For those taking the standard deduction or the dependent exemption at the state level, Minnesota has calculated those amounts for 2022 as follows:

- Married Filing Joint standard deduction - $25,800

- Married Filing Separate standard deduction - $12,900

- Single standard deduction - $12,900

- Head of Household standard deduction - $19,400

- Dependent exemption - $4,450

Full Answer

When Am I getting my tax refund?

There were also a lot of changes to tax law. The State Department of Revenue has been saying for months that tax law changes would delay getting refunds to people. The agency said it started sending out money the first full week of April. At that time, it said most people would get their refunds by April 30.

What time does the IRS issue refunds?

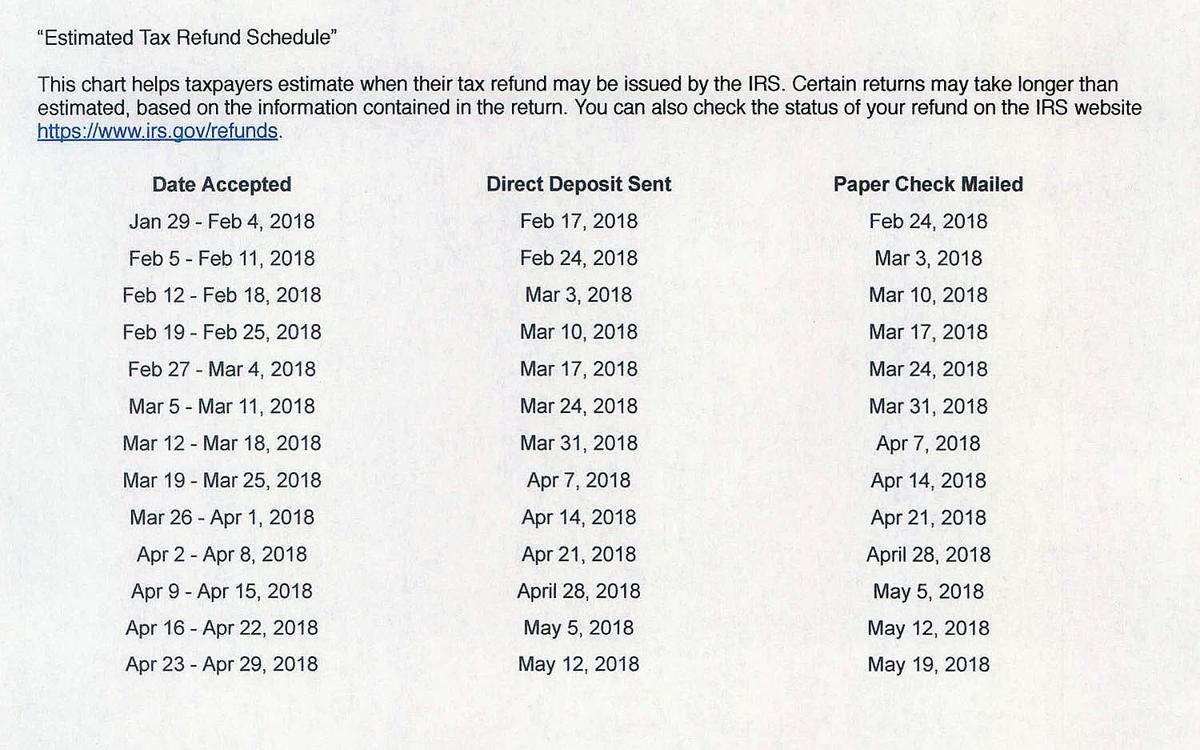

The IRS usually issues 9 out of 10 refunds within 10 days after efiling. The chart below will ...

What is the standard deduction in Minnesota?

- Married Filing Joint standard deduction - $25,800

- Married Filing Separate standard deduction - $12,900

- Single standard deduction - $12,900

- Head of Household standard deduction - $19,400

- Dependent exemption - $4,450

When will refunds start being deposited?

You can wait anywhere from one to a little over two weeks to get your refund when you e-file and choose the direct deposit option. Paper return and direct deposit can take about two weeks, but it shouldn’t be any more than three. The real wait time starts when you paper file and request a check.

What happens if you close your Minnesota state tax account?

How long does it take to get your spouse's tax refund?

How long do you have to reissue a property tax refund?

How long are property tax refunds valid?

See 1 more

About this website

Renter’s Property Tax Refund | Minnesota Department of Revenue

If you cannot get a CRP from your landlord, you can request a Rent Paid Affidavit (RPA) to apply for the Renter's Property Tax Refund. See CRP Information for Landlords for more information.. Note: We issue Rent Paid Affidavits beginning March 1 each year. To request an RPA, you need the following information:

Where’s My Minnesota State Refund? – MN Tax Return

You can check the status of your Minnesota state tax refund online at the Minnesota Department of Revenue website. You will need to know

Refunds | Internal Revenue Service - IRS tax forms

Get information about tax refunds and track the status of your e-file or paper tax return.

What happens if you close your Minnesota state tax account?

For more information, see Direct Deposit. Note: If you close your account, we cannot change your banking information on your return. If your direct deposit fails because you closed your account, the Minnesota Department of Revenue will send you a paper check.

How long does it take to get your spouse's tax refund?

You must contact us or the other agency (if listed) within 18 months to get your refund divided.

How long do you have to reissue a property tax refund?

If you can show reasonable cause, you may ask us to reissue your property tax refund check for up to five years after the original check date.

How long are property tax refunds valid?

Income tax refund checks are valid for two years. If you have an expired income tax refund check, mail it along with a written request to reissue it to: Property tax refund checks are also valid for two years. If you have an expired property tax refund check, we cannot reissue it.

How long will my tax refund take?

The IRS sends over 9 out of 10 refunds to taxpayers in less than three weeks.

Tax refund process

Below is an estimated breakdown of how soon you might expect to receive your tax refund, based on filing and delivery choices.

2022 IRS refund schedule chart

The IRS started accepting 2021 tax returns on Jan. 24, 2022. The IRS has not yet released its 2022 refund schedule, but you can use the chart below to estimate when you may receive your tax refund via direct deposit or paper check.

Other factors that could affect the timing of your refund

Additional factors could slow down the processing of your tax refund, such as errors, incomplete returns or fraud.

How to track the progress of your refund

The IRS has eliminated the guesswork of waiting for your tax refund by creating IRS2Go, an app that allows you to track the status of your return. You can also check the status of your refund with the " Where's My Refund? " online portal.

What to do once your refund arrives

For many people, their IRS tax refund is the biggest check they receive all year, the IRS says. In anticipation of your windfall, it's wise to have a plan for how you're going to use your windfall. Deciding how to spend, save or invest the money in advance can help stop the shopping impulse from getting the best of you.

How to get a refund in 2021?

The fastest way to get your refund is to file electronically and request a direct deposit. Paper returns take longer. Here's the 2021 refund schedule.

When is the tax return deadline for 2020?

Firstly, the IRS has extended the tax filing deadline by one month to May 17. Secondly, with your extra funds, you may be able to pay off some debt, start saving in a high-interest savings account ...

How long does it take to get a tax refund?

If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive – or longer, if your state has been or still is under social distancing restrictions. To find out the status of your refund, you’ll need to contact your state tax agency or visit your state’s Department of Revenue website.

When is the deadline to file taxes for 2020?

Last year the IRS pushed back to July 15, 2020, the filing deadline for 2019 taxes due to the ongoing Coronavirus pandemic.

Where's my tax refund?

The Where’s My Refund? tool lets you check the status of your refund through the IRS website or the IRS2Go mobile app. If you submit your tax return electronically, you can check the status of your refund within 24 hours. But if you mail your tax return, you’ll need to wait at least four weeks before you can receive any information about your tax refund. Keep in mind that usually you can file your taxes in January.

Why do we need a tax filing service?

They can take a lot of the confusion out of the process for you and help you file a more accurate tax return. They can also help you find deductions or exemptions that you wouldn’t have known about on your own.

What happens if you close your Minnesota state tax account?

For more information, see Direct Deposit. Note: If you close your account, we cannot change your banking information on your return. If your direct deposit fails because you closed your account, the Minnesota Department of Revenue will send you a paper check.

How long does it take to get your spouse's tax refund?

You must contact us or the other agency (if listed) within 18 months to get your refund divided.

How long do you have to reissue a property tax refund?

If you can show reasonable cause, you may ask us to reissue your property tax refund check for up to five years after the original check date.

How long are property tax refunds valid?

Income tax refund checks are valid for two years. If you have an expired income tax refund check, mail it along with a written request to reissue it to: Property tax refund checks are also valid for two years. If you have an expired property tax refund check, we cannot reissue it.