| IRS Transcript Cycle Codes | Calendar Date |

| 20220102 | Monday, January 3, 2022 |

| 20220102 | Tuesday, January 4, 2022 |

| 20220104 | Wednesday, January 5, 2022 |

| 20220105 | Thursday, January 6, 2022 |

Why is my tax refund still processing?

Tax return still being processed after 3 months. There are many reasons your tax refund could have been delayed. Perhaps your numbers and your employer’s numbers did not match, or you accidentally skipped a line or an entire form, or maybe you claimed a credit that the IRS takes longer to check.

How long till refund approved?

The major steps in the refund approval process are the following: You submit the refund with an e-postmark, and the application is sent to the government. You wait for the IRS to accept the return. It will take from 24 to 48 hours. They will check the personal data to ensure that all the records match.

When does IRS send out refunds?

- The IRS runs their system after the close of business twice per week.

- Sometime between 10 p.m. ...

- Once the IRS system runs some tests on the file, it uploads to the ACH.

- The ACH transmits that data almost immediately to every bank receiving data from it.

- That process usually completes before 5 a.m.

What does the processing date mean on my tax transcript?

You are able to see your cycle date via the free official IRS transcript, with this being an eight-digit number that follows the format of year-week of year-day of week. Therefore, it will look something like 20220602. The first four digits indicates the tax processing year, so this would be 2022.

What is the processing date on IRS account transcript 2022?

Therefore, it will look something like 20220602. The first four digits indicates the tax processing year, so this would be 2022. The fifth and sixth digits are the week of the year, so in this example the '06' would mean it is the sixth calendar week of the year.

How long does it take for IRS to update transcripts?

If you filed your tax return electronically, IRS's return processing takes from 2 to 4 weeks before a transcript becomes available. If you mailed your tax return, it takes about 6 weeks.

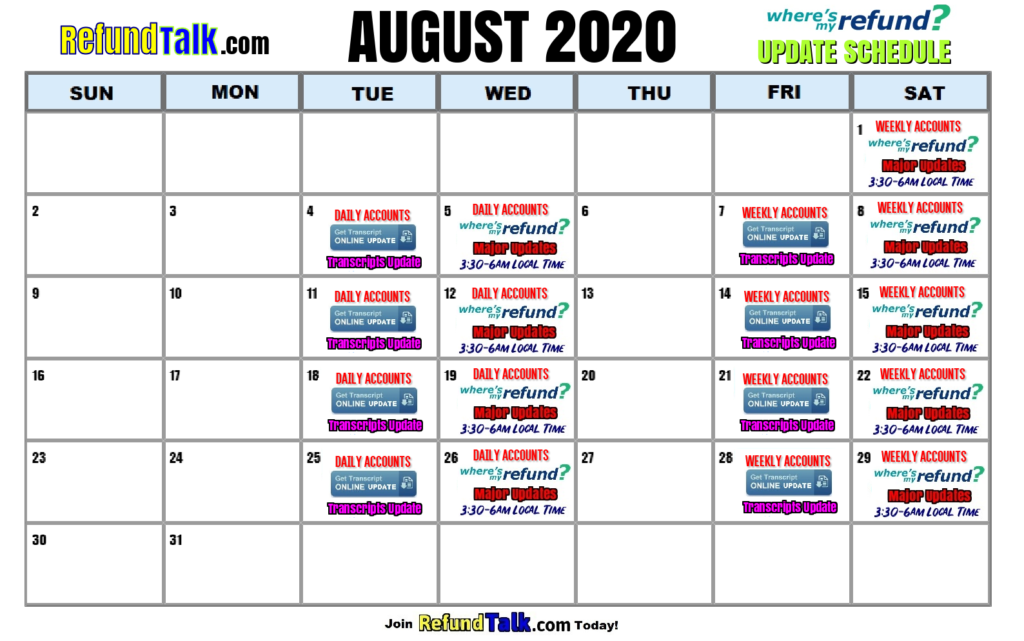

What time of day does the IRS update refund status 2022?

Note that the IRS only updates tax return statuses once a day during the week, usually between midnight and 6 a.m. They do not update the status more than once a day, so checking throughout the day will not give you a different result. Should I call the IRS to check my federal tax refund status?

What is the cycle date on tax transcript?

The IRS cycle code is an eight-digit number that you can find on your online tax transcript once your return has been posted to the IRS Master File. If you see a cycle code along with transaction code 150, you'll know that your tax return is being processed.

Why does my tax transcript have a future date?

The “As Of” date on a Tax Account Transcript is the date your penalties and interest are estimated to be calculated to determine if you have a balance due or tax refund. It's computed to a future date in the case someone may owe and they want to mail their check-in rather than pay online.

What does processing date on transcript mean?

What does the processing date on an IRS transcript mean? The processing date represented by your cycle code informs you when your tax transcript will be updated. What day of the week does the IRS update refund status? The IRS will update your refund status information once a week and it takes place on Wednesdays.

What time on Wednesday does the IRS update?

: 3:30 a.m. to 6 a.m.Wednesday: 3:30 a.m. to 6 a.m. Thursday: 3:30 a.m. to 6:00 a.m. Friday: 3:30 a.m. to 6 a.m. Saturday: 3:30 a.m. to 6 a.m. and 9 p.m. to Midnight.

Does the IRS update refund status on weekends?

The IRS only updates your refund status information once per week on Wednesdays.

What time of night does IRS deposit refunds?

Does the irs make direct deposits throughout the day or just in the am or pm? Normally they sent to your bank between 12am and 1am. That does not mean it will go directly into your bank account. You bank can take up to 5 days to deposit it but normally it only takes a few hours.

What does code 766 and 768 mean on IRS transcript?

Transaction Codes Code 806 is simply an acknowledgement that your electronically filed tax return was received. Code 766 indicates a credit to your account (generally, a refund – but it can be a credit toward taxes in a prior year, if you have those) Code 768 indicates an earned income credit amount.

Where is refund date on transcript?

A tax transcript will not help you find out when you'll get your refund. The information transcripts have about your account does not necessarily reflect the amount or timing of your refund.

What is request and response date on transcript?

It's the date you requested to view it and the date the irs responded. If you do it online, it is the same as today's date. 1.

How can I look at my tax transcript online immediately?

An IRS Tax Return Transcript can be obtained: ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

Why is my transcript taking so long?

It depends how far your school is from your prospective institution and how they are able to receive it. If the school accepts electronic transcripts, it may take 24 to 48 hours. If a hard copy is required, it can take a few days to be received. If the schools are on each coast, it could take over a week.

Why does my IRS transcript says N A 2022?

The N/A is letting you know that your transcripts for the current filed tax year are Not Available yet.

Will my tax transcript show refund date?

While the official line is that tax transcripts will not help you find out how much or when you will get your refund for the current tax year, there is some compelling evidence from recent tax seasons that this is not always the case.

What does the transcript cycle code mean?

The tax transcript cycle code means your return has been submitted to the IRS master file (IMF) and generally means that your filed tax return is under processing (code 150) by the IRS.

How do I find my IRS Cycle Code?

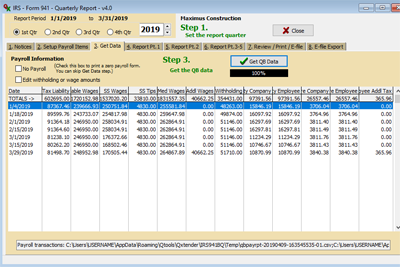

You will need to get access to your (free) official IRS transcript. Once you have that look for the cycle date per the image below. It will be a 8 digit number like this 20220602. The cycle is interpreted as follows: (YEAR) (WEEK OF YEAR) (DAY OF WEEK)

2022 IRS Cycle Codes for Direct Deposit Dates

The table below shows the IRS cycle code to calendar date conversion. Remember the cycle code can update/change through out the tax season as your tax return is processed.

Refund direct deposit date (with Code 846) via cycle code

When you see the IRS code 846 (refund of overpayment) on your transcript it means a refund has been issued. This is when you can use the cycle code to get an estimated date for your refund. It will generally be the day after your “day of the week” cycle code.

What does it mean to request a transcript from the IRS?

Generally if you can request a transcript, it means the refund is on the way and the IRS has completed processing of your tax return. But this is all anecdotal evidence.

When will the IRS start processing 2020 tax returns?

This all meant that the the IRS has had to push out the start of processing 2020 tax returns by two to three weeks to February 12, 2021 and have delayed the end of the regular 2020-2021 tax season to May 17th, 2021. It is expected that tax returns and refund processing will stretch well into summer as the IRS clears a large back log of current and past tax year returns, in addition to making catch-up stimulus payments.

What does "Refer to Tax Topic 152" mean?

When you see the “Refer to Tax Topic 152” message it means your refund is being processed and the IRS is directing you its generic refund page for more information. There is not much you can do but wait to see if the IRS finds any issues or requires further verification of your identity or items in your tax return. See the various reader comments below on timing and their experience after getting this and other WMR messages.

What is estimated tax refund?

The estimated tax season refund payment dates schedule is based on past refund cycles and IRS guidelines. It shows the date your refund will be processed and paid based on the week your return is accepted and approved by the IRS.

How long does it take to get a tax refund in 2020?

Note that refund deposit dates could be much longer than shown (the IRS says on average most refunds are processing by 21 days) if your return is pulled for additional security or manual processing checks. To get the exact date of your refund payment check the IRS’ Where is My Refund ( WMR) tool/app.

How many refunds will the IRS issue in 2020?

According to the IRS in 2020, they received more than 167.2 million individual returns and issued more than 124.8 million refunds for more than $314.5 billion. This number is expected to increase to over 175 million in 2021 due to the claiming of missed stimulus payments as a recovery rebate ...

How long does it take for a refund to be processed?

Note that refund deposit dates could be much longer than shown (the IRS says on average most refunds are processing by 21 days) if your return is pulled for additional security or manual processing checks. To get the exact date of your refund payment check the IRS’ Where is My Refund ( WMR) tool/app. It’s also important to note that not all states ...

Who is the /r/IRS subreddit?

This sub-reddit is about news, questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service, IRS. Originally started by John Dundon, an Enrolled Agent, who represents people against the IRS, /r/IRS has grown into an excellent portal for quality information from any number of tax professionals, and Reddit contributing members. /r/IRS does not represent the IRS. Contact John@JohnRDundon.com for immediate professional advice.

Is tramscript weekly or daily?

Some are weekly cycle, some are daily, its not super common but you could get it without an update, some dude posted an hour ago with N/A on his tramscript