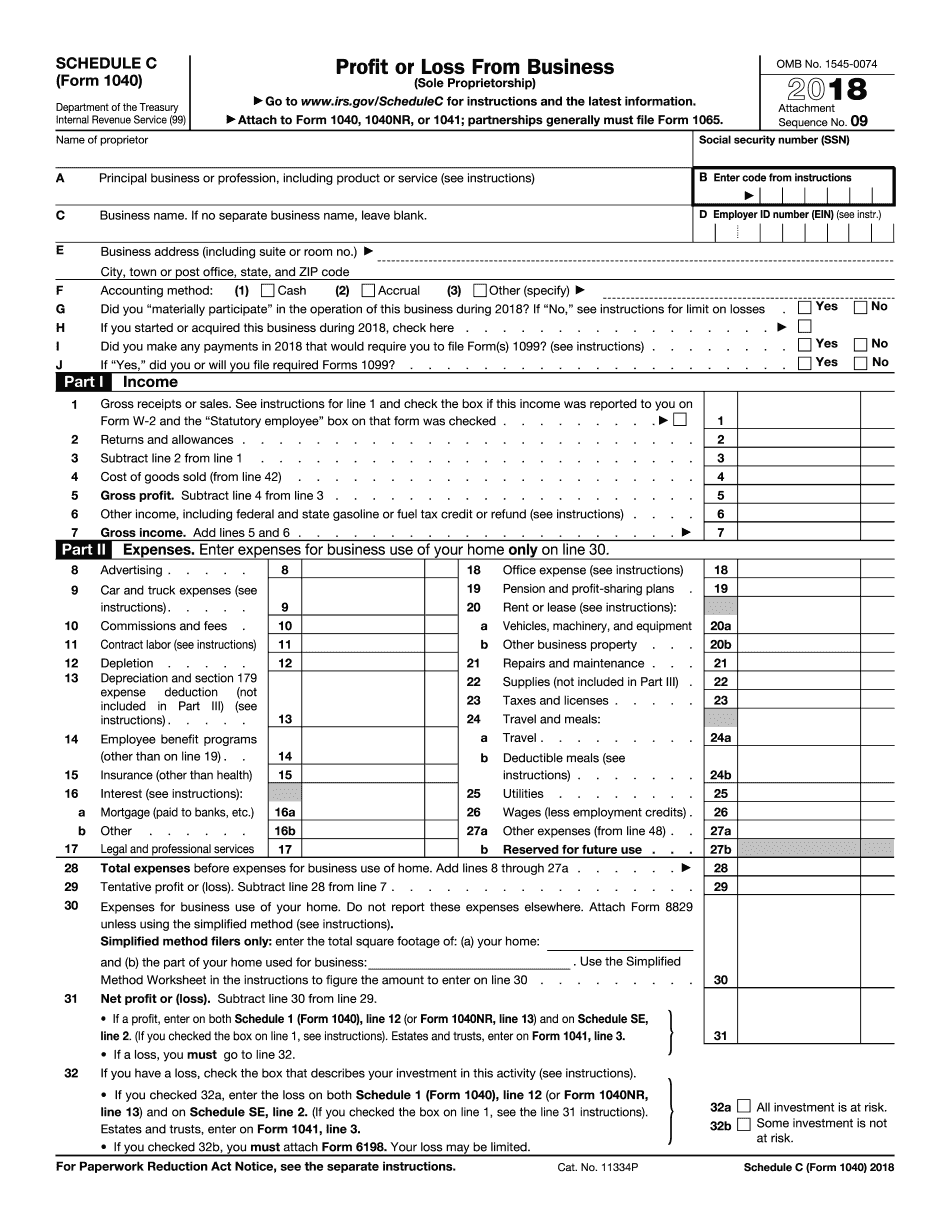

▶ Go to www.irs.gov/ScheduleC for instructions and the latest information. ▶ Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships must generally file Form 1065. C Business name.

Are tax forms for 2022 available?

The 2022 Tax Forms can be uploaded, completed, and signed online. Then download, print, and mail the paper forms to the IRS. Detailed information on 2022 State Income Tax Returns, Forms, etc.

How do I fill out a Schedule C form?

Steps to Completing Schedule CStep 1: Gather Information. Business income: You'll need detailed information about the sources of your business income. ... Step 2: Calculate Gross Profit and Income. ... Step 3: Include Your Business Expenses. ... Step 4: Include Other Expenses and Information. ... Step 5: Calculate Your Net Income.

Do I need to file a Schedule C?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit. You are involved in the activity with continuity and regularity.

Where do I get a tax form?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS).Download them from IRS.gov.Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Where can I pick up IRS tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed One-Stop page. Requesting copies by phone - 1-800-TAX-FORM (or 1-800-829-3676) Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time - except Alaska and Hawaii which are Pacific time.

How much money do you have to make to file a Schedule C?

What Is the Minimum Income to File Schedule C? There is no minimum income threshold for filing a Schedule C. You must report all business income and expenses on your Schedule C, no matter how much or how little you make. The minimum threshold for paying self-employment tax is $400.

What documents do I need to file Schedule C?

Here's some information you'll need:Your business income statement and balance sheet for the tax year.Receipts for your business expenses.Inventory records, if you have inventory.Mileage and other vehicle records if you used one for business.

What expenses qualify for Schedule C?

Schedule C is also where business owners report their tax-deductible business expenses, such as advertising, certain car and truck expenses, commissions and fees, supplies, utilities, home office expenses, and many more. A business expense must be ordinary and necessary to be listed as a tax deduction on Schedule C.

What happens if I don't file a Schedule C?

If You Don't File a Schedule C… Losses can offset other income on your tax return reducing your taxes. Claim a loss (net operating loss) that you can carry over to offset income on future tax returns. (See rules about net operating losses due to CARES Act.)

What happens if you don't have receipts for Schedule C?

What to do if you don't have receipts. The IRS will only require that you provide evidence that you claimed valid business expense deductions during the audit process. Therefore, if you have lost your receipts, you only be required to recreate a history of your business expenses at that time.

Can I file a Schedule C by itself?

You will need to file Schedule C annually as an attachment to your Form 1040. The quickest, safest, and most accurate way to file is by using IRS e-file either online or through a tax professional that is an authorized IRS e-file provider. Here are a few tips for Schedule C filers.

Is there a 1040ez form for 2022?

Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

Are the 2021 tax forms available?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

Is the 2022 w4 form available?

The 2022 Form W-4, Employee's Withholding Certificate, has not yet been released by the IRS. As soon as a new form is released we will notify you. Until then, you may use the 2021 W-4 version to make any changes to your withholdings.

What forms has the IRS not finalized yet?

The tax year 2021 Forms, to which Schedules K-2 and K-3 must be attached, have not yet been finalized....Form 1065, Schedule K, line 16p, and Schedule K-1(Form 1065), line 16. ... Form 8865, Schedule K, line 16p, and Schedule K-1(Form 8865), line 16, Codes P and Q;More items...•

Filing Schedule C (Form 1040) in 2022 - Deskera Blog

The tax code is filled with exceptions—there are modifications, alternative minimum tax (AMT), and special rules just about everywhere you look. When does the tax law say that employees can deduct certain expenses on their tax return but self-employed people cannot? Seems unfair. The law is not always fair,

2021 Instructions for Schedule C (2021) | Internal Revenue Service

Schedule A (Form 1040) to deduct interest, taxes, and casualty losses not related to your business. Schedule E (Form 1040) to report rental real estate and royalty income or (loss) that is not subject to self-employment tax.

About Schedule C (Form 1040), Profit or Loss from Business (Sole ...

Information about Schedule C (Form 1040), Profit or Loss from Business, used to report income or loss from a business operated or profession practiced as a sole proprietor; includes recent updates, related forms, and instructions on how to file.

IRS Tax Return Forms and Schedule For Tax Year 2022

IRS Income Tax Forms, Schedules and Publications for Tax Year 2022: January 1 - December 31, 2022. (This page is being updated for Tax Year 2022). 2022 Tax Returns are due on April 15, 2023.The tax forms and schedules listed here are for the 2022 Tax Year tax returns and they can be e-filed via eFile.com between early January 2023 and October 15, 2023.

Forms and Instructions (PDF)

Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Click Find. Click on the product number in each row to view/download.

Forms and Instructions (PDF)

Product Number Title Revision Date Posted Date; Inst 1040: Instructions for Form 1040 or Form 1040-SR, U.S. Individual Income Tax Return 2021

Who uses Form 1040-C?

Form 1040-C is used by aliens who intend to leave the United States or any of its possessions to:

When do you need to file a 1040c?

Form 1040-C must be filed before an alien leaves the United States or any of its possessions. For more information, see How To Get the Certificate, later. . If you are a nonresident alien, use the 2020 Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return, to help you complete Form 1040-C. .

What is the new limitation on excess business losses?

What's New. Excess business losses. The Coronavirus Aid, Relief, and Economic Security Act (CARES) Act repealed the limitation on excess business losses under section 461 of the Internal Revenue Code for tax years 2018, 2019, and 2020. Beginning in 2021, you must limit the deduction of excess business losses.

How to get a copy of my tax return?

The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Click on either “Get Transcript Online” or “Get Transcript by Mail” to order a free copy of your transcript. If you prefer, you can order your transcript by calling 800-908-9946.

What is the purpose of a 1040-C?

Form 1040-C is used by aliens who intend to leave the United States or any of its possessions to: Report income received or expected to be received for the entire tax year, and. Pay the expected tax liability on that income, if they are required to do so.

How much is the AMT exemption?

The AMT exemption amount is increased to $73,600 ($114,600 if married filing jointly or qualifying widow (er); $57,300 if married filing separately). The income level at which the AMT exemption begins to phase out has increased to $523,600 ($1,047,200 if married filing jointly; $523,600 if married filing separately).

What is the maximum amount of income that will be taxed in 2021?

For 2021, the maximum amount of earned income (wages and net earnings from self-employment) subject to the social security tax is $142,800.

Who Should File a Schedule C Tax Form?

If you’re self-employed and set up your business as a sole proprietorship, you should file Schedule C with your Form 1040 to report the profit or loss for your business. An activity qualifies as a business activity if it is operated with the intent to make a profit and is operated regularly and continually. That means you don’t need to use a Schedule C to report income from a hobby.

What is Schedule C?

The Schedule C: Profit or Loss From Business (Sole Proprietorship) is used to report how much money you made or lost in a business you operated by yourself. The form reports how much of the income from your business is subject to tax or whether you have a loss for tax purposes.

What is Schedule C for business?

Schedule C collects the following business information: Name. Product or service activity. Employer Identification Number (EIN) ...

How to file 2022 tax return?

The 2022 Tax Forms can be uploaded, completed, and signed online. Then download, print, and mail the paper forms to the IRS. Detailed information on 2022 State Income Tax Returns, Forms, etc.

How to prepare a state tax return for a previous year?

To prepare and file a state tax return for a previous tax year, select a state and download state tax return income forms. You can also find state tax deadlines. Prepare, calculate and file back taxes or previous year tax returns, f ind federal tax forms for 2004-2019 back taxes.

When is the 2021 tax season?

The 2021 eFile Tax Season starts in January 2021. Prepare and eFile your IRS and State 2020 Tax Return (s) by April 15, 2021. If you missed this deadline you have until October 15, 2021. 2020 Tax Return Forms and Schedules - January 1 - December 31, 2020 - can be e-Filed now.

When are 2022 taxes due?

IRS Income Tax Forms, Schedules and Publications for Tax Year 2022: January 1 - December 31, 2022. (This page is being updated for Tax Year 2022). 2022 Tax Returns are due on April 15, 2023. The tax forms and schedules listed here are for the 2022 Tax Year tax returns and they can be e-filed via eFile.com between early January 2023 and October 15, 2023. Use the 2022 Tax Calculator to estimate 2022 Tax Returns - it's never too early to begin tax planning!

Who files a Schedule C tax form?

You'll need to file a Schedule C if you earn income through self-employment as a sole proprietor or as a single-member Limited Liability Company (LLC). You wouldn't use a Schedule C to report business income and expenses of a C Corporation or S corporation.

What is Schedule C: Profit or Loss from Business (Form 1040)?

IRS Schedule C, Profit or Loss from Business, is a tax form you file with your Form 1040 to report income and expenses for your business. The resulting profit or loss is typically considered self-employment income.

Does an LLC file a Schedule C?

You can also operate your own business as a single-member LLC. In that case, you’ll usually still need to complete Schedule C. It doesn't have to be a business with employees or an office, but it can be. If you run a single-member LLC, there’s no distinction between you and the LLC for tax purposes. Instead, whatever profits or losses produced by the LLC go directly onto your personal tax return. The IRS considers this a “Disregarded Entity.”

Is Schedule C only for self-employed?

You might be both self-employed and an employee of another business. If you work as an employee with pay reported by your employer on Form W-2, you may also need to file a Schedule C when you have income you earn outside of your W-2 job. You typically should not include your W-2 income with your self-employed income on Schedule C.

What info is on a Schedule C?

Schedule C asks for several items related to your trade or business. Some of the items include:

How do I get a Schedule C?

You can download all versions of a Schedule C on the IRS website. You can also use online tax preparation software to access a Schedule C and complete your tax return.

Is Schedule C the same as a 1099?

A 1099 is not the same as Schedule C. A 1099 typically reports money exchanged between a payor and a payee. A copy of a 1099 usually goes to both the payee and the IRS. Depending on the type of income earned or 1099 received, you may report this on Schedule C or other Schedules of Form 1040.

How much do sole proprietors pay in taxes?

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

What line is Schedule 1 on a 2018 1040?

Schedule 1 accompanies your Form 1040 tax return. You'll then add the total income you arrive at by completing Schedule 1 on line 6 of the 2018 Form 1040.

What are legal fees on a 1040?

These include fees charged by accountants, bookkeepers, and online bookkeeping services such as Bench.

What is gross income?

Gross income refers to an individual's entire income from all sources -- wages, self-employment, bonuses, dividends, etc. Net income is the number that matters for tax purposes, and refers to your income after adjustments, deductions, and credits are subtracted from your gross income.

Is Schedule C easy to get?

When the tax season began unexpectedly or you just forgot about it, it could probably cause problems for you. IRS 1040 - Schedule C is not the easiest one, but you do not have reason for panic in any case.

When will repeating information be filled?

Repeating information will be filled automatically after the first input.

Why do you have to make quarterly tax payments?

Make estimated quarterly tax payments to avoid penalties. Taxes are a pay-as-you-go arrangement in the United States; when you earn money, the IRS wants its cut as soon as possible. That’s why employers withhold taxes from employee paychecks. But when you’re paying yourself, that’s probably not happening. To avoid late-payment penalties, you can make estimated quarterly payments to the IRS.

What is Schedule C for 2021?

What Schedule C (Form 1040) Is & Who Has to File It in 2021. If you freelance, have a side gig, run a small business or otherwise work for yourself, you may need to file a Schedule C at tax time. Here's how it works. Many or all of the products featured here are from our partners who compensate us.

Why do you need a tax professional?

If you're self-employed or make money from a variety of sources, working with a tax professional can save you time, reduce stress and possibly lead you to unknown tax breaks.

What is single member LLC?

Single-member LLCs are business entities owned by just one person. In most cases, there’s no distinction between the owner and the LLC for income tax purposes; the business’s income and profits go right onto the owner’s personal tax return.

What is a sole proprietorship?

Sole proprietorships are unincorporated businesses that are owned and run by one person who is entitled to all of the profits and is responsible for all of the losses and liabilities. They're often the choice of people who freelance, have a side gig, are independent contractors or operate a business by themselves.

What is the difference between Part III and IV?

Part III helps you calculate your cost of goods sold. Part IV is a place to report certain information on a vehicle if you have car - or truck- related business expenses. Part V is a place to list other business expenses that didn’t fit into the categories in Part II.

What is a part IV?

Part IV is a place to report certain information on a vehicle if you have car- or truck-related business expenses. Part V is a place to list other business expenses that didn’t fit into the categories in Part II.

What is TAs service?

TAS can help you resolve problems that you can’t resolve with the IRS. And their service is free. If you qualify for their assistance, you will be assigned to one advocate who will work with you throughout the process and will do everything possible to resolve your issue. TAS can help you if:

What is the new limitation on excess business losses?

What's New. Excess business losses. The Coronavirus Aid, Relief, and Economic Security Act (CARES) Act repealed the limitation on excess business losses under section 461 of the Internal Revenue Code for tax years 2018, 2019, and 2020. Beginning in 2021, you must limit the deduction of excess business losses.

What happens if someone steals your SSN?

Tax-related identity theft happens when someone steals your personal information to commit tax fraud. Your taxes can be affected if your SSN is used to file a fraudulent return or to claim a refund or credit.

How to get a copy of my tax return?

The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Click on either “Get Transcript Online” or “Get Transcript by Mail” to order a free copy of your transcript. If you prefer, you can order your transcript by calling 800-908-9946.

What is the purpose of a 1040-C?

Form 1040-C is used by aliens who intend to leave the United States or any of its possessions to: Report income received or expected to be received for the entire tax year, and. Pay the expected tax liability on that income, if they are required to do so.

How much is the AMT exemption?

The AMT exemption amount is increased to $73,600 ($114,600 if married filing jointly or qualifying widow (er); $57,300 if married filing separately). The income level at which the AMT exemption begins to phase out has increased to $523,600 ($1,047,200 if married filing jointly; $523,600 if married filing separately).

What is the maximum amount of income that will be taxed in 2021?

For 2021, the maximum amount of earned income (wages and net earnings from self-employment) subject to the social security tax is $142,800.