How to complete schedule Form 941?

To complete a Schedule B for Form 941, you will need to provide the following information:

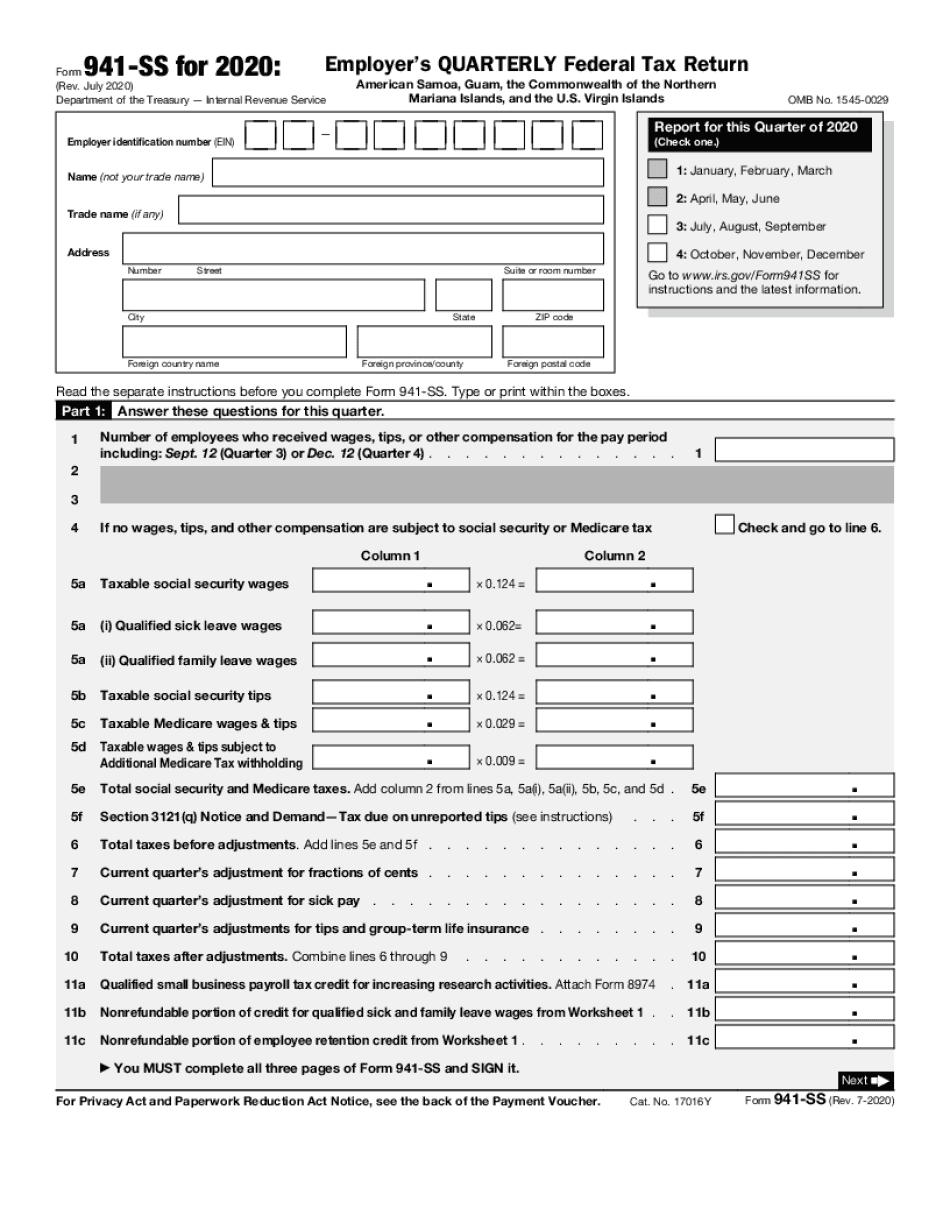

- Employer identification number (EIN)

- Name

- Calendar year

- Quarter

- For each month: break down tax liability by day and than by total amount

- Total liability for quarter

What is a Schedule B on Form 941?

What is the Form 941 Schedule B and who needs to file? The IRS Form 941 Schedule B is a tax form for reporting employer’s tax liabilities for semiweekly pay schedules. Schedule B must be filed along with Form 941.

What is the deadline for IRS Form 941?

Your 941 quarterly Form is due by the last day of the month that follows the end of the quarter: If the due date falls on any federal holiday, then the next business day will be the filing deadline. If your taxes have been deposited on time and in full, the deadline is extended to the 10th day of the second month following the end of the quarter.

When are EFTPS payments due for 941?

Forms Filed Quarterly with Due Dates of April 30, July 31, October 31, and January 31 (for the fourth quarter of the previous calendar year) File Form 941, Employer’s QUARTERLY Federal Tax Return, if you paid wages subject to employment taxes with the IRS for each quarter by the last day of the month that follows the end of the quarter.

Is there a new 941 Schedule B for 2022?

The IRS Form 941 Schedule B for 2022 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Businesses that acquire more than $100,000 in liabilities during a single day in the tax year are also required to begin filing this Schedule.

Where can I find form 941 for 2022?

Go to www.irs.gov/Form941 for instructions and the latest information. Read the separate instructions before you complete Form 941.

What goes on a 941 Schedule B?

On Form 941 (Schedule B), you must list your tax liability for each day. Liabilities include: The federal income tax you withheld from your employees' paychecks. Both employee and employer Social Security and Medicare taxes.

When filing form 941 when must a Schedule B be completed?

File Schedule B if you're a semiweekly schedule depositor. You're a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the lookback period or accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

Can I see my 941 online?

You can access your federal tax account through a secure login at IRS.gov/account.

How do I get a copy of my form 941?

Call 800-829-3676.

What is the difference between 941 and 941 Schedule B?

Form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Schedule B specifically deals with reporting federal income tax, social security tax, and Medicare tax withheld from the employee's pay.

Do you have to file Schedule B?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

Where do I mail my 941 and Schedule B?

Department of the Treasury Internal Revenue Service; Ogden, UT 84201-0005—this address is used for any business that wishes to file without a payment attached. Internal Revenue Service PO Box 37941; Hartford, CT 06176-7941—this address is for businesses that wish to include a payment with their 941 tax form.

Where do I send form 941 without payment?

Mailing Addresses for Forms 941Mail return without payment ...Mail return with payment ...Internal Revenue Service PO Box 409101 Ogden, UT 84409Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-21003 more rows

How do I file a corrected 941 Schedule B?

File your amended Schedule B with Form 941-X. The total liability for the quarter reported on your amended Schedule B must equal the corrected amount of tax reported on Form 941-X. If your penalty is decreased, the IRS will include the penalty decrease with your tax decrease.

How often does an employer complete a 941 report?

You're required to file a separate Form 941 for each quarter (first quarter - January through March, second quarter - April through June, third quarter - July through September, fourth quarter - October through December). Form 941 is generally due by the last day of the month following the end of the quarter.

Where is form 941 in Quickbooks desktop?

Select Reports, then search for the Tax and Wage Summary report. Next to Date Range select a quarter, then select Apply. Look for the totals under Federal Taxes (941/944) (Federal Withholding, Medicare Company, Medicare Employee, Social Security Company, and Social Security Employee taxes).

Is it too late to apply for the employee retention credit?

However, for wages paid by a Recovery Startup Business, the expiration date remains December 31, 2021. The ever-evolving changes in the Employee Retention Credit legislation have left many business owners wondering if they can still take advantage of the program. The good news is, it's not too late!

Is there a worksheet for the employee retention credit?

The simple answer to this question is the Employee Retention Credit Worksheet 2021. ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified. The worksheet is not required by the IRS to be attached to Form 941.

What is a 941 quarterly tax report?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

What is a 941 V?

Complete Form 941-V if you’re making a payment with Form 941. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you.

When is sick leave taxable in 2021?

Use lines 5a(i) and 5a(ii) only for wages paid after March 31, 2020, for leave taken before April 1, 2021.

What is a 941 V?

Complete Form 941-V if you’re making a payment with Form 941. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you.

What line does total liability for quarter equal?

Total liability for quarter .Total must equal line 12.You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Go to Part 3.

What is Schedule B on taxes?

On Schedule B, list your tax liability for each day. Your tax liability is based on the dates wages were paid. Your liability includes:

How long does Schedule B take?

The time needed to complete and file Schedule B will vary depending on individual circumstances. The estimated average time is 2 hours, 53 minutes.

What is a prior period adjustment?

Prior period adjustments are reported on Form 941-X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund, or Form 944-X, Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund, and aren’t taken into account when figuring the tax liability for the current quarter.

How many spaces are there in Schedule B?

Schedule B is divided into the 3 months that make up a quarter of a year. Each month has 31 numbered spaces that correspond to the dates of a typical month. Enter your tax liabilities in the spaces that correspond to the dates you paid wages to your employees, not the date payroll liabilities were accrued or deposits were made.

When did Elm Co become semi weekly?

Elm Co. became a semiweekly schedule depositor on April 24, 2021, because Elm Co. had a total accumulated employment tax liability of $112,000 on April 23, 2021. For more information, see section 11 of Pub. 15 or section 8 of Pub. 80. Elm Co. must complete Schedule B as shown next and file it with Form 941.

Why do we need Schedule B?

You’re required to give us the information. We need it to ensure that you’re complying with these laws and to allow us to figure and collect the right amount of tax.

When will Elm Co. deposit in 2021?

On April 23, 2021, and on every subsequent Friday during 2021, Elm Co. accumulated a $110,000 employment tax liability. Under the deposit rules, employers become semiweekly schedule depositors on the day after any day they accumulate $100,000 or more of employment tax liability in a deposit period.