What are the pay periods for 2022?

Unlike last year, 2022 will have the usual 26 pay periods for those being paid bi-weekly. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while others are paid weekly receiving up to 52 paychecks in a given year.

What is the payroll schedule?

What is a payroll schedule? A payroll schedule determines the length of your pay period and how often you pay your employees. The most common payroll schedules are weekly, biweekly, semimonthly, and monthly. Your payroll schedule is dependent upon a few factors, including state laws and regulations.

Why does 2022 have 27 pay periods?

For 2022, the leave year began Jan. 1, 2022 (Pay Period 02-22) and ends Jan. 13, 2023 (Pay Period 02-23) for a total of 27 pay periods. Therefore, employees may earn one additional pay period's worth of annual leave during the 2022 leave year as compared to the typical 26 pay period leave year.

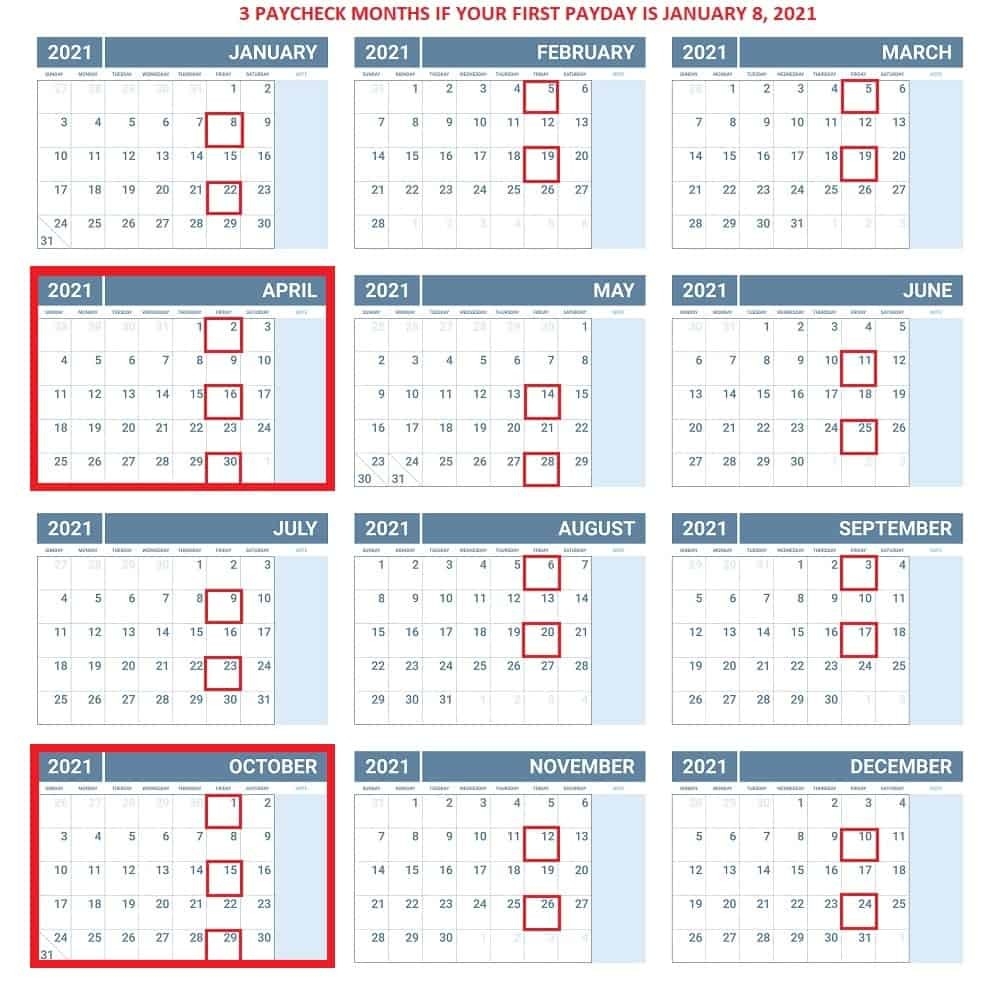

Which month has 3 biweekly pay periods 2022?

If your first paycheck of 2022 is Friday, January 7, your three paycheck months are April and September. If your first paycheck of 2022 is Friday, January 14, your three paycheck months are July and December.

What is the most common payroll schedule?

Biweekly payroll This schedule is popular for hourly employees. Often employers will select a biweekly payroll schedule with a week in arrears. This means they pay their employees for a given pay period one week after the pay period has ended.

What is a monthly payroll cycle?

Monthly payroll pays employees on a specific date each month, typically the first or last day, although payday can be set to mid-month. The biggest positive of using monthly payroll is that is the easiest to calculate and has the lowest processing cost.

What year has 27 biweekly pay periods?

The number of pay weeks in a year is normally fixed when it comes to biweekly or weekly paychecks. However, in some years, such as 2021, there are 27 biweekly pay periods. This is because January first was a Friday, resulting in a total of 53 Fridays in 2021.

How do you calculate 27 pay periods?

Divide the annual payroll by 27. Subtract the result from the annual wage....For example, if the employee annual wage is $50,000.00:$50,000.00 divided by 27 = $1851.85.Subtract $1851.85 from $50,000.00 = $48,148.15.Enter $48,148.15 using Maintain Employees, Pay Info, Pay Rate, and Year.

How do you explain 27 pay periods to employees?

To simplify matters, employers should distribute the 27th paycheck during the year in which it occurs, which is the same year in which the wages are earned. Otherwise, it could magnify the confusion with pushing the 27th pay day into the following year, when the add-a-day cycle restarts.

How many biweekly pay periods are there in 2022?

26 paychecksEmployees receive 26 paychecks per year with a biweekly pay schedule.

Do 3 paycheck months make a difference?

Though your annual salary remains the same, your take-home income changes with the third paycheck. Those extra funds will help you get out of debt faster and save you money in interest and fees down the road.

What months do we get paid 3 times 2022?

If your first paycheck in 2022 is scheduled for Friday, January 7, your three-paycheck months will be April and September. If your first paycheck in 2022 is Friday, January 14, your three-paycheck months are July and December.

What are the semi monthly pay periods for 2022?

Semimonthly pay Employers who choose this schedule can either pay their employees on the first and 15th of the month or on the 16th and last day of the month. Semimonthly pay has 24 pay periods and is most often used with salaried workers.

How do I choose a payroll schedule?

Several factors go into choosing your company's payroll schedule, and these are the most important:Your business's cash flow rhythm. Small businesses live and die by their cash flow. ... Labor market expectations. Some industries have unwritten standards around payroll frequency. ... State regulations.

What are the types of payroll?

4 types of payroll systems (+ pros & cons)In-House Payroll. In-House payroll is most suitable for small companies with a limited number of employees, who have consistent work hours from week to week. ... Bookkeepers/CPA managed payroll. ... Agency managed payroll. ... Software managed payroll.

Is it better to get paid every week or biweekly?

Generally speaking, employees prefer getting paid more frequently because it's the best alignment of work and earnings. Hourly employees, in particular, prefer getting paychecks weekly. Weekly payroll better matches an hourly employee's cash flow needs.

Paid Time Off Schedule

Paid Time Off is credited to employees on the following dates each month.

January through December 2021

Paid Time Off is credited to employees on the following dates each month.