| Ex/EFF DATE | TYPE | PAYMENT DATE |

|---|---|---|

| 09/19/2022 | CASH | 09/27/2022 |

| 08/22/2022 | CASH | 08/30/2022 |

| 07/18/2022 | CASH | 07/26/2022 |

| 06/21/2022 | CASH | 06/29/2022 |

When does qyld pay dividend?

QYLD has a dividend yield of 14.41% and paid $2.76 per share in the past year. The dividend is paid every month and the last ex-dividend date was Apr 18, 2022.

Is qyld still paying dividends?

QYLD Dividend Information. QYLD has a dividend yield of 12.82% and paid $2.85 per share in the past year. The dividend is paid every month and the last ex-dividend date was Dec 30, 2021. Dividend Yield. 12.82%. Annual Dividend. $2.85. Ex-Dividend Date. Dec 30, 2021.

Is qyld a good ETF?

The ETF is an exchange traded fund that offers covered call exposure to the popular Nasdaq-100 Index (NDX). With a yield of 12.06%, QYLD is an ideal income elixir in today’s low-yield climate. The fund also brings income to an asset investors don’t often associated with income as NDX currently yields 0.53%.

Does qyld pay monthly dividend?

QYLD offers a stellar 10% annual dividend yield with monthly payouts, beating most “dividend stocks”. QYLD has offered steady stock performance over the past 5 years, which beats most stocks with a similar yield. QYLD is hard to beat when it comes to income. YouTube. Bob Sharpe.

What is Global X NASDAQ 100 Covered Call ETF's dividend yield?

When did Global X NASDAQ 100 Covered Call ETF last increase or decrease its dividend?

About this website

What is the next ex-dividend date for QYLD?

The next Global X Funds - Global X NASDAQ 100 Covered Call ETF dividend is expected to go ex in 10 days and to be paid in 18 days....Dividend Summary.SummaryPrevious dividendNext dividendPay date27 Sep 2022 (Tue)01 Nov 2022 (Tue)5 more rows

What happened QYLD dividend?

QYLD has a dividend yield of 16.59% and paid $2.62 per share in the past year. The dividend is paid every month and the last ex-dividend date was Sep 19, 2022.

Are QYLD dividends qualified?

QYLD may be tax-inefficient, as distributions from the fund may be taxed as income, and dividends from underlying stock holdings are not considered qualified because of the offsetting options positions. QYLD isn't eligible for Tax-Loss Harvesting, since we can't find a viable alternate fund.

What is the ex-date for dividends?

Ex-dividend date: This is the cutoff date to decide who gets the next dividend payment. If you own the stock one business day before the ex-dividend date, you get the payment. If somebody else owns the stock on that date, they get the payment.

Is QYLD a good ETF?

From an income standpoint, QYLD is an incredible investment. Since its inception, QYLD has had an annualized yield of 9.48% and has outpaced inflation yearly. The major bear thesis has been debunked as QYLD has declined less than the Nasdaq and QQQ during the bear market.

What is the best Covered Call ETF?

The 6 Best High-Yield Covered Call ETFs NowInvesco S&P 500 BuyWrite ETF (PBP) ... Amplify CWP Enhanced Dividend Income ETF (DIVO) ... Nationwide Nasdaq 100 Risk-Managed Income ETF (NUSI) ... Global X S&P 500 Covered Call ETF (XYLD) ... Global X Russell 2000 Covered Call ETF (RYLD) ... Global X Nasdaq 100 Covered Call ETF (QYLD) ... Conclusion.

Is QYLD better than QQQ?

QQQ - Volatility Comparison. The volatility of QYLD is currently 24.28%, which is lower than the volatility of QQQ at 33.30%. The chart below compares the 10-day rolling volatility of QYLD and QQQ.

Do I pay taxes on QYLD?

Based upon this information, any investor who held QYLD in a taxable account during 2021 are likely to have to report taxable income and/or short term gains on the distributions they received.

What taxes do I pay on dividends?

What is the dividend tax rate? The tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. The tax rate on nonqualified dividends is the same as your regular income tax bracket. In both cases, people in higher tax brackets pay a higher dividend tax rate.

Is it better to buy before or after ex-dividend date?

If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend.

How long do you need to hold stock for dividend?

Briefly, in order to be eligible for payment of stock dividends, you must buy the stock (or already own it) at least two days before the date of record and still own the shares at the close of trading one business day before the ex-date.

Do stocks fall after dividends?

After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Dividends paid out as stock instead of cash can dilute earnings, which can also have a negative impact on share prices in the short term.

Will Dis pay a dividend again?

Disney CFO Christine McCarthy declared the company's intention to pay a dividend again: "In light of the ongoing recovery from the COVID-19 pandemic as well as our continued prioritization of investments that support our growth initiatives, the board decided not to declare or pay a dividend for the first half of fiscal ...

Will Vermilion reinstate the dividend?

"We plan to reinstate a $0.06 per share quarterly dividend commencing in Q1 2022.

Why did Autodesk stop paying dividends?

Autodesk's dividend yield is just 0.2%. We believe that the administration cost and effort cost to both Autodesk and our shareholders was greater than the value of the dividend paid.

Did DIS pay a dividend in 2021?

Disney common stock dividends paid for the twelve months ending June 30, 2022 were $0M, a 100% decline year-over-year. Disney annual common stock dividends paid for 2021 were $0B, a 100% decline from 2020.

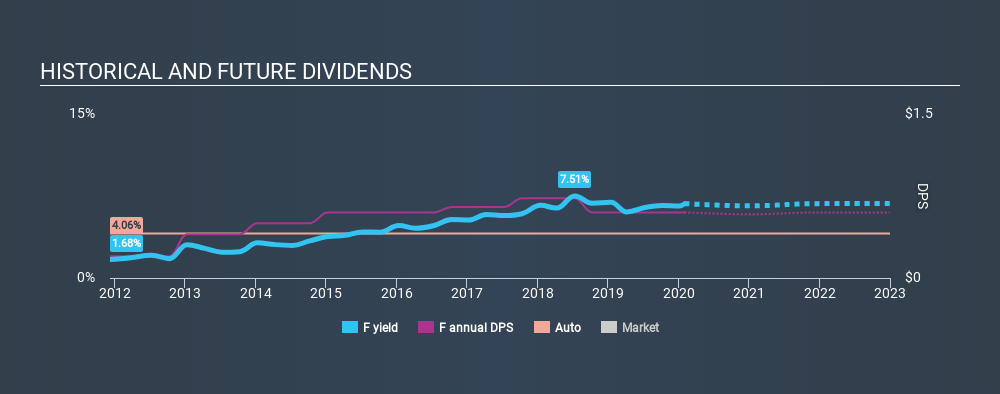

What is Global X NASDAQ 100 Covered Call ETF's dividend yield?

The current dividend yield for Global X NASDAQ 100 Covered Call ETF is 14.60%. Learn more on QYLD's dividend yield history.

How much is Global X NASDAQ 100 Covered Call ETF's annual dividend?

The annual dividend for QYLD shares is $2.65. Learn more on QYLD's annual dividend history.

How often does Global X NASDAQ 100 Covered Call ETF pay dividends?

Global X NASDAQ 100 Covered Call ETF pays monthly dividends to shareholders.

When was Global X NASDAQ 100 Covered Call ETF's most recent dividend payment?

Global X NASDAQ 100 Covered Call ETF's most recent monthly dividend payment of $0.1810 per share was made to shareholders on Tuesday, July 26, 2022.

When did Global X NASDAQ 100 Covered Call ETF last increase or decrease its dividend?

The most recent change in the company's dividend was an increase of $0.0070 on Friday, July 15, 2022.

QYLD: Dividend Date & History for Global X NASDAQ 100 Covered Call ETF ...

The fund will invest at least 80% of its total assets in the securities of the underlying index. The CBOE NASDAQ-100® BuyWrite Index is a benchmark index that measures the performance of a theoretical portfolio that holds a portfolio of the stocks included in the NASDAQ-100® Index, and "writes" (or sells) a succession of one-month at-the-money NASDAQ-100® Index covered call options.

Global X NASDAQ-100 Covered Call ETF (QYLD)

To add symbols: Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

QYLD Global X Funds - Global X NASDAQ 100 Covered Call ETF

Global X Funds - Global X NASDAQ 100 Covered Call ETF (QYLD) dividend growth history: By month or year, chart. Dividend history includes: Declare date, ex-div, record, pay, frequency, amount.

Global X NASDAQ 100 Covered Call ETF (QYLD) - Yahoo!

Find the latest Global X NASDAQ 100 Covered Call ETF (QYLD) stock quote, history, news and other vital information to help you with your stock trading and investing.

Nasdaq 100 Covered Call ETF (QYLD) - Global X ETFs

The Global X Nasdaq 100 Covered Call ETF (QYLD) follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Nasdaq 100 Index and “writes” or “sells” corresponding call options on the same index.

QYLD | $23.05 | Dividend History | Dividend Channel

Description of the stock QYLD, $23.05, from Dividend Channel. QYLD Dividend History & Description — $23.05. Learn more about the QYLD $23.05 ETF at ETF Channel. When considering the $23.05 stock dividend history, we have taken known splits into account, such that the QYLD dividend history is presented on a split-adjusted ("apples to apples") basis.

What is Global X NASDAQ 100 Covered Call ETF's dividend yield?

The current dividend yield for Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD) is 13.70%. Learn more

When did Global X NASDAQ 100 Covered Call ETF last increase or decrease its dividend?

The most recent change in Global X NASDAQ 100 Covered Call ETF's dividend was a decrease of $0.2960 on Friday, January 21, 2022.

What is QYLD option?

An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed upon price within a certain period or on a specific date. A covered call option involves holding a long position in a particular asset, in this case U.S. common equities, and writing a call option on that same asset with the goal of realizing additional income from the option premium. QYLD writes covered call index options on the Nasdaq 100 Index. By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying index above the exercise price, but continues to bear the risk of a decline in the index. A liquid market may not exist for options held by the fund. While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. QYLD is non-diversified.

What index does QYLD write on?

QYLD writes call options on the Nasdaq-100 Index, saving investors the time and potential expense of doing so individually.

When did the CBOE buywrite V2 change?

The Fund’s investment objective and investment strategies changed effective October 15, 2015. Hybrid index performance (noted as "Index" above in the chart) reflects the performance of the Cboe NASDAQ-100 BuyWrite Index through October 14, 2015 and the Cboe NASDAQ-100 BuyWrite V2 Index thereafter. The Fund was also re-organized effective December 24, 2018. Fund returns (NAV & Closing Price) presented above reflect the performance of the predecessor Fund through December 21, 2018.

What time does the last trade of Global X take place?

Time of Last Trade. Trading of Global X funds generally takes place during normal trading hours (9:30 a.m. to 4:00 p.m. eastern time). However, it is important to note that the last trade - from which the closing price is determined - may not occur at exactly 4:00 p.m. eastern time. Therefore, changing market sentiment during the time difference may cause the NAV to deviate from the closing price.

What is cumulative return?

Cumulative return is the aggregate amount that an investment has gained or lost over time. Annualized return is the average return gained or lost by an investment each year over a given time period. The performance data quoted represents past performance. Past performance does not guarantee future results.

Is Qyld a risk?

Investing involves risk, including the possible loss of principal. Concentration in a particular industry or sector will subject QYLD to loss due to adverse occurrences that may affect that industry or sector. Investors in QYLD should be willing to accept a high degree of volatility in the price of the fund’s shares and the possibility of significant losses.

What is Global X NASDAQ 100 Covered Call ETF's dividend yield?

The current dividend yield for Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD) is 13.70%. Learn more

When did Global X NASDAQ 100 Covered Call ETF last increase or decrease its dividend?

The most recent change in Global X NASDAQ 100 Covered Call ETF's dividend was a decrease of $0.2960 on Friday, January 21, 2022.