What is the Cy 2022 Medicare Physician Fee Schedule (PFS)?

CMS issued the CY 2022 Medicare Physician Fee Schedule (PFS) final rule that updates payment policies, payment rates, and other provisions for services. See a summary of key provisions, effective on or after January 1, 2022:

What is the Medicare physician fee schedule proposed rule?

This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021. This proposed rule proposes potentially misvalued codes and other policies affecting the calculation of payment rates.

What is a fee schedule for a doctor?

Fee Schedules - General Information. A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis.

How do I Find my Medicare fee schedule from CMS?

CMS offers the complete file in several different formats and provides a single code look up. Access the Medicare Physician Fee Schedule Database (MPFSDB)/Relative Value File on the CMS website. Access the Medicare Physician Fee Schedule Database (MPFSDB)/Fee Schedule Look-Up.

When is the Medicare Physician Fee Schedule 2020?

When will Medicare start charging for PFS 2022?

What is the MPFS conversion factor for 2021?

What is the calendar year 2021 PFS?

What is the CY 2021 rule?

When will CMS issue a correction notice for 2021?

What is the 2020 PFS rule?

See 4 more

About this website

Is the 2022 Medicare physician fee schedule available?

The Centers for Medicare & Medicaid Services (CMS) released the 2022 Medicare Physician Fee Schedule and Quality Payment Program final rule on Nov. 2 .

Where can I download the Medicare physician fee schedule?

you may wish to access the Medicare Physician Fee Schedule Database (MPFSDB)/Relative Value File on the CMS website. CMS offers the complete file in several different formats and provides a single code look up. Access the Medicare Physician Fee Schedule Database (MPFSDB)/Relative Value File on the CMS website.

What is the Medicare fee for 2022?

If you don't get premium-free Part A, you pay up to $499 each month. If you don't buy Part A when you're first eligible for Medicare (usually when you turn 65), you might pay a penalty. Most people pay the standard Part B monthly premium amount ($170.10 in 2022).

What is the Medicare fee schedule?

A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis.

How often is the Medicare physician fee schedule updated?

annuallyThe fee schedule is updated annually by the Centers for Medicare and Medicaid Services (CMS) with new rates going into effect January 1 of each year. By law, CMS must publish the new rates in the Federal Register by November of the preceding year.

Is Rbrvs the same as Medicare fee schedule?

The Medicare Physician Fee Schedule (MPFS) uses a resource-based relative value system (RBRVS) that assigns a relative value to current procedural terminology (CPT) codes that are developed and copyrighted by the American Medical Association (AMA) with input from representatives of health care professional associations ...

What are the Medicare changes for 2022?

In 2022, Original Medicare costs will increase across the board, but average Medicare Advantage premiums will be lower. Other changes include more plans that cap insulin costs, improved access to mental health care and Medicare Advantage for ESRD patients for coverage starting in 2022.

How do I find the Medicare allowable rate?

You can search the MPFS on the federal Medicare website to find out the Medicare reimbursement rate for specific services, treatments or devices. Simply enter the HCPCS code and click “Search fees” to view Medicare's reimbursement rate for the given service or item.

Did Medicare Reimbursement go up in 2022?

Thus, Medicare reimbursement for most services in 2022 will be approximately the same as in 2021. For care management services, however, CMS is adopting the American Medical Association (AMA) RVU Update Committee's (RUC) recommended increases in the assigned relative value units.

How Much Does Medicare pay for 99214?

$141.78CPT Code 99214 Reimbursement Rate Medicare reimburses for procedure code 99214 at $141.78.

What is the Medicare physician fee schedule Mpfs?

The Medicare Physician Fee Schedule (MPFS) is the annual regulatory rule released by the Centers for Medicare and Medicaid Services (CMS) that updates the standards for physician reimbursement and policies related to the delivery of health care.

Do Medicare Advantage plans follow Medicare fee schedule?

CMS does not require Medicare Advantage plans to pay providers the rates established by the MPFS. However, plans in many cases have provider contracts tied to the MPFS.

How do you find out how much Medicare paid my doctor?

Calling 1-800-MEDICARE (1-800-633-4227) and using the automated phone system. TTY users can call 1-877-486-2048 and ask a customer service representative for this information. If your health care provider files the claim electronically, it takes about 3 days to show up in Medicare's system.

What is the physician look up tool?

This look-up tool is a searchable database that allows you to look up a provider by National Provider Identifier (NPI), or by name and location. The look-up tool will return information on services and procedures provided to beneficiaries enrolled in Original Medicare (fee-for-service) for 2020.

How is the Medicare physician fee schedule calculated?

The GPCIs are applied in the calculation of a fee schedule payment amount by multiplying the RVU for each component times the GPCI for that component. The Medicare limiting charge is set by law at 115 percent of the payment amount for the service furnished by the nonparticipating physician.

How are Rbrvs fee schedules calculated?

Payments are calculated by multiplying the combined costs of a service times a conversion factor (a monetary amount determined by CMS) and adjusting for geographical differences in resource costs.

Medicare physician fee schedule updated for 2022 - cmadocs

In another last-minute effort to stave off physician payment cuts, Congress recently passed—and President Biden signed—a law that stopped all but .75% of the nearly 10% cut to Medicare physician payments that would have otherwise occurred in 2022.

Calendar Year (CY) 2022 Medicare Physician Fee Schedule Final Rule

On November 2, 2021, the Centers for Medicare & Medicaid Services (CMS) issued a final rule that includes updates on policy changes for Medicare payments under the Physician Fee Schedule (PFS), and other Medicare Part B issues, on or after January 1, 2022.

Physician Fee Schedule Look-Up Tool | CMS

Flu Shots. Get payment, coverage, billing, & coding information for the 2022-2023 season. You can now check eligibility (PDF) for the flu shot. We give information from claims billed in the last 18 months: CPT or HCPCS codes; Dates of service; NPIs who administered the shots

2022 Medicare Physician Fee Schedules (MPFS)

By continuing, you agree to follow our policies to protect your identity. This means you won’t share your user ID, password, or other identity credentials. It also means you won’t use a computer program to bypass our CAPTCHA security check.

2022 Final Physician Fee Schedule (CMS-1751-F) Payment Rates for ...

2022 Final Physician Fee Schedule (CMS-1751-F) Payment Rates for Medicare Physician Services - Evaluation and Management CPT Code

Fee Schedule Lookup - NGSMEDICARE

Fee Schedule Assistance. The fee schedule assistance page provides access to information about fee schedule definitions and acronyms.. National Fee Schedules. Access the CMS website to view and download the following national fee schedules:. Ambulance Fee Schedule; Ambulatory Surgical Center (ASC) Payment; Clinical Laboratory Fee Schedule

What is the calendar year 2022 PFS?

The calendar year (CY) 2022 PFS proposed rule is one of several proposed rules that reflect a broader Administration-wide strategy to create a health care system that results in better accessibility, quality, affordability, empowerment, and innovation.

What is the PFS conversion factor for 2021?

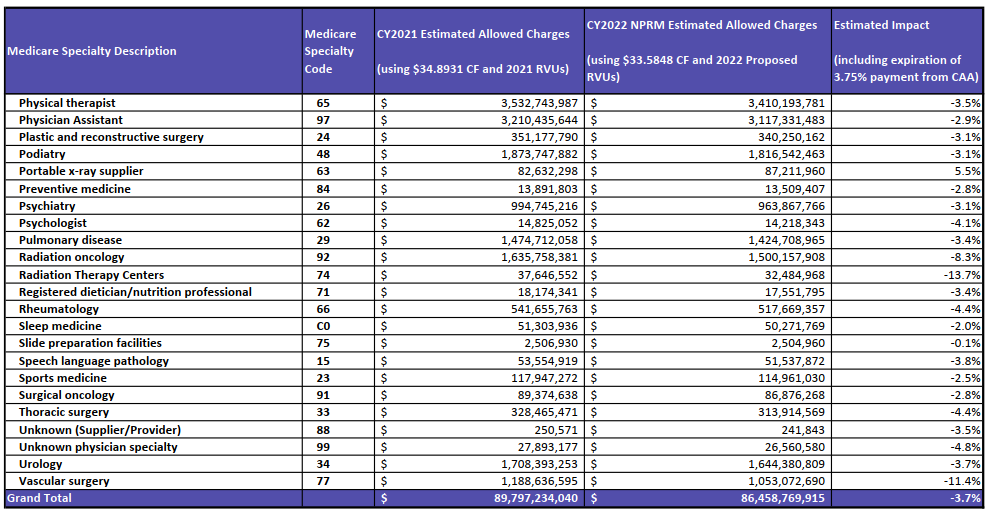

With the proposed budget neutrality adjustment to account for changes in RVUs (required by law), and expiration of the 3.75 percent payment increase provided for CY 2021 by the Consolidated Appropriations Act, 2021 (CAA), the proposed CY 2022 PFS conversion factor is $33.58, a decrease of $1.31 from the CY 2021 PFS conversion factor of $34.89. The PFS conversion factor reflects the statutory update of 0.00 percent and the adjustment necessary to account for changes in relative value units and expenditures that would result from our proposed policies.

What is the OIG methodology for Medicare?

Section 405 of the CAA requires the Office of Inspector General (OIG) to conduct periodic studies on non-covered, self-administered versions of drugs or biologicals that are included in the calculation of payment under section 1847A of the Social Security Act. This provision permits CMS to apply a payment limit calculation methodology (the “lesser of” methodology) to applicable billing codes, if deemed appropriate. That is, the Medicare payment limit for the drug or biological billing code would be the lesser of: (1) the payment limit determined using the current methodology (where the calculation includes the ASPs of the self-administered versions), or (2) the payment limit calculated after excluding the non-covered, self-administered versions. CMS is proposing the “lesser of” methodology for drug and biological products that may be identified by future OIG reports.

When will telehealth services be added to the Medicare telehealth list?

As CMS continues to evaluate the temporary expansion of telehealth services that were added to the telehealth list during the COVID-19 PHE, CMS is proposing to allow certain services added to the Medicare telehealth list to remain on the list to the end of December 31, 2023, so that there is a glide path to evaluate whether the services should be permanently added to the telehealth list following the COVID-19 PHE.

How long after hospitalization can you get pulmonary rehabilitation?

We are proposing to expand coverage of outpatient pulmonary rehabilitation services, paid under Medicare Part B, to beneficiaries who were hospitalized with COVID-19 and experience persistent symptoms, including respiratory dysfunction, for at least four weeks after hospitalization.

When is telehealth required in CAA?

Section 123 of the CAA removed the geographic restrictions and added the home of the beneficiary as a permissible originating site for telehealth services when used for the purposes of diagnosis, evaluation, or treatment of a mental health disorder, and requires that there be an in-person, non-telehealth service with the physician or practitioner within six months prior to the initial telehealth service, and thereafter, at intervals as specified by the Secretary.

Why do you need to report modifiers on a claim?

Requiring reporting of a modifier on the claim to help ensure program integrity.

What is the final rule for Medicare?

In this final rule, we are finalizing payment and policy changes under the Medicare PFS and required statutory changes under the Consolidated Appropriations Act, 2021 and sections 2003 and 2005 of the SUPPORT for Patients and Communities Act of 2018. We also are finalizing changes to payment policy and other related policies for Medicare Part B. In addition, this final rule will make modest revisions to certain Medicare provider and supplier enrollment regulatory provisions and add already existing provider and supplier requirements pertaining to prepayment and post-payment review activities.

What is the delay in CY 2022 PFS?

In the CY 2022 PFS proposed rule, we proposed to amend § 414.1395 (c) to add a 1-year delay of publicly reporting new improvement activities and Promoting Interoperability measures and attestations reported via MVP. We also proposed a one-time, 1-year delay to subgroup-level public reporting, such that subgroup-level public reporting will begin with CY 2024 performance information available in 2025, and each year thereafter, on the Compare Tools hosted by the U.S. Department of Health and Human Services (HHS), referred to as “compare tool” throughout this final rule, available at https://www.medicare.gov/care-compare/ and data.medicare.gov, as technically feasible. We proposed to add facility affiliations, beyond the hospital affiliations currently displayed on individual profile pages. Additional facility affiliations would include: Inpatient rehabilitation facilities (IRFs); long-term care hospitals (LTCHs); skilled nursing facilities (SNFs); inpatient psychiatric facilities (IPFs); home health agencies (HHAs); hospices; and dialysis facilities. Finally, we solicited comments on publicly reporting utilization data on clinician and group profile pages ( 86 FR 39466 through 39469).

What if QCDR is not approved?

Additionally, if a QCDR measure owner is not approved or is not in good standing, any QCDR measures associated with that QCDR would also not be approved. We believe it is important to have an approved QCDR measure owner for all approved QCDR measures. This would ensure that there is active involvement by the QCDR measure owner so that any potential measure issues can be mitigated during the specified MIPS performance period. For example, any mid-year guideline changes or measure questions would need to be immediately clarified to avoid negative impacts to clinicians such as the inability to construct a benchmark due to an error in the measure specifications. Therefore, we proposed to codify another rejection criterion at § 414.1400 (b) (4) (iv) (N) to state that, if a QCDR measure owner is not approved during a given self-nomination period, any associated QCDR measures with that QCDR would also not be approved. We solicited comments on this proposal.

How many organizations are eligible for MDPP?

Currently, more than 1,000 organizations nationally are eligible to become MDPP suppliers based on their preliminary or full CDC Diabetes Prevention Recognition Program (DPRP) status. However, only 27 percent of eligible organizations are participating in MDPP. We anticipate that the removal of the second year of the MDPP set of services will make MDPP attractive and feasible to more MDPP eligible organizations. Not only does a 12-month MDPP services period align with that of the CDC's National DPP and the DPP model test, our data show that only 10 percent of enrolled MDPP participants continue with the Ongoing Maintenance phase sessions (Year 2), and the majority are reaching their weight loss milestone within the first 6 months of the set of MDPP services. Stakeholders report that the second year of MDPP, or the ongoing maintenance phase, is cost prohibitive due to the costs to retain beneficiaries in year 2 of the expanded model as well as the costs to deliver an additional year of the expanded model that is not supported by the CDC National DPP curriculum. The CDC's National DPP curriculum supports a 1-year program and suppliers have found it difficult to extrapolate the curriculum to a second year. Additionally, MDPP suppliers commented that they have an increasingly difficult time making the business case for MDPP given the costs associated with the ongoing maintenance phase and the low performance payments associated with the second year. Given the low volume of participants continuing in the second year of MDPP, delivering the MDPP ongoing maintenance period creates an undue burden to MDPP suppliers. The cost to offer and deliver the sessions to a small cohort of individuals outweigh the maximum payments available from Medicare.

What is the final rule of PFS?

This final rule contains a range of policies, including some provisions related to specific statutory provisions. The preceding preamble provides descriptions of the statutory provisions that are addressed, identifies those policies when discretion has been exercised, presents rationale for our policies and, where relevant, alternatives that were considered. For purposes of the payment impact on PFS services of the policies contained in this final rule, we presented the estimated impact on total allowed charges by specialty.

What is CMS 405?

Codifying the provisions set forth by section 405 will permit to CMS to apply the lesser of payment methodology at section 1847 (g) (2) of the Act to billing and payment codes identified by future OIG studies (described in section III.D.2. of this final rule). This provision addresses distorted payment limits for these products and may result in payment amounts that are better aligned with versions of these products that are payable under Part B (for example, versions that are usually not self-administered). Although we are unable to quantify the total magnitude of the potential savings, these changes have the potential to substantially reduce program expenditures and beneficiary coinsurance.

What is open payment system?

Currently the Open Payments system allows for a reporting entity to submit either a general record with a nature of payment category of ownership, or an ownership and investment interest record. For Program Years 2015-2019, approximately 92 applicable Start Printed Page 65565 manufacturers and GPOs reported records with the nature of payment category of ownership. Since reporting these general records as ownership records will require the addition of two additional pieces of information, we anticipate that it will take these 92 entities an additional 3 hours at $42.40/hr to report the two extra fields. In aggregate, we estimate an added annual burden of 276 hours (92 entities × 3 hr/response) at a cost of $11,702 (276 hr × $42.40/hr). This will be included in the AM (Data collection and submission) and Applicable GPO (Data Collection and Submission) IC requirements and the “Open Payments User Guide” Instrument in the existing PRA package.

When are MPFS fees due for 2020?

The CY 2020 MPFS fees have been updated by the Further Consolidated Appropriations Act of 2020. The fees are valid January 1, 2020 through December 31, 2020

What is limiting charge 2021?

2021. If you have elected to be a participant during 2021, the limiting charges indicated on the report will not pertain to your practice. The non-participating fee schedule amounts and limiting charges do not apply to services or supplies unless they are paid under the physician fee schedule.

What is Medicare Part B?

Medicare Part B pays for physician services based on the Medicare Physician Fee Schedule (MPFS), which lists the more than 7,400 unique covered services and their payment rates. Physicians' services include office visits, surgical procedures, anesthesia services and a range of other diagnostic and therapeutic services.

What is a non-facility practice expense?

The higher non-facility practice expense RVUs are generally used to calculate payments for services performed in a physician's office and for services furnished to a patient in the patient's home; facility; or institution other than a hospital, skilled nursing facility (SNF), or ambulatory surgical center (ASC). For these services, the physician typically bears the cost of resources, such as labor, medical supplies and medical equipment associated with the physician's service.

Do you have to accept assignment for Medicare?

Some practitioners who provide services under the Medicare program are required to accept assignment for all Medicare claims for their services. This means that they must accept the Medicare allowed charge amount as payment in full for their practitioner services. The beneficiary's liability is limited to any applicable deductible plus the 20 percent coinsurance. The following practitioners must accept assignment for all Medicare covered services they furnish, and carriers do not send a participation enrollment package to these practitioners. The non-participating fee schedule amounts and limiting charges do not apply to services rendered by:

Is facility based fee a separate RVU?

The facility-based fees are linked to their own separate RVUs independent of the non-facility fee RVUs. This differs from the former site-of-service fee reductions, which were based simply on a percentage reduction of the full fee rather than a separate RVU.

Do limiting charges apply to Medicare?

If you have elected to be a participant during 2020, the limiting charges indicated on the report will not pertain to your practice. The non-participating fee schedule amounts and limiting charges do not apply to services or supplies unless they are paid under the physician fee schedule. Limiting charge applies to unassigned claims by non-participating providers. All services provided to Medicare beneficiaries are subject to audit and documentation requirements.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

What is the MPFS conversion factor for 2021?

CMS has recalculated the MPFS payment rates and conversion factor to reflect these changes. The revised MPFS conversion factor for CY 2021 is 34.8931. The revised payment rates are available in the Downloads section of the CY 2021 Physician Fee Schedule final rule (CMS-1734-F) webpage.

What is the calendar year 2021 PFS?

The calendar year (CY) 2021 PFS proposed rule is one of several proposed rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When will CMS issue a correction notice for 2021?

On January 19, 2021, CMS issued a correction notice to the Calendar Year 2021 PFS Final Rule published on December 28, 2020, and a subsequent correcting amendment on February 16, 2021. On March 18, 2021, CMS issued an additional correction notice to the Calendar Year 2021 PFS Final Rule. These notices can be viewed at the following link:

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.