When will Vanguard funds and ETFs distribute dividends in 2022?

View the dates that Vanguard funds and ETFs are expected to distribute dividends in 2022, including December. View the list of Vanguard funds that were expected, as of October 31, 2022, to distribute taxable capital gains in December 2022. View the dates that Vanguard funds and ETFs are expected to distribute dividends in December 2022.

What is the Vanguard fund CUSIP ticker 2022 record date?

VANGUARD FUND CUSIP TICKER 2022 RECORD DATE 2022 REINVEST AND/OR EX-DIVIDEND DATE 2022 PAYABLE DATE Total Stock Market Index Institutional Plus Shares922908355 VSMPX 3/21/22 3/22/22 3/23/22 6/21/22 6/22/22 6/23/22 9/21/22 9/22/22 9/23/22 Total Stock Market Index Institutional Select Shares

Are Vanguard funds eligible for the intercorporate dividends-receiving deduction?

These Vanguard funds had ordinary income (i.e., dividend income plus short-term capital gains, if any) that qualifies for the intercorporate dividends-received deduction for corporations. This information for the fiscal year ended December 31, 2022, is included pursuant to provisions of the Internal Revenue Code for corporate shareholders only.

When did the vanguard short-term inflation-protected securities index fund ETF shares dividend increase?

The most recent change in Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares's dividend was an increase of $0.3870 on Wednesday, June 30, 2021. This page was last updated on 9/14/2021 by MarketBeat.com Staff

How often are Vanguard dividends paid?

Most Vanguard exchange-traded funds (ETFs) pay dividends on a regular basis, typically once a quarter or year.

How do I check my Vanguard dividends?

How can I keep track of transactions? You can view the dividend reinvestment status of the securities in your account online at vanguard.com or in the Holdings section of your regular Vanguard Brokerage statement. Reinvestment transactions will be reported in the Activity section on your regular brokerage statement.

How are Vanguard dividends taxed?

What's the tax rate on dividends? Dividends that are nonqualified are taxed at your usual income tax rate.

Which Vanguard dividend fund is best?

Vanguard Dividend Growth (VDIGX) is best for investors looking for reasonable dividends now who want to see the dividend payouts (yields) grow over time.

Are dividends taxed if reinvested?

When dividends are reinvested on your behalf and used to purchase additional shares or fractions of shares for you: If the reinvested dividends buy shares at a price equal to their fair market value (FMV), you must report the dividends as income along with any other ordinary dividends.

Do dividends count as income?

They're paid out of the earnings and profits of the corporation. Dividends can be classified either as ordinary or qualified. Whereas ordinary dividends are taxable as ordinary income, qualified dividends that meet certain requirements are taxed at lower capital gain rates.

When should I buy a dividend?

If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend.

Which Vanguard funds are most tax-efficient?

These are some of the best Vanguard funds for taxable accounts, in no order.Vanguard Total Stock Market Index (VTSAX)Vanguard Tax-Managed Capital Appreciation Fund (VTCLX)Vanguard Tax-Managed Balanced Fund (VTMFX)Vanguard Intermediate-Term Tax-Exempt Fund (VWITX)Vanguard Tax-Exempt Bond Index (VTEAX)

Is Vanguard exempt from federal or state tax?

For example, if you reside in California and own shares of Vanguard California Municipal Money Market Fund, the income reported on Form 1099-DIV, Box 11, is 100% exempt from California state income tax.

What Vanguard fund does Warren Buffett recommend?

Vanguard 500 Index Fund ETFBuffett revealed that his will stipulates that 90% of the money should be invested in a low-cost S&P 500 index fund with 10% in short-term government bonds. He suggested Vanguard, which operates the Vanguard 500 Index Fund ETF (VOO 2.40%).

What are the top 5 Vanguard funds?

Top Vanguard funds to buy and hold:Vanguard Total Stock Market ETF (VTI)Vanguard S&P 500 ETF (VOO)Vanguard Total International Stock ETF (VXUS)Vanguard Total World Stock ETF (VT)Vanguard Balanced Index Fund Admiral Shares (VBIAX)Vanguard 500 Index Fund Admiral Shares (VFIAX)More items...•

Which ETF pays highest dividend?

25 high-dividend ETFsSymbolETF nameAnnual dividend yieldVOOVanguard S&P 500 ETF1.24%VTIVanguard Total Stock Market ETF1.19%ITOTiShares Core S&P Total U.S. Stock Market ETF1.17%XLKTechnology Select Sector SPDR Fund0.67%21 more rows•Oct 5, 2022

Where can I find dividend information?

Sites like CNBC, Morningstar, The Wall Street Journal, and Investopedia are all great resources available for researching dividend data. For example, on Investopedia's Markets Today page, you can use the stock search tool to enter the company name or ticker symbol that you're researching.

How do I check my mutual fund dividend history?

You can get the dividend history of any open ended mutual fund scheme from this section of our website - https://www.advisorkhoj.com/mutual-funds... - Type the scheme name in the search bar and the dividend will pop for the searched scheme.

How do I know if my mutual fund pays dividends?

Types of Mutual Funds Stock funds include only investments in the stock market. If any of these stocks pay dividends, then the mutual fund also pays dividends. Similarly, bond funds include only investments in corporate and government bonds.

Are Vanguard ETF dividends automatically reinvested?

It's automatic. You're buying at various prices, averaging out the price per share over the long term. You're compounding your investment's growth by continually adding more shares which, in turn, will generate dividends of their own.

When will Vanguard funds be distributed?

The remaining taxable income or gains will be distributed in March 2021 as "supplemental" income dividends or capital gains distributions.

Does Vanguard fund have dividends?

These Vanguard funds had ordinary income (i.e., dividend income plus short-term capital gains, if any) that qualifies for the intercorporate dividends-received deduction for corporations.

Is Vanguard a dividend?

These Vanguard funds had ordinary income (i.e., dividend income plus short-term capital gains, if any) in 2021 that may qualify as interest dividends under section 163 (j).

Fund Description

The fund employs an indexing investment approach designed to track the performance of the index, which represents approximately 100% of the investable U.S. stock market and includes large-, mid-, small-, and micro-cap stocks regularly traded on the New York Stock Exchange and Nasdaq.

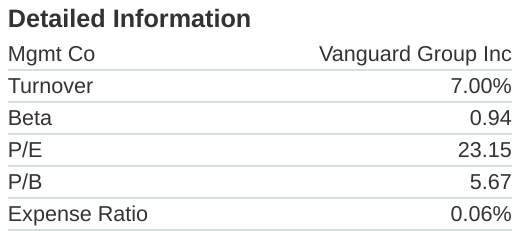

Related Fees

Turnover provides investors a proxy for the trading fees incurred by mutual fund managers who frequently adjust position allocations. Higher turnover means higher trading fees.

Walter Nejman

Walter Nejman, Portfolio Manager at Vanguard. He has been with Vanguard since 2005; has worked in investment management since 2008; and has co-managed the Communication Services Index, Health Care Index, Industrials Index, and Information Technology Index Funds since 2015. Education: B.A., Arcadia University; M.B.A., Villanova University.

What is Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares's dividend yield?

The current dividend yield for Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares (NASDAQ:VTIP) is 4.72%. Learn more

How much is Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares's annual dividend?

The annual dividend for Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares (NASDAQ:VTIP) is $2.41. Learn more

How often does Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares pay dividends?

Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares (NASDAQ:VTIP) pays n/a dividends to shareholders.

When was Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares's most recent dividend payment?

Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares's most recent n/a dividend payment of $0.9580 per share was made to shareholders on Wednesday, December 29, 2021.

Is Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares's dividend growing?

Over the past three years, Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares's dividend has not grown. It has decreased by 0.00%.

When did Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares last increase or decrease its dividend?

The most recent change in Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares's dividend was an increase of $0.0840 on Wednesday, December 22, 2021.