What is Form 941 Schedule B?

Form 941 Schedule B is the IRS tax form used by the semiweekly schedule depositor to report tax liability, including federal income taxes and FICA. Whether you have to file Schedule B or not depends on your deposit schedule. If any of the following criteria applies to you, you are a semiweekly depositor and liable to complete Schedule B with ...

When is Schedule B required?

Schedule B numbers are administered and used by the U.S. Commerce Department, Census Bureau, Foreign Trade Division to collect and publish the U.S. export statistics. Schedule B numbers are required to be reported in the Automated Export System (AES) when shipments are valued over $2,500 or the item requires a license.

What is a 941 Schedule B?

The IRS Form 941 (Schedule B) is a tax form for the reporting of tax liability for semi-weekly pay schedules. The federal income tax you withheld from your employees' paychecks. Both employee and employer Social Security and Medicare taxes. Click here to know more about it.

How to submit 941 form?

When you submit your Form 940/941/944 (Form 94X) enrollment information, the following occurs:

- You send the enrollment information electronically.

- The secure filing system forwards the information to the IRS agency.

- The filing system sends you an e-mail that indicates the IRS has received your e-file enrollment request.

Is there a new 941 Schedule B for 2022?

The IRS Form 941 Schedule B for 2022 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Businesses that acquire more than $100,000 in liabilities during a single day in the tax year are also required to begin filing this Schedule.

Where can I find Form 941 for 2022?

www.irs.gov/Go to www.irs.gov/Form941 for instructions and the latest information. Read the separate instructions before you complete Form 941. Type or print within the boxes.

Is Schedule B required for 941?

Who Must File? File Schedule B if you're a semiweekly schedule depositor. You're a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the lookback period or accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

What is the difference between 941 and 941 Schedule B?

Form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Schedule B specifically deals with reporting federal income tax, social security tax, and Medicare tax withheld from the employee's pay.

Is there a new Form 941 for 2nd Quarter 2022?

IRS has released an updated Form 941 for the second & third quarter of 2022, there are a few notable changes that employers will need to be aware of Employers who are required to report federal income taxes, social security taxes, or medicare taxes withheld from their employees' paychecks must submit the new revised ...

Can I see my 941 online?

You can access your federal tax account through a secure login at IRS.gov/account.

Do you have to file Schedule B?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

What is a 941 Schedule B used for?

The IRS Form 941 Schedule B is a tax form for the reporting of tax liability for semi-weekly pay schedules. The employer is required to withhold federal income tax and payroll taxes from the employee's paychecks. The 941 form reports the total amount of tax withheld during each quarter.

What is tax liability on Schedule B Form 941?

On Form 941 (Schedule B), you must list your tax liability for each day. Liabilities include: The federal income tax you withheld from your employees' paychecks. Both employee and employer Social Security and Medicare taxes.

Where do I mail my 941 and Schedule B?

Department of the Treasury Internal Revenue Service; Ogden, UT 84201-0005—this address is used for any business that wishes to file without a payment attached. Internal Revenue Service PO Box 37941; Hartford, CT 06176-7941—this address is for businesses that wish to include a payment with their 941 tax form.

Who is a semi weekly depositor for 941?

Lookback period for Form 941. If you reported $50,000 or less of Form 941 taxes for the lookback period, you're a monthly schedule depositor; if you reported more than $50,000, you're a semiweekly schedule depositor.

Do I need to file Schedule B Quickbooks?

Form Schedule B is missing Not everyone is required to file the Schedule B form with their 941. You only need to file Schedule B if: You're required to pay your 941 taxes semiweekly. You accrued $100,000 or more in 941 taxes on any given day in the quarter.

How do I get a copy of my IRS form 941?

Call 800-829-3676.

Are 2022 tax forms available?

Forms 1040 and 1040-SR and the associated instructions are available now on IRS.gov. For the latest IRS forms and instructions, visit the IRS website at IRS.gov/forms .

Where is form 941 in Quickbooks desktop?

Select Reports, then search for the Tax and Wage Summary report. Next to Date Range select a quarter, then select Apply. Look for the totals under Federal Taxes (941/944) (Federal Withholding, Medicare Company, Medicare Employee, Social Security Company, and Social Security Employee taxes).

What are the form 941 quarterly due dates?

Form 941 is generally due by the last day of the month following the end of the quarter. For example, you're required to file Form 941 by April 30 for wages you pay during the first quarter, January through March.

What is Schedule B on taxes?

On Schedule B, list your tax liability for each day. Your tax liability is based on the dates wages were paid. Your liability includes:

How long does Schedule B take?

The time needed to complete and file Schedule B will vary depending on individual circumstances. The estimated average time is 2 hours, 53 minutes.

What is a prior period adjustment?

Prior period adjustments are reported on Form 941-X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund, or Form 944-X, Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund, and aren’t taken into account when figuring the tax liability for the current quarter.

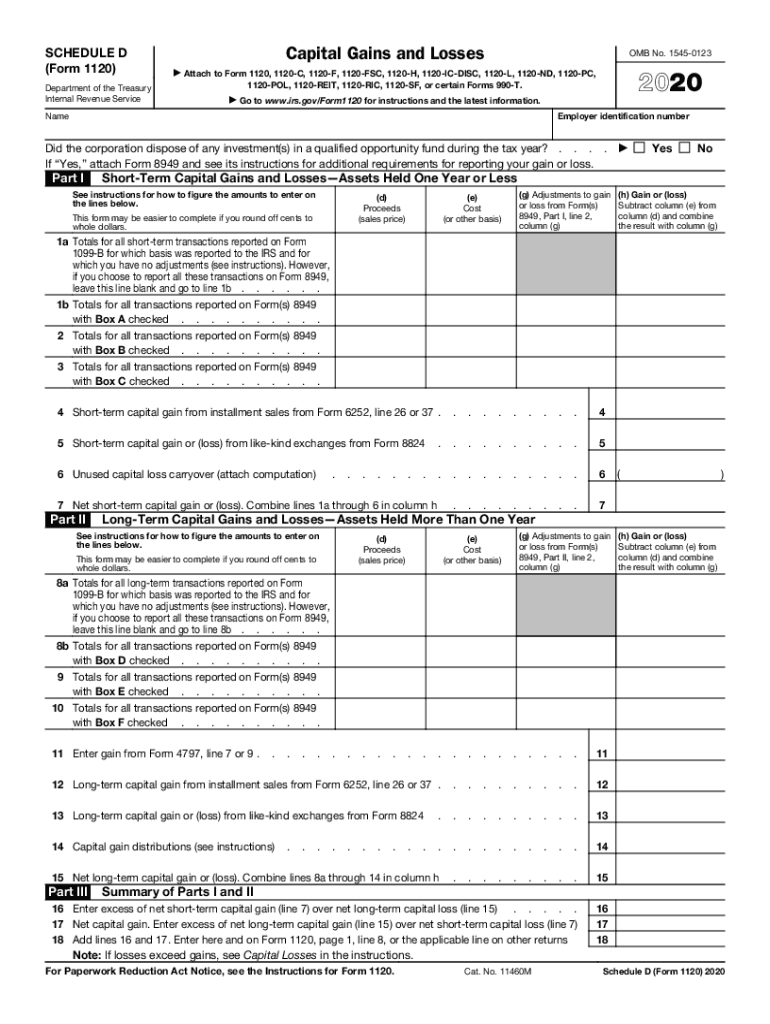

How many spaces are there in Schedule B?

Schedule B is divided into the 3 months that make up a quarter of a year. Each month has 31 numbered spaces that correspond to the dates of a typical month. Enter your tax liabilities in the spaces that correspond to the dates you paid wages to your employees, not the date payroll liabilities were accrued or deposits were made.

When did Elm Co become semi weekly?

Elm Co. became a semiweekly schedule depositor on April 24, 2021, because Elm Co. had a total accumulated employment tax liability of $112,000 on April 23, 2021. For more information, see section 11 of Pub. 15 or section 8 of Pub. 80. Elm Co. must complete Schedule B as shown next and file it with Form 941.

Why do we need Schedule B?

You’re required to give us the information. We need it to ensure that you’re complying with these laws and to allow us to figure and collect the right amount of tax.

When will Elm Co. deposit in 2021?

On April 23, 2021, and on every subsequent Friday during 2021, Elm Co. accumulated a $110,000 employment tax liability. Under the deposit rules, employers become semiweekly schedule depositors on the day after any day they accumulate $100,000 or more of employment tax liability in a deposit period.

How to complete a 941 Schedule B?

To complete your Schedule B report, you are required to enter your tax liability in the numbered space that corresponds to the date that wages were paid. TaxBandits helps you to file Form 941 Schedule B for you that's based on the information you provide while completing your Form 941.

What are the changes to Schedule B for Q2 2021?

For Q2 2021, report Schedule B adjustments to tax liabilities for the following lines: Line 11a, 11b, 11c, 11d and 11e. For more information on Form 941 changes, click here.

What form is used for semi weekly depositors?

The IRS requires additional information regarding the TAX LIABILITIES for a semiweekly depositors. This information is collected on Schedule B (Form 941).

What is 303 D?

Section 303 (d) of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 allows for a new payroll tax credit for certain tax-exempt organizations affected by certain qualified disasters not related to COVID-19. How TaxBandits Helps You Complete Your. Form 941 Schedule B?

What is a 941 V?

Complete Form 941-V if you’re making a payment with Form 941. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you.

When is sick leave taxable in 2021?

Use lines 5a(i) and 5a(ii) only for wages paid after March 31, 2020, for leave taken before April 1, 2021.

What is Schedule B?

Use Schedule B to report federal income taxes withheld from your employees’ income on a daily basis. This tax form basically reports your tax liability for the federal income taxes withheld from your income.

Who must file Schedule B with Form 941?

All semi-weekly schedule depositors are required to file Schedule B with their Forms 941. Employers that reported more than $50,000 during a quarter or accumulated a tax liability of more than $100,000 are semi-weekly schedule depositors. File Schedule B with your Form 941 for every quarter of 2022 if it applies to you.

Online fillable Schedule B

The same as 941 Form 2022, you can file Schedule B of the form online using our PDF Filler. This is an alternative to filing Form 941 on paper. Fill out Schedule B and Form 941 itself on your computer and print out a paper copy with the information entered.

IRS Form 941 Schedule B Instructions

On Form 941 Schedule B, start by entering your personal information: Employer Identification Number, Full Name, and enter the calendar year. Then, check the quarter that you’re filing Form 941 Schedule B.