In this year, 2022, those who are paid biweekly will receive 26 paychecks. If the first January paycheck was run on January 7, then there will be three paychecks distributed in April and September. If the first January paycheck was run on January 14, there will be an extra paycheck distributed in July and December.

Full Answer

How to create a bi weekly payroll calendar?

- When in Google Mail, click on ‘Calendar’

- Click on the first day & time you want the email to show up

- In the ‘Add title’ box, type in Submit time sheet (or Approve time sheets)

- Click on ‘More Options’

- Click on the ‘Does not repeat’ dropdown menu and select: Custom > Repeat every 2 weeks

- Click on ‘Done’

- Click on ‘Save’

How many pay period in one year if paid biweekly?

There are 26 biweekly pay periods in a year, whereas there are 24 semimonthly pay periods in a year. A biweekly pay cycle means that your employees are paid every two weeks, always on the same day. Biweekly payroll offers consistent pay days every month, with the added bonus of two extra pay periods.

What is bi monthly pay period?

The term "bimonthly" means that something occurs once every two months. Therefore, a bimonthly payroll means paying employees once every two months. Since this is not only illegal in many locations, but also an oppressively long pay period, a bimonthly payroll is not recommended! In many locations, the longest legally allowed payroll period is one month.

How many paychecks in a year biweekly?

Workers paid bi-weekly should receive 26 pay checks in a year. This is based on the fact that there are 52 weeks in a year. In order to calculate the number of pay periods in a year, you divide the number of weeks in a year (52) by the frequency of payroll payments. Fifty-two divided by two equals 26.

How many biweekly pay periods will there be in 2022?

26 paychecksEmployees receive 26 paychecks per year with a biweekly pay schedule.

What are the pay periods for 2022?

In this year, 2022, those who are paid biweekly will receive 26 paychecks. If the first January paycheck was run on January 7, then there will be three paychecks distributed in April and September. If the first January paycheck was run on January 14, there will be an extra paycheck distributed in July and December.

What months are biweekly paid 3 times in 2022?

If your first paycheck in 2022 is scheduled for Friday, January 7, your three-paycheck months will be April and September. If your first paycheck in 2022 is Friday, January 14, your three-paycheck months are July and December.

Why does 2022 have 27 pay periods?

For 2022, the leave year began Jan. 1, 2022 (Pay Period 02-22) and ends Jan. 13, 2023 (Pay Period 02-23) for a total of 27 pay periods. Therefore, employees may earn one additional pay period's worth of annual leave during the 2022 leave year as compared to the typical 26 pay period leave year.

How do you calculate biweekly pay?

In a year of 52 weeks, biweekly paychecks go out 26 times. To figure out the gross biweekly pay for a salaried employee, divide their annual pay by 26; if they make $52,000, for instance, the gross pay is $2,000 every two weeks. Subtract withholding and deductions from that amount to get biweekly net pay.

What years have 27 biweekly pay periods?

The number of pay weeks in a year is normally fixed when it comes to biweekly or weekly paychecks. However, in some years, such as 2021, there are 27 biweekly pay periods. This is because January first was a Friday, resulting in a total of 53 Fridays in 2021.

What months do we get an extra paycheck?

2022 Three Paycheck Months If your first paycheck of 2022 is Friday, January 7, your three paycheck months are April and September. If your first paycheck of 2022 is Friday, January 14, your three paycheck months are July and December.

Do 3 paycheck months make a difference?

Though your annual salary remains the same, your take-home income changes with the third paycheck. Those extra funds will help you get out of debt faster and save you money in interest and fees down the road.

What time does ADP direct deposit hit?

he batch cut-off time for all ADP Payments ACH processors is 5:00 PM Eastern time. Your Bank's Policy for Posting Funds to Your Account ACH Processors typically send deposits to your bank in the afternoon, and your bank posts them to your account on the next business day.

Are there 26 or 27 pay periods in 2022?

Unlike last year, 2022 will have the usual 26 pay periods for those being paid bi-weekly. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while others are paid weekly receiving up to 52 paychecks in a given year.

How do you calculate 27 pay periods?

Divide the annual payroll by 27. Subtract the result from the annual wage....For example, if the employee annual wage is $50,000.00:$50,000.00 divided by 27 = $1851.85.Subtract $1851.85 from $50,000.00 = $48,148.15.Enter $48,148.15 using Maintain Employees, Pay Info, Pay Rate, and Year.

How do you explain 27 pay periods to employees?

To simplify matters, employers should distribute the 27th paycheck during the year in which it occurs, which is the same year in which the wages are earned. Otherwise, it could magnify the confusion with pushing the 27th pay day into the following year, when the add-a-day cycle restarts.

What months in 2022 have 3 pay periods?

2022 Three Paycheck Months If your first paycheck of 2022 is Friday, January 7, your three paycheck months are April and September. If your first paycheck of 2022 is Friday, January 14, your three paycheck months are July and December.

Are there 27 pay periods in 2023?

* Note: there are 27 pay periods in leave year 2023.

What is semi-monthly pay schedule?

A semi-monthly pay schedule means pay checks are distributed two times a month, usually on fixed dates such as the 1st and 15th, or the 15th and 30th. However, they may not necessarily fall on the same day of the week, and you would end up paying your employees 24 times in a year instead of 26.

How do pay periods work?

A pay period is a time frame used to calculate earned wages and determine when employees receive their paychecks. Pay periods are fixed and most often recurring on a weekly, bi-weekly, semi-monthly or monthly basis. It's important to remember that the pay period is different from a workweek.

What Is Biweekly Pay?

A biweekly pay schedule means you pay your employees every other week on a particular day of the week. For instance, you may send paychecks out to employees every other Friday. Since one year has 52 weeks, the biweekly pay schedule has 26 pay periods during the calendar year.

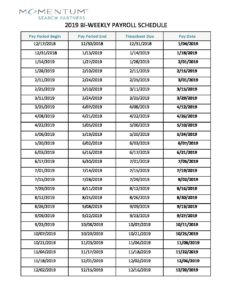

2022 Biweekly Payroll Calendar Template

In 2022, there are 26 pay dates under the biweekly schedule. Most employers use Friday as their paycheck due date since holidays such as Labor Day and Memorial Day fall on Mondays.

How To Calculate Biweekly Paychecks

Calculating paycheck amounts is relatively simple. Here’s how to do it:

Which Pay Schedule Should You Use?

When selecting which payroll schedule, there are several factors to consider—including the amount of administrative work involved, industry standards, and employee preferences. Here are the most common ones and some things you may want to consider when choosing which one to go with:

Which Months Have Three Pay Periods in Them?

Some months are longer than others, and that means payday may occur three times, instead of two. If you start your biweekly payroll schedule on Friday, January 7, 2022, your three-paycheck months will be April and September.

Why Do Some Years Have 27 Paydays?

When you use a biweekly schedule, most years have 26 pay periods. However, some years will have 27. Why is that? Well, calendar math can be complicated. Here’s why it happens. (And heads up, we’re about to get a bit technical.)

Your Payroll Process is Up to You

Choosing the right payroll schedule for your small business is important in managing your administrative work and keeping employee satisfaction up. No matter what schedule you choose, it’s helpful to have a calendar handy to plan out your paydays in advance.

What is a TEL document?from uab.edu

The TEL document is utilized by the University to process the biweekly payroll for non-exempt employees.

What is the element name for Biweekly?from uab.edu

Biweekly (non-exempt) employees use the TEL document to submit new employee orientation hours. The element name is NEO.

What is nonrecurring element pay?from uab.edu

Nonrecurring element pay is processed to compensate employees/trainees for specific duties or activities. These payments are processed using the ACT form.

Does UAB collect overpayments?from uab.edu

As a trustee of state and federal funds, UAB must aggressively collect overpayments while not jeopardizing the characteristics of the dollars originally disbursed. We deem any significant amounts overpaid to be subject to collection procedures set by Financial Affairs.

Does UAB pay employees biweekly?from uab.edu

UAB disburses pay to all campus, hospital and LLC employees and trainees either on a biweekly or monthly basis. Non-exempt employees are paid on the biweekly payroll which occurs every other Friday based on the time recorded in the Campus or Hospital Kronos system.

Why are there guidelines for out of cycle payments?from uab.edu

Reason for Guidelines: This procedure was put in place due to audit concerns surrounding the controls, justification, regulations, and business practices that are put at risk when issu ing an out-of-cycle payment.

When is an out of cycle payment made?from uab.edu

Justification for Payment: Generally, out-of-cycle payments will be made only when an employee receives less than 50% of what they should have received in the normal payroll cycle and the discrepancy resulted because of an Oracle system or Central Administration issue.

How often does Duke pay employees?

Duke University and Duke University Health System pays its non-exempt employees once every two weeks. Since biweekly employees are paid an hourly wage, their payments are based on the time submitted and paid in accordance with Duke University. pay policies.

How long does it take for payroll to be paid?

Due to the processing time required, the payment is paid to the employee two weeks after the end of the pay period.

How many hours did the employee work on March 26?

On March 26, two week after March 14, Employee A will receive his paycheck for 80.2 hours of work. For pay period of March 15 through March 28, Employee A worked 85.1 hours. Therefore, Employee A will receive his paycheck for 85.1 hours of work on April 9, which is two weeks after March 28.