The Department anticipates issuing substantially all the refunds by early August for returns filed by April 18, 2022. Your H.B. 1302 refund will not be issued until your 2021 tax return has been processed. For additional information, please review these frequently asked questions: https://dor.georgia.gov/hb-1302-tax-refund-faqs

When will Georgia send out tax refunds?

Special state income tax refunds paid out of Georgia’s historic budget surplus could be on their way to taxpayers in six to eight weeks. Georgia Gov. Brian Kemp signs a bill to give state income refunds of more than $1.1 billion on Wednesday, March 23, 2022, at the Georgia capitol in Atlanta.

When will Georgia tax rebates go out?

When are the Georgia Tax Rebate Checks being sent out? This money will be paid back to the eligible taxpayers once they complete their form for the 2021 tax year.

How to check your GA state refund?

- Completed Form GA-5347 – Deceased Taxpayer Refund Check Claim

- Copy of the death certificate

- Original refund check issued in the deceased’s name

- Any other information specified on the form

Why are Georgia refunds delayed?

This is two to three times what it normally takes. Other causes for extended delays are due to the manual processing of past year amended returns and tax returns which need to be adjusted for incorrectly claimed refundable credit amounts related to the EITC, RRC or CTC.

How long does it take to get a Georgia tax refund?

How to check on my tax refund?

About this website

When can I expect my Georgia state tax refund?

Most error free, electronically filed returns are processed within 5 business days of receiving the return and most refunds are issued within 21 days from the date a taxpayer files their return.

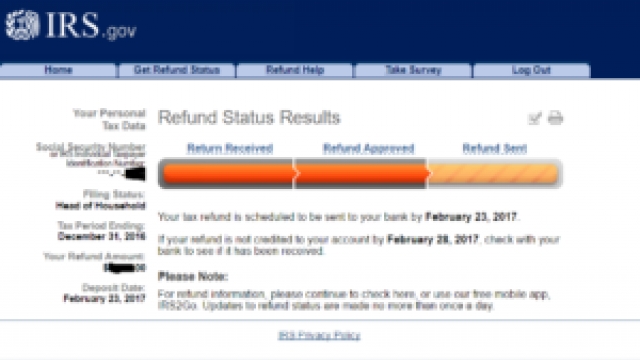

What is the schedule for tax refunds 2022?

2022 IRS refund schedule chartDate taxes acceptedDirect deposit sentPaper check mailedFeb. 8 – Feb. 14Feb. 21Feb. 28Feb. 15 – Feb. 21Feb. 28March 7Feb. 22 – Feb. 28March 7March 14March 1 – March 7March 14March 2123 more rows

What day of the week are refunds deposited 2022?

They now issue refunds every business day, Monday through Friday (except holidays). Due to changes in the IRS auditing system, they no longer release a full schedule as they did in previous years.

Why is GA state tax refund taking so long?

There are a number of issues that could be delaying your Georgia tax refund, such as: Paper filed returns. If the department needs to verify information reported on your return or request additional information. Mathematical errors on your return or other adjustments.

What time in the morning do taxes get deposited?

Does the irs make direct deposits throughout the day or just in the am or pm? Normally they sent to your bank between 12am and 1am. That does not mean it will go directly into your bank account. You bank can take up to 5 days to deposit it but normally it only takes a few hours.

Where is my federal refund GA?

Call the DOR automated telephone line at 877-423-6711 to check the status of your tax refund. Press option 2 (“Individual Income Tax Information”), then option 2 to inquire about the status of your refund. Follow the prompts to check your tax refund status.

Why has my refund been accepted but not approved?

An incomplete return, an inaccurate return, an amended return, tax fraud, claiming tax credits, owing certain debts for which the government can take part or all of your refund, and sending your refund to the wrong bank due to an incorrect routing number are all reasons that a tax refund can be delayed.

How long does it take for state tax refund direct deposit 2022?

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive.

Do banks process refunds on weekends?

The time between the IRS issuing the refund and the bank posting it to an account may vary since many banks do not process payments on weekends or holidays. The return may require additional review.

Are Georgia tax refunds delayed 2022?

Due to the volume of refunds, it may take some time for all refunds to be processed. The Department anticipates issuing substantially all the refunds by early August for returns filed by April 18, 2022. Your H.B. 1302 refund will not be issued until your 2021 tax return has been processed.

Is the state of GA sending out checks?

Beginning in September, around 3 million Georgians can expect a cheque of $350 to arrive in their bank accounts. This is because Governor Brian Kemp has released up to $1.2 billion in covid-19 aid to send people funds to deal with inflation.

What is the GA tax refund?

It depends on your filing status. Single filers and married individuals who file separately could receive a maximum refund of $250. Head of Household filers could receive a maximum refund of $375.

How long does it take for IRS to approve refund after it is accepted 2022?

(updated July 7, 2022) We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return.

Why has my refund been accepted but not approved?

An incomplete return, an inaccurate return, an amended return, tax fraud, claiming tax credits, owing certain debts for which the government can take part or all of your refund, and sending your refund to the wrong bank due to an incorrect routing number are all reasons that a tax refund can be delayed.

When can I expect my refund from TurboTax 2022?

The IRS issues more than 9 out of 10 refunds in less than 21 days. TurboTax Product Support: Customer service and product support hours and options vary by time of year.

How long does it take for state tax refund direct deposit 2022?

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive.

Track My Tax Refund | Georgia.gov

Your tax refund will be either electronically deposited into your bank account or mailed to you as a paper check. Most tax filers should expect to receive their refund electronically deposited into their bank account, unless otherwise noted on their returns.

Where's My Refund? | Georgia Department of Revenue

The .gov means it’s official. Local, state, and federal government websites often end in .gov. State of Georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the address.

2022 Tax Refund Schedule: When Will I Get My Refund? - SmartAsset

If you’re like most people, you dread tax season. But if you’re expecting a tax refund, you may have something to look forward to. Most people will get their tax refund within three weeks of filing, but it varies based on how you file and how you get your refund.

Where's My Refund? Check the Status of My Tax Return | USAGov

Find out if the IRS received your tax return and check the status of your refund. Learn why your tax refund could be lower than you expected.

Income Tax & Refunds | Georgia.gov

The .gov means it’s official. Local, state, and federal government websites often end in .gov. State of Georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the address.

Refunds | Georgia Department of Revenue

Information on Georgia tax refunds for corporate, individual, motor fuel, sales and use, and withholding taxes.

How long does it take to get a Georgia tax refund?

If a return contains incorrect or questionable information, it may take up to 90 days from the date of receipt by DOR to process a return and issue a refund. All first-time Georgia income tax filers, or taxpayers who have not filed in Georgia for at least five years, will receive a paper check. Read Georgia Tax Facts for important tax information ...

How to check on my tax refund?

Check the status of your refund online using Where's My Refund ? 1 We will begin accepting returns January 27, 2020. 2 Most error free, electronically filed returns are processed within 5 business days of receiving the return and most refunds are issued within 21 days from the date a taxpayer files their return. 3 If a return contains incorrect or questionable information, it may take up to 90 days from the date of receipt by DOR to process a return and issue a refund. 4 All first-time Georgia income tax filers, or taxpayers who have not filed in Georgia for at least five years, will receive a paper check. 5 Read Georgia Tax Facts for important tax information and to learn more about what we are doing to protect Georgia taxpayers against fraud.

When will UWG refund housing plans?

Other fees will be prorated and refunded. Housing plans refunds will be prorated using March 16 as the last date of service.

When will the 2021 MBA refunds be available?

Refunds for Fall Full Term, Session I, and WebMBA courses are estimated to begin processing September 9, 2021 .

How is a refund based on a semester?

Refunds will be based on a proportional percentage determined by the number of calendar days in the Semester that the student completed along with the total number of calendar days in a Semester.

How long does it take for financial aid to be processed?

Financial aid refunds are processed within 14 days of the Financial Aid Office disbursing aid to your student account. Roster verification must be completed for your registered sessions and all your tuition, fees, and charges must be covered for your refund to be processed. Also, undergraduates must be enrolled in at least six (graduate students ...

How many credit hours do you need to get a refund for a second semester?

Also, undergraduates must be enrolled in at least six (graduate students must be enrolled in at least five) credit hours during the first session to receive your refund prior to the beginning of the second session.

How to contact UWG?

If you have any questions or concerns, please do not hesitate to contact the UWG Office of Student Accounts and Billing Services by calling (678) 839-4737 or emailing studentaccounts@westga.edu.

Does West Georgia have a student refund plan?

We cannot thank you enough for your patience as we work through new processes. In response to guidance provided by the University System of Georgia (USG), the University of West Georgia will implement a Student Refund Plan for students who have paid fees for the Spring 2020 semester. This includes housing, dining, and other appropriate fees. Please see more details below.

How long does it take to get a Georgia tax refund?

If a return contains incorrect or questionable information, it may take up to 90 days from the date of receipt by DOR to process a return and issue a refund. All first-time Georgia income tax filers, or taxpayers who have not filed in Georgia for at least five years, will receive a paper check. Read Georgia Tax Facts for important tax information ...

How to check on my tax refund?

Check the status of your refund online using Where's My Refund ? 1 We will begin accepting returns January 27, 2020. 2 Most error free, electronically filed returns are processed within 5 business days of receiving the return and most refunds are issued within 21 days from the date a taxpayer files their return. 3 If a return contains incorrect or questionable information, it may take up to 90 days from the date of receipt by DOR to process a return and issue a refund. 4 All first-time Georgia income tax filers, or taxpayers who have not filed in Georgia for at least five years, will receive a paper check. 5 Read Georgia Tax Facts for important tax information and to learn more about what we are doing to protect Georgia taxpayers against fraud.