2022 Medicare Part A Coinsurance & Medicare Part B Deductible Effective January 1, 2022, the Medicare Part A coinsurance rate for SNFs will increase to $194.50 per day from $185.50 for days 21 through 100. The Part B deductible will be $233.00 for 2022, up $30 from 2021.

Full Answer

What is the maximum premium for Medicare Part B?

The standard Part B premium in 2021 is $148.50/month. But for those subject to IRMAA, the Part B premium ranges from $207.90/month to $504.90/month. And for Part D, the IRMAA surcharge amounts to an extra $12.30/month to $77.10/month, in addition to the regular premium for the plan you select.

How much does Medicare Part B costs?

• Part B Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

How high will the Medicare Part B deductible get?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Does Medicaid pay for Part B premium?

The standard premium also may apply to you if get both Medicare and Medicaid benefits, but your state may pay the standard Medicare Part B premium if you qualify. If you delayed enrollment in Part B, you might have to pay a late-enrollment penalty along with your monthly premium- see below.

When will Medicare start charging for PFS 2022?

When is the Medicare Physician Fee Schedule 2020?

What is the MPFS conversion factor for 2021?

What is the calendar year 2021 PFS?

What is the CY 2021 rule?

When will CMS issue a correction notice for 2021?

What is the 2020 PFS rule?

See 4 more

About this website

Is the 2022 Medicare physician fee schedule available?

Contacts. The Centers for Medicare & Medicaid Services (CMS) released the 2022 Medicare Physician Fee Schedule and Quality Payment Program final rule on Nov. 2 .

What is the Medicare fee for 2022?

If you don't get premium-free Part A, you pay up to $499 each month. If you don't buy Part A when you're first eligible for Medicare (usually when you turn 65), you might pay a penalty. Most people pay the standard Part B monthly premium amount ($170.10 in 2022).

Where can I find Medicare fee schedules?

To start your search, go to the Medicare Physician Fee Schedule Look-up Tool. To read more about the MPFS search tool, go to the MLN® booklet, How to Use The Searchable Medicare Physician Fee Schedule Booklet (PDF) .

What is the Medicare fee schedule?

A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis.

What is premium for Part B in 2022?

$170.10Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $164.90 for 2023, a decrease of $5.20 from $170.10 in 2022. The annual deductible for all Medicare Part B beneficiaries is $226 in 2023, a decrease of $7 from the annual deductible of $233 in 2022.

What is the cost for Medicare Part B?

$170.10 each monthPart B (Medical Insurance) costs. $170.10 each month ($164.90 in 2023) (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How often is the Medicare fee schedule updated?

annuallyThe fee schedule is updated annually by the Centers for Medicare and Medicaid Services (CMS) with new rates going into effect January 1 of each year. By law, CMS must publish the new rates in the Federal Register by November of the preceding year.

How Much Does Medicare pay for 98941?

Reimbursement ReductionsCode2020 Total RVU2021 Fee989400.80$23.23989411.15$33.39989421.50$43.55Aug 7, 2020

How much does Medicare Part B pay for physician fees quizlet?

Part B of Medicare pays 80% of physician's fees (based upon Medicare's physician fee schedule) for surgery, consultation, office visits and institutional visits after the enrollee meets a $185 deductible/yr.

Did Medicare reimbursement go up in 2022?

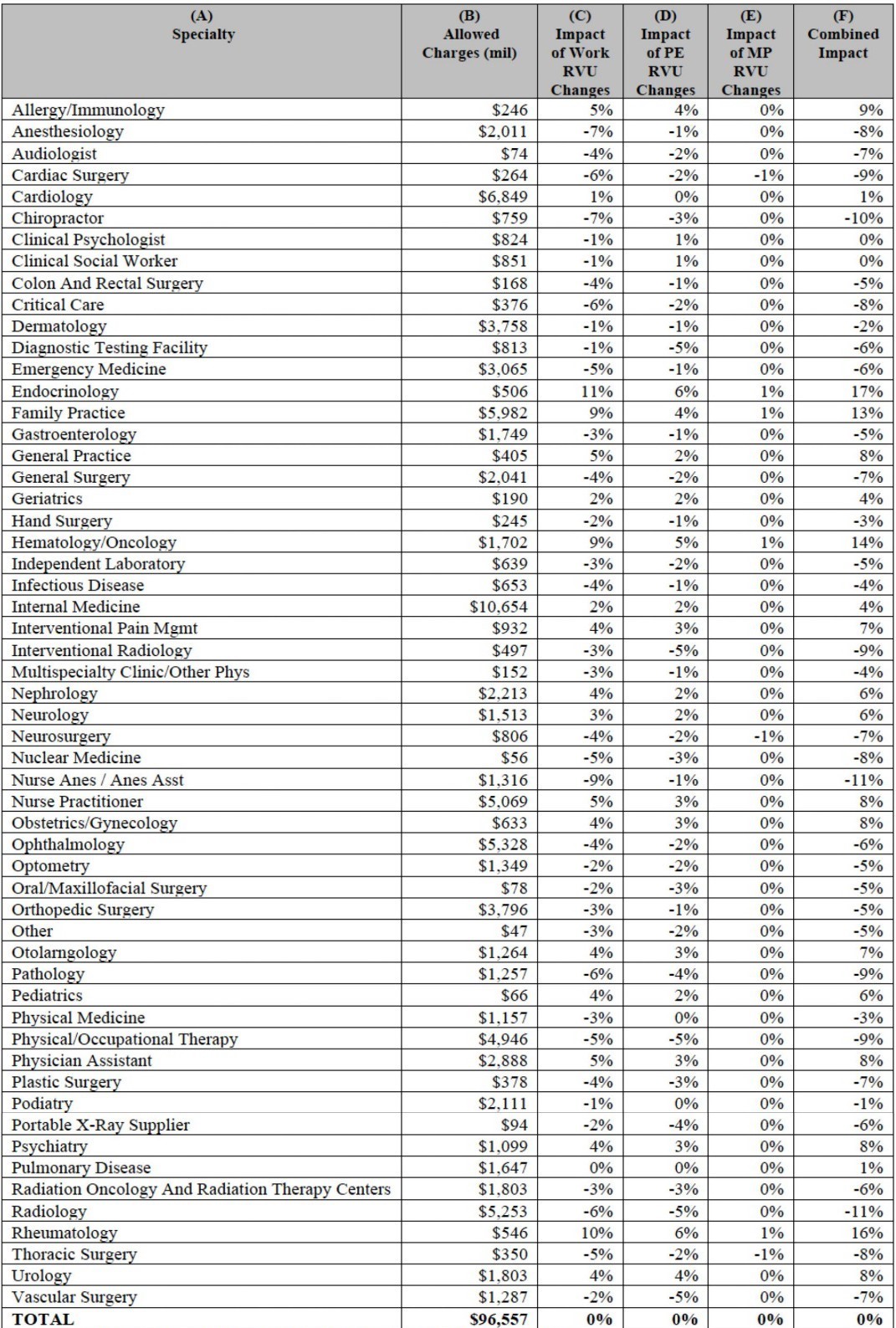

Thus, Medicare reimbursement for most services in 2022 will be approximately the same as in 2021. For care management services, however, CMS is adopting the American Medical Association (AMA) RVU Update Committee's (RUC) recommended increases in the assigned relative value units.

Is Rbrvs the same as Medicare fee schedule?

The Medicare Physician Fee Schedule (MPFS) uses a resource-based relative value system (RBRVS) that assigns a relative value to current procedural terminology (CPT) codes that are developed and copyrighted by the American Medical Association (AMA) with input from representatives of health care professional associations ...

Do Medicare Advantage plans follow Medicare fee schedule?

CMS does not require Medicare Advantage plans to pay providers the rates established by the MPFS. However, plans in many cases have provider contracts tied to the MPFS.

How much is deducted from Social Security for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

How much will Medicare premiums increase in 2022?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $164.90 in 2023, a decrease of $5.20 from $170.10 in 2022. This follows an increase of $21.60 in the 2022 premium, largely due to the cost of a new Alzheimer's drug.

Is Medicare free at age 65?

Most people age 65 or older are eligible for free Medicare hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

What is the 2022 Part B Medicare deductible?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Medicare physician fee schedule updated for 2022 - cmadocs

In another last-minute effort to stave off physician payment cuts, Congress recently passed—and President Biden signed—a law that stopped all but .75% of the nearly 10% cut to Medicare physician payments that would have otherwise occurred in 2022.

Physician Fee Schedule Look-Up Tool | CMS

Flu Shots. Get payment, coverage, billing, & coding information for the 2022-2023 season. You can now check eligibility (PDF) for the flu shot. We give information from claims billed in the last 18 months: CPT or HCPCS codes; Dates of service; NPIs who administered the shots

Calendar Year (CY) 2022 Medicare Physician Fee Schedule Proposed Rule

On July 13, 2021, the Centers for Medicare & Medicaid Services (CMS) issued a proposed rule that announces and solicits public comments on proposed policy changes for Medicare payments under the Physician Fee Schedule (PFS), and other Medicare Part B issues, on or after January 1, 2022.

2022 Medicare Physician Fee Schedules (MPFS)

By continuing, you agree to follow our policies to protect your identity. This means you won’t share your user ID, password, or other identity credentials. It also means you won’t use a computer program to bypass our CAPTCHA security check.

2022 Final Physician Fee Schedule (CMS-1751-F) Payment Rates for ...

2022 Final Physician Fee Schedule (CMS-1751-F) Payment Rates for Medicare Physician Services - Evaluation and Management CPT Code

Fee Schedule Lookup - NGSMEDICARE

Fee Schedule Assistance. The fee schedule assistance page provides access to information about fee schedule definitions and acronyms.. National Fee Schedules. Access the CMS website to view and download the following national fee schedules:. Ambulance Fee Schedule; Ambulatory Surgical Center (ASC) Payment; Clinical Laboratory Fee Schedule

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

What is the MPFS conversion factor for 2021?

CMS has recalculated the MPFS payment rates and conversion factor to reflect these changes. The revised MPFS conversion factor for CY 2021 is 34.8931. The revised payment rates are available in the Downloads section of the CY 2021 Physician Fee Schedule final rule (CMS-1734-F) webpage.

What is the calendar year 2021 PFS?

The calendar year (CY) 2021 PFS proposed rule is one of several proposed rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When will CMS issue a correction notice for 2021?

On January 19, 2021, CMS issued a correction notice to the Calendar Year 2021 PFS Final Rule published on December 28, 2020, and a subsequent correcting amendment on February 16, 2021. On March 18, 2021, CMS issued an additional correction notice to the Calendar Year 2021 PFS Final Rule. These notices can be viewed at the following link:

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

What is Medicare Part B?

Medicare Part B pays for physician services based on the Medicare Physician Fee Schedule (MPFS), which lists the more than 7,400 unique covered services and their payment rates. Physicians' services include office visits, surgical procedures, anesthesia services and a range of other diagnostic and therapeutic services.

When are MPFS fees due for 2020?

The CY 2020 MPFS fees have been updated by the Further Consolidated Appropriations Act of 2020. The fees are valid January 1, 2020 through December 31, 2020

What is limiting charge 2021?

2021. If you have elected to be a participant during 2021, the limiting charges indicated on the report will not pertain to your practice. The non-participating fee schedule amounts and limiting charges do not apply to services or supplies unless they are paid under the physician fee schedule.

What is a non-facility practice expense?

The higher non-facility practice expense RVUs are generally used to calculate payments for services performed in a physician's office and for services furnished to a patient in the patient's home; facility; or institution other than a hospital, skilled nursing facility (SNF), or ambulatory surgical center (ASC). For these services, the physician typically bears the cost of resources, such as labor, medical supplies and medical equipment associated with the physician's service.

Do you have to accept assignment for Medicare?

Some practitioners who provide services under the Medicare program are required to accept assignment for all Medicare claims for their services. This means that they must accept the Medicare allowed charge amount as payment in full for their practitioner services. The beneficiary's liability is limited to any applicable deductible plus the 20 percent coinsurance. The following practitioners must accept assignment for all Medicare covered services they furnish, and carriers do not send a participation enrollment package to these practitioners. The non-participating fee schedule amounts and limiting charges do not apply to services rendered by:

Is facility based fee a separate RVU?

The facility-based fees are linked to their own separate RVUs independent of the non-facility fee RVUs. This differs from the former site-of-service fee reductions, which were based simply on a percentage reduction of the full fee rather than a separate RVU.

Do limiting charges apply to Medicare?

If you have elected to be a participant during 2020, the limiting charges indicated on the report will not pertain to your practice. The non-participating fee schedule amounts and limiting charges do not apply to services or supplies unless they are paid under the physician fee schedule. Limiting charge applies to unassigned claims by non-participating providers. All services provided to Medicare beneficiaries are subject to audit and documentation requirements.

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

What is the MPFS conversion factor for 2021?

CMS has recalculated the MPFS payment rates and conversion factor to reflect these changes. The revised MPFS conversion factor for CY 2021 is 34.8931. The revised payment rates are available in the Downloads section of the CY 2021 Physician Fee Schedule final rule (CMS-1734-F) webpage.

What is the calendar year 2021 PFS?

The calendar year (CY) 2021 PFS proposed rule is one of several proposed rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When will CMS issue a correction notice for 2021?

On January 19, 2021, CMS issued a correction notice to the Calendar Year 2021 PFS Final Rule published on December 28, 2020, and a subsequent correcting amendment on February 16, 2021. On March 18, 2021, CMS issued an additional correction notice to the Calendar Year 2021 PFS Final Rule. These notices can be viewed at the following link:

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.