All payment* dates

- July 15, 2022 (includes retroactive amount for April 2022)

- October 14, 2022

Full Answer

When is the next child tax credit payment?

Next child tax credit payments will begin on Monday. November 15, 2021, 9:49 AM. Parents can expect the next child tax credit payment to start hitting their bank accounts on Monday. Our goal is to create a safe and engaging place for users to connect over interests and passions.

Do Child Tax Credit payments stop when child turns 18?

The enhanced child tax credit extended the benefit to children who are 17 in 2021, but those who turn 18 during the year may not be eligible. The IRS will use 2019 or 2020 returns to determine how much money is sent but will reconcile the credit based on the age of children on Jan. 1, 2022.

When does the child tax credit end?

The push comes as the IRS has already started shutting down its child tax credit that runs out on December 31. Parents are waiting to find out if their child tax credit checks, sent out on December 17, will be their last of the relief money as Congress deliberates extending the child tax credit another year.

Does Everyone qualify for child tax credit?

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes. While the deadline to sign up for monthly Child Tax Credit payments this year was November 15, you can still claim the full credit of up to $3,600 per child by filing a tax return next year.

Is there another child tax credit for 2022?

Time is running out to claim the expanded Child Tax Credit that could bring an eligible family as much as $3,600 per child under the age of 6.

Will child tax credit be paid 2022 monthly?

As of 2022, the child tax credit has reverted to $2,000 per child under 17 with no advance monthly checks. The 2021 expanded child tax credit helped reduce child poverty by about 30% as of December, as measured by monthly income, according to the Center on Budget and Policy Priorities.

When should I expect my 2022 refund with child tax credit?

If you claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), you can expect to get your refund March 1 if: You file your return online. You choose to get your refund by direct deposit. We found no issues with your return.

Is California getting a new stimulus check in 2022?

In June, Gov. Gavin Newsom signed California's budget for 2022-2023, which includes direct payments of $350 to $1,050 for 23 million Californians—more than half of the state's residents.

Are we getting a stimulus check in 2022?

The rebate was issued in July and sent automatically to taxpayers who filed a 2021 state return. Another rebate was issued to all taxpayers. Single filers received $500, and joint filers received $1,000. This rebate was split into two equal payments, delivered in June and August 2022.

What time will the Child Tax Credit be deposited?

People who receive payments by direct deposit get their payments on the 15th of every month. (In August the payment will go out on August 13th since the 15th falls on a weekend.)

What days do refunds get deposited 2022?

2022 IRS refund schedule chartDate taxes acceptedDirect deposit sentPaper check mailedFeb. 8 – Feb. 14Feb. 21Feb. 28Feb. 15 – Feb. 21Feb. 28March 7Feb. 22 – Feb. 28March 7March 14March 1 – March 7March 14March 2123 more rows•Feb 8, 2022

Are we getting a stimulus check June 2022?

The first round of relief checks were mailed in June 2022, but checks are being sent out until the end of the year.

What day of the week does the IRS deposit refunds 2022?

They now issue refunds every business day, Monday through Friday (except holidays). Due to changes in the IRS auditing system, they no longer release a full schedule as they did in previous years.

When should I expect my California stimulus check?

If you are eligible, you will automatically receive a payment. Payments are expected to be issued between October 2022 and January 2023. For taxpayers receiving a debit card, call 800-240-0223 to activate your card.

Can I track my California relief check?

2 days agoAs the state continues to send out the direct payments, is there a way to track the progress of your check? The short answer is no, the Franchise Tax Board says.

Is California sending out stimulus checks?

Payments will be issued between this month and January. Direct deposits will be sent to residents who e-filed their 2020 state returns and received a refund from the state by direct deposit. About 90% of the direct deposits are expected to be issued in October, starting Friday.

Is Child Tax Credit monthly?

It is broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17. You'll get the remainder of the credit when you file your taxes next year.

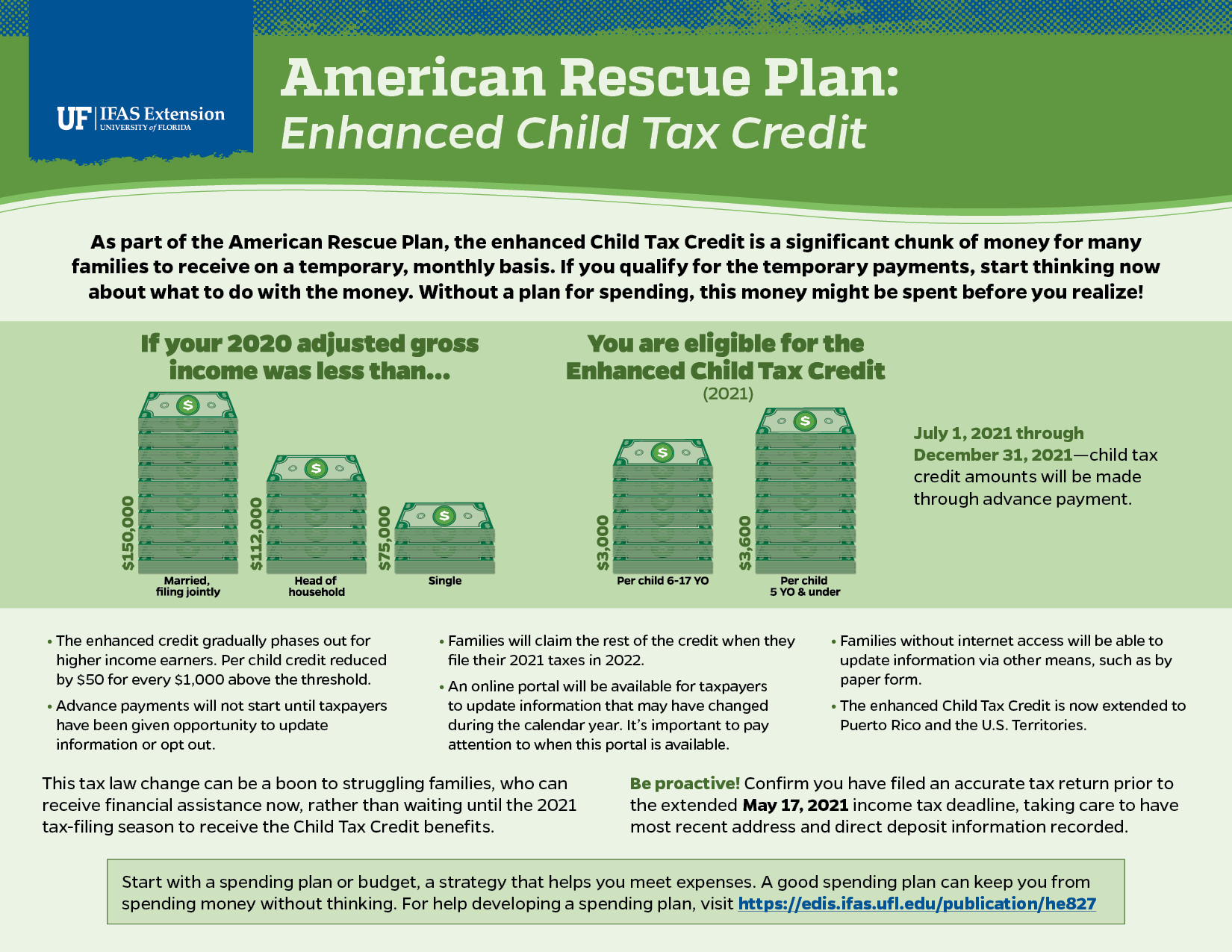

Is Child Tax Credit being extended?

The act is temporary and will expire on Dec. 31, 2025. The American Rescue Plan Act of 2021 (ARPA) temporarily expanded the child tax credit for tax year 2021 from $2,000 to $3,600 per child under age 6 and $3,000 per child up to age 17 (rather than the previous limit of age 16).

Is the Child Tax Credit ending?

That could provide some monetary relief, but the support won't last: In 2022, the CTC reverts to its earlier level, which provides $2,000 per eligible child. Full payments also only go to families who earned enough to owe taxes, which means the nation's poorest families aren't likely to qualify.

Is there a CTC payment in April 2022?

When is the next Child Tax Credit payment due? This final payment of up to 1,800 or up to 1,500 is due out in April of 2022. Those parents who received the advance payments over the second half of 2021 will still have this boost to look forward to. Some parents will receive an even larger amount, though.