How long does it take to get a tax refund?

Is Rhode Island taxable income?

Is Social Security taxable in Rhode Island?

Can you claim itemized deductions in Rhode Island?

About this website

When can I expect my refund 2022?

within 21 daysOverall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return. The IRS urges taxpayers and tax professionals to file electronically.

How long does it take to get your RI State Tax Refund?

Tax Administrator: should receive your refund within 10 to 15 business days. If you file your return on paper, you should receive your refund within four to six weeks. Keep in mind that the closer to April 15 you file, the longer it will take for your return to be processed and your refund issued.

How long does it take for state tax refund direct deposit 2022?

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive.

How do I track my state refund RI?

You filed your tax return, now - "Where's My Refund?" Access this secure Web site to find out if the Division of Taxation received your return and whether your refund was processed. To get to your refund status, you'll need the following information as shown on your return: Your social security number.

How do I track my tax refund?

Use the Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can call the IRS to check on the status of your refund.

Does RI have a state income tax?

Rhode Island has a graduated individual income tax, with rates ranging from 3.75 percent to 5.99 percent. Rhode Island also has a 7.00 percent corporate income tax rate. Rhode Island has a 7.00 percent state sales tax rate and does not levy local sales taxes.

How is RI state income tax calculated?

Rhode Island Tax Brackets for Tax Year 2021Tax Rate:3.75% Income Range:$0 to $66,200. Taxes Due:3.75% of Income.Tax Rate:4.75% Income Range:$66,200 to $150,550. Taxes Due:$2,482.50 + 4.75%Tax Rate:5.99% Income Range:$150,550+ Taxes Due:$6,489.13 + 5.99% over $150,550.

Can I pay my Ri taxes online?

We have created a Tax Portal that allows for same-day and future payments for all taxes administered by the Division of Taxation. We allow for estimated payments, extension payments, payments with a tax filing, license renewal payments, bill payments and payments for various fees.

How long does it take to get a tax refund?

Note: Please wait at least two to three weeks before checking the status of your refund on electronically filed returns and four to six weeks for paper filed returns.

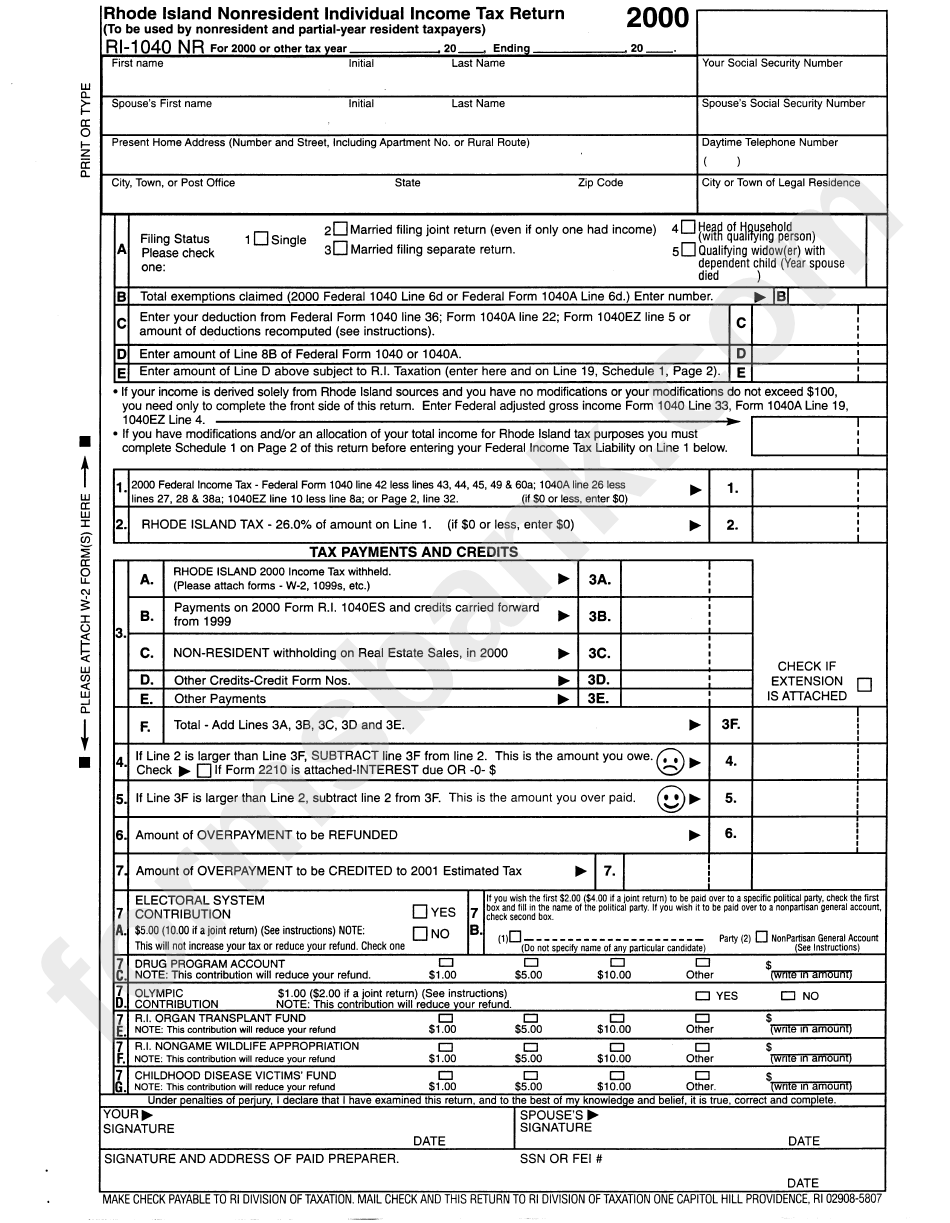

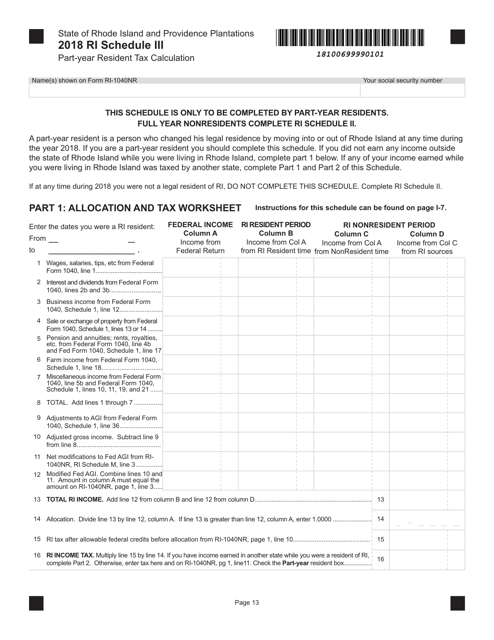

Is Rhode Island taxable income?

Rhode Island Taxable Income. When it comes to calculating a taxpayer’s total taxable income in the state of Rhode Island, several different types of income should be subtracted from their federal adjusted gross income (AGI).

Is Social Security taxable in Rhode Island?

Unlike several other states, however, some Social Security benefits are considered taxable income in Rhode Island.

Can you claim itemized deductions in Rhode Island?

Taxpayers in Rhode Island cannot claim itemized deductions, but a standard deduction is available. For Single filers, the standard deduction is $8,375, and for individuals filing a joint return, it’s $16,750. A total personal exemption of $3,875 is also available for all filer types.

When are Rhode Island taxes due 2021?

You will automatically receive a 6-month extension of time to file your return (not to pay). The extended tax return due date is October 15, 2021.

When are Rhode Island state taxes due?

Rhode Island State Income Taxes for Tax Year 2020 (January 1 - Dec. 31, 2020) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a RI state return ). Attention: The Rhode Island tax filing and tax payment deadline is April 15, 2021 May 17, 2021.

What happens if you don't file your taxes in Rhode Island?

Important: If you owe Rhode Island and/or IRS income taxes and do not file an IRS and Rhode Island tax return or extension by April 18, 2022, you will be subject to IRS and RI late filing penalties. Estimate IRS late filing, payment penalties. In addition, if you do not pay your taxes by April 18, 2022, you will be subject to late tax payment penalties. Filing an extension on time will ONLY eliminate the late filing penalties but not the late tax payment penalties. Late filing penalties are generally higher than late payment penalties, thus file something on time even if you can't pay anything on time!

When is the IRS eFile deadline for 2021?

Instructions on how to eFile an IRS tax extension for free on eFile.com by April 15, 2021. The extended IRS/Rhode Island eFile deadline is Oct. 15, 2021 - eFileIT* now. If you plan to file or mail-in a Rhode Island tax return on paper - the Forms and Mailing Address are below - your due date is Oct. 15, 2021.

What is the penalty for late payment of taxes?

Late Payment Penalty: A delinquent penalty is charged when at least 90% of the tax is not paid by the deadline. The penalty amounts to 5%. A one-time 5% delinquent penalty and interest accruing at 1.25% per month will be charged on any taxes owed not paid by the original tax return due date. 3.

How to submit a 1040V?

Submit a tax payment through the state tax agency's site. When you're on the site, select the "Voucher - 1040-V & 1040NR-V" option, then follow the on-screen prompts to enter and submit your information (e.g. SSN, Tax Year, Form Type, Filing Status).

When is the deadline to file 2021 taxes?

The deadline to e-file an IRS extension for 2021 Tax Returns is April 18, 2022. e-File a 2020 Tax Extension for free on eFile.com. Here are instructions on whether you should consider a Tax Extension or not.

What is the tax rate for Rhode Island in 2021?

Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 3.75%, 4.75% and 5.99% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses. The Rhode Island tax rate is unchanged from last year, however, the income tax brackets increased due to the annual inflation adjustment.

When are Rhode Island income tax forms published?

Rhode Island income tax forms are generally published at the end of each calendar year, which will include any last minute 2020 - 2021 legislative changes to the RI tax rate or tax brackets. The Rhode Island income tax rate tables and tax brackets shown on this web page are for illustration purposes only.

What is the state tax rate in Rhode Island?

We can also see the progressive nature of Rhode Island state income tax rates from the lowest RI tax rate bracket of 3.75% to the highest RI tax rate bracket of 5.99%.

Who published the 2020 tax rate schedule?

Source: 2020 Tax Rate Schedule, published by the Rhode Island Division of Taxation.

What is the tax rate for the first $65,250?

Tax rate of 3.75% on the first $65,250 of taxable income.

How long does it take to get a tax refund?

Note: Please wait at least two to three weeks before checking the status of your refund on electronically filed returns and four to six weeks for paper filed returns.

Is Rhode Island taxable income?

Rhode Island Taxable Income. When it comes to calculating a taxpayer’s total taxable income in the state of Rhode Island, several different types of income should be subtracted from their federal adjusted gross income (AGI).

Is Social Security taxable in Rhode Island?

Unlike several other states, however, some Social Security benefits are considered taxable income in Rhode Island.

Can you claim itemized deductions in Rhode Island?

Taxpayers in Rhode Island cannot claim itemized deductions, but a standard deduction is available. For Single filers, the standard deduction is $8,375, and for individuals filing a joint return, it’s $16,750. A total personal exemption of $3,875 is also available for all filer types.