Does MetLife pay for dentures?

These rules determine the order in which the plans will pay benefits. If the MetLife dental benefit plan is primary, MetLife will pay the full amount of benefits that would normally be available under the plan.

Is MetLife a PPO or HMO?

Reviewing Your Choices Regarding MetLife Dental Plans. MetLife is a full service provider in areas such as investments, employee benefits and insurance. MetLife offers more than just basic health insurance and has extended their service offerings to include dental insurance as well. MetLife dental plans come in two main types, MetLife Dental PPO and MetLife Dental HMO, and offer dental insurance seekers options when it comes to high quality dental insurance.

Does MetLife offer individual dental plans?

MetLife offers dental plans to individuals who do not have insurance through an employer under the MetLife TakeAlong Dental trademark. This plan is portable so that it can stay with you through all stages of your life. It is also developing an HMO Managed Care dental plan that will be available only to residents of California, Florida, New York and Texas.

Is MetLife dental a PPO?

Metlife Dental specializes in providing dental insurance for groups and is currently one of the top providers of dental insurance in the country. Included in their Dental PPO plan is full service coverage for retirees, a big plus when enhancing retirement benefits. What's included with Metlife Dental?

How many languages does MetLife have?

Multi-Language Health History Forms- MetLife offers access to health history forms in 40 different languages to address the needs of patients and dentists who do not speak the same language. Each health history form has the same questions and numbering sequence. This means that if you speak English and a patient who speaks Vietnamese comes to your practice, you can access a health history form in Vietnamese for your patient to complete. You can compare the patient’s answers to your English version. Access the Multi-Language Health History Forms library 24 hours a day at www.metdental.com in the resource center section or at www.oralfitness library.com in the tools section.

What is a non covered procedure?

NON-COVERED PROCEDURES: A procedure could be a covered service under one plan and a non-covered service under another plan. The plan allowance applies in both situations (except as noted in Appendix A for certain states) and a participant cannot be billed any amount in excess of the plan allowance. *Many situations may cause a service to not be covered, but regardless of the reason, the allowance applies. The plan allowance applies to all services rendered to dental plan participants and their eligible dependents whether or not the service is covered under the applicable plan. Exclusion:Dental Services not covered under a particular dental benefit program. (Certain states**have laws that allow the dentist to charge their original fee for non-covered expenses.) Non-covered:These are services that are declined for benefits based upon a patient’s plan such as but not limited to a frequency limitation but are still subjected to the MetLife PDP fee as by definition they are covered but not payable due to the plan limits.

What is the MetLife oral health library?

MetLife’s Oral Health Library is an online (www.oralfitnesslibrary.com) resource for patients that include educational content and tools. In addition to MetLife-produced material, the library contains articles and information from the National Institutes of Health, the American Academy of Periodontology, and the National Institute of Dental and Craniofacial Research. To assist you in helping patients understand their risk for dental disease, a comprehensive dental health risk assessment (HRA) is available on the Oral Health Library. Patients, who complete on the online HRA, are encouraged to print and bring their results to their next dental visit.

What is the mission of QIP?

The mission of the QIP is to assist dentists in promoting the oral health of their patients through education and research. MetLife is accomplishing this through dentist and patient education and communication, as well as industry feedback and oversight by our Dental Advisory Council.

What is a pre treatment estimate?

PRE-TREATMENT ESTIMATES Pre-treatment estimates are strongly recommended for crowns, inlays, onlays, veneers, fixed bridgework, implants, implant prosthetics, periodontal treatment and any time charges are expected to exceed $300.00. The process can be a useful tool in providing the plan participants with an estimate of their out-of-pocket expenses, whether a service is covered or not covered by the dental plan, or if an alternate benefit will be applied. This can help avoid any potential billing disputes.

What is a COB in dental?

COORDINATION OF BENEFITS : In most cases, coordination of benefits (COB) occurs when a patient is covered by more than one dental benefits plan. One payer will be represented as the “primary carrier,” and benefits from that plan will be paid first. Then the “secondary carrier” will determine the benefits payable towards the remaining balance. To determine primary and secondary coverage for a patient, use the following steps:

What happens when a dentist denies a service?

When a service is denied and the reason for denial is considered “integral to another dental service”, the participating dentist agrees to the negotiated fee as adjudicated and cannot charge the participant for the denied integral service.

What is MetLife Vision?from metlife.com

MetLife Vision can help you and your family see well, stay healthy, and save.1. Save on a wide range of services that are standard benefits under this plan , including routine eye exams, glasses, contact fittings and lenses. Plus, additional savings on non-prescription sunglasses and laser vision correction. 2.

What is a PPO in MetLife?from metlife.com

MetLife’s Preferred Provider Organization (PPO) plans feature the MetLife Preferred Dentist Program, which is designed to save you money on dental services. 1 You can choose from thousands of participating general dentists and specialists nationwide.

What to do if you visit an out of network provider?from metlife.com

If you visit an out-of-network provider, you are responsible for paying the provider in full for the services and eyewear received at the time of your appointment, including taxes. Then you must submit a completed MetLife Vision claim form and itemized receipt to:

What is a participating dentist?from metlife.com

A participating dentist is a general dentist or specialist who has agreed to accept negotiated fees as payment in full for covered services. Negotiated fees typically range from 30 - 45% less than the average charges in a dentist’s community for similar services. 2 Negotiated fees refers to the fees that in-network dentists have agreed to accept as payment in full for covered services, subject to any copayments, deductibles, cost sharing, and benefit maximums. Negotiated fees are subject to change.

Why is it important to have a dental plan?from metlife.com

Whether you’re in need of routine cleanings, braces, or a filling, a solid dental plan makes it easier for you to help protect your smile and your budget. 1. Routine visits to the dentist help prevent costly dental bills later on, as well as problems linked to medical conditions like diabetes or heart disease. 2.

What is a federal dental plan?from metlife.com

PPO plans provide benefits for a broad range of covered services/procedures, giving you the flexibility to choose any licensed dentist, in or out of network. 3.

What happens if you cannot reach your dentist?from metlife.com

If you cannot reach your selected participating dentist, you may receive emergency care from any licensed dental care professional. The definition of what is considered “emergency care” and other specifics can be found in your policy, Certificate of Insurance, Evidence of Coverage or Summary Plan Description.

What is a $20 implant?

Removal of plaque, calculus and stains from the tooth structures and $20 implants in the permanent and transitional dentition. It is intended to control local irritational factors.

Is general anesthesia covered by dental insurance?

General anesthesia is a covered benefit only when administered by the treating dentist, in conjunction with oral and periodontal surgical procedures or when deemed necessary by the treating dentist

Is periodontal charting included in overall diagnosis?

Periodontal charting for planning treatment of periodontal disease is included as part of overall diagnosis and treatment. No additional charge will apply to You or Your Dependent or Us.

What is the purpose of a $5 permanent dentition?

It is intended to control local irritational factors.

Do you need a referral for an orthodontist?

If You or Your Dependent require the services of an ort hodontist, a referral must first be facilitated by Your Selected General Dentist. If a referral is not obtained before the Orthodontic treatment begins, You will be responsible for all costs associated with any Orthodontic treatment.

Is periodontal charting included in overall diagnosis?

Periodontal charting for planning treatment of periodontal disease is included as part of overall diagnosis and treatment. No additional charge will apply to You or Your Dependent or Us.

What is MetLife TakeAlong Dental?from metlife.com

MetLife TakeAlong Dental makes it easy to offer a lifelong dental solution through the workplace for a segment of the workforce not eligible under your group plan such as part-timers and consultants. And, employees can choose MetLife TakeAlong Dental as an alternative to COBRA when they retire or leave your organization. 4

What is a PPO in MetLife?from metlife.com

MetLife’s Preferred Provider Organization (PPO) plans feature the MetLife Preferred Dentist Program, which is designed to save you money on dental services. 1 You can choose from thousands of participating general dentists and specialists nationwide.

What is HMO dental?from metlife.com

A Dental Health Maintenance Organization (HMO) or Managed Care, covers in-network providers only, and you must choose a primary care dentist for all services. Available in CA, FL, NJ, NY, TX.

What is a participating dentist?from metlife.com

A participating dentist is a general dentist or specialist who has agreed to accept negotiated fees as payment in full for covered services. Negotiated fees typically range from 30 - 45% less than the average charges in a dentist’s community for similar services. 2 Negotiated fees refers to the fees that in-network dentists have agreed to accept as payment in full for covered services, subject to any copayments, deductibles, cost sharing, and benefit maximums. Negotiated fees are subject to change.

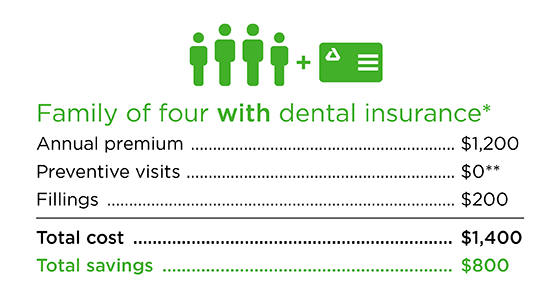

Why is it important to have a dental plan?from metlife.com

Whether you’re in need of routine cleanings, braces, or a filling, a solid dental plan makes it easier for you to help protect your smile and your budget. 1. Routine visits to the dentist help prevent costly dental bills later on, as well as problems linked to medical conditions like diabetes or heart disease. 2.

What is a federal dental plan?from metlife.com

PPO plans provide benefits for a broad range of covered services/procedures, giving you the flexibility to choose any licensed dentist, in or out of network. 3.

What happens if you cannot reach your dentist?from metlife.com

If you cannot reach your selected participating dentist, you may receive emergency care from any licensed dental care professional. The definition of what is considered “emergency care” and other specifics can be found in your policy, Certificate of Insurance, Evidence of Coverage or Summary Plan Description.