The Department anticipates issuing substantially all the refunds by early August for returns filed by April 18, 2022. Your H.B. 1302 refund will not be issued until your 2021 tax return has been processed. For additional information, please review these frequently asked questions: https://dor.georgia.gov/hb-1302-tax-refund-faqs

When will Georgia send out tax refunds?

Special state income tax refunds paid out of Georgia’s historic budget surplus could be on their way to taxpayers in six to eight weeks. Georgia Gov. Brian Kemp signs a bill to give state income refunds of more than $1.1 billion on Wednesday, March 23, 2022, at the Georgia capitol in Atlanta.

When will Georgia tax rebates go out?

When are the Georgia Tax Rebate Checks being sent out? This money will be paid back to the eligible taxpayers once they complete their form for the 2021 tax year.

How to check your GA state refund?

- Completed Form GA-5347 – Deceased Taxpayer Refund Check Claim

- Copy of the death certificate

- Original refund check issued in the deceased’s name

- Any other information specified on the form

Why are Georgia refunds delayed?

This is two to three times what it normally takes. Other causes for extended delays are due to the manual processing of past year amended returns and tax returns which need to be adjusted for incorrectly claimed refundable credit amounts related to the EITC, RRC or CTC.

When can I expect my Georgia state tax refund?

Most error free, electronically filed returns are processed within 5 business days of receiving the return and most refunds are issued within 21 days from the date a taxpayer files their return.

How soon will I get my 2022 tax refund?

21 daysMore than 90 percent of tax refunds are issued by the IRS in less than 21 days, according to the IRS. However, the exact timing of receiving your refund depends on a range of factors, and in some cases, the process may take longer.

What day is the IRS releasing refunds 2022?

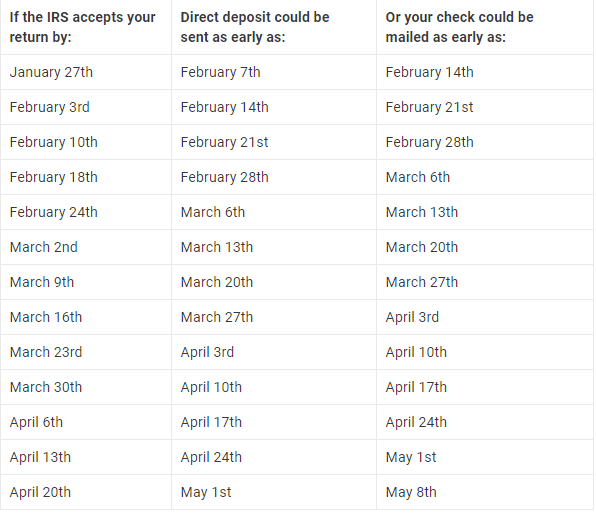

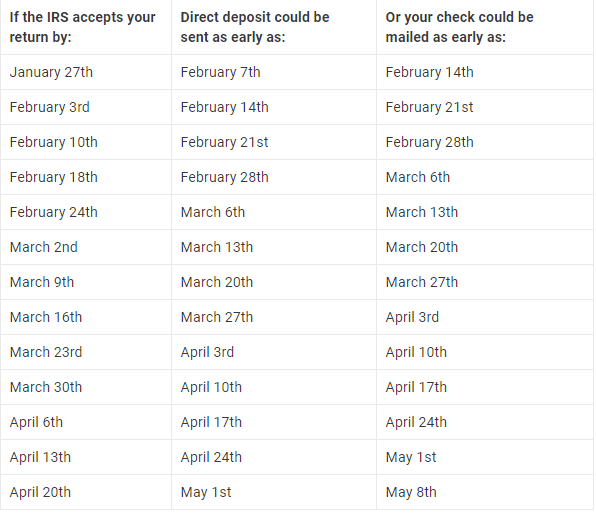

2022 IRS Tax Refund Dates: When to Expect Your RefundIRS Accepts E-Filed Return By:Direct Deposit Sent (Or Paper Check Mailed 1 week later):IRS will start accepting income tax returns on Jan. 24, 2022.Jan. 24, 2022*Jan. 31 (Feb. 11)**Jan. 31, 2022*Feb. 11 (Feb. 18)**Feb. 7Feb. 18 (Feb. 25)**7 more rows•Jan 8, 2022

Where is my federal refund GA?

Call the DOR automated telephone line at 877-423-6711 to check the status of your tax refund. Press option 2 (“Individual Income Tax Information”), then option 2 to inquire about the status of your refund. Follow the prompts to check your tax refund status.

How long does it take for state tax refund direct deposit 2022?

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive.

What time do tax refunds get deposited?

Does the irs make direct deposits throughout the day or just in the am or pm? Normally they sent to your bank between 12am and 1am. That does not mean it will go directly into your bank account. You bank can take up to 5 days to deposit it but normally it only takes a few hours.

How long after taxes are received are they approved?

When you e-file, it typically takes 24 to 48 hours for the IRS to accept your return. Once your return is accepted, you are on the IRS' refund timetable. The IRS typically issues refunds in less than 21 days after your e-filed return is accepted.

Do banks process refunds on weekends?

The time between the IRS issuing the refund and the bank posting it to an account may vary since many banks do not process payments on weekends or holidays. The return may require additional review.

How long does it take for IRS to approve refund after it is accepted?

The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it's possible your tax return may require additional review and take longer.

What time do tax refunds get deposited?

Does the irs make direct deposits throughout the day or just in the am or pm? Normally they sent to your bank between 12am and 1am. That does not mean it will go directly into your bank account. You bank can take up to 5 days to deposit it but normally it only takes a few hours.

How long does it take to get your tax return Australia?

Online returns process in 2 weeks (14 days) while paper takes up to 10 weeks (50 business days). Paper returns can take up to 7 weeks to show in our systems. If your tax return requires manual checks processing it may take longer.

How long does it take to get tax refund direct deposit?

If you file a complete and accurate paper tax return, your refund should be issued in about six to eight weeks from the date IRS receives your return. If you file your return electronically, your refund should be issued in less than three weeks, even faster when you choose direct deposit.

How long does it take to get a Georgia tax refund?

If a return contains incorrect or questionable information, it may take up to 90 days from the date of receipt by DOR to process a return and issue a refund. All first-time Georgia income tax filers, or taxpayers who have not filed in Georgia for at least five years, will receive a paper check. Read Georgia Tax Facts for important tax information ...

How to check on my tax refund?

Check the status of your refund online using Where's My Refund ? 1 We will begin accepting returns January 27, 2020. 2 Most error free, electronically filed returns are processed within 5 business days of receiving the return and most refunds are issued within 21 days from the date a taxpayer files their return. 3 If a return contains incorrect or questionable information, it may take up to 90 days from the date of receipt by DOR to process a return and issue a refund. 4 All first-time Georgia income tax filers, or taxpayers who have not filed in Georgia for at least five years, will receive a paper check. 5 Read Georgia Tax Facts for important tax information and to learn more about what we are doing to protect Georgia taxpayers against fraud.