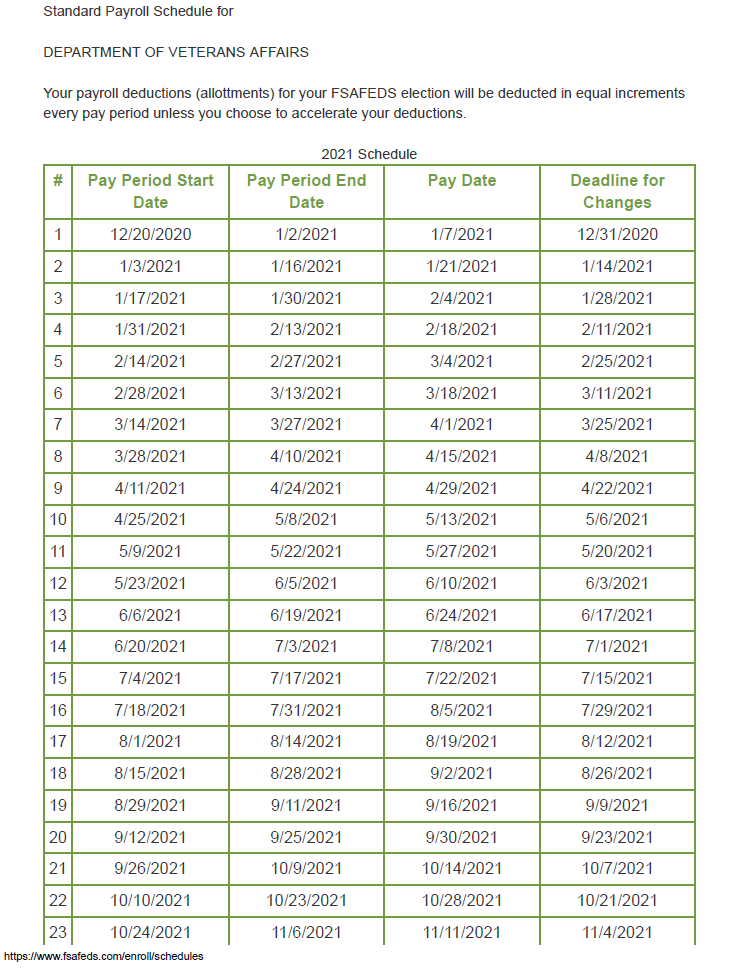

How do I add Medicare modifier to the 2022 VA fee schedule?

Open the 2022 VA Fee Schedule–All Payers file above. Identify the service to include modifier (if applicable). Identify the Medicare locality and carrier for the location where services were rendered.

What is the VA loan funding fee for 2020?

What is the VA Funding Fee for 2020? The VA funding fee is 2.3% of the amount borrowed with a VA home loan. The funding fee increases to 3.6% for borrowers who have previously used the VA loan program, but can be reduced by putting at least 5% down at closing.

What is the VA funding fee and closing costs?

Learn about the VA funding fee and other closing costs you may need to pay on your VA-backed or VA direct home loan. What is the VA funding fee? The VA funding fee is a one-time payment that the Veteran, service member, or survivor pays on a VA-backed or VA direct home loan.

What is the VA fee schedule for Community Care Network?

For the Community Care Network (CCN), when there is no Medicare rate available, the VA Fee Schedule dictates the maximum allowable rate where applicable. In the event that neither a CMS nor VA Fee Schedule rate is available, Third Party Administrators (TPAs) reimburse a percentage of billed charges.

Is the VA dental schedule public?

Is Alaska VA fee schedule an exception?

Is VA a secondary payer?

Does Alaska pay VA for non-physician services?

Is Alaska a fee state for veterans?

Does the VA pay for emergent care?

Does the VA publish fee schedules?

See 4 more

About this website

Did the VA stop charging for prescriptions?

You won't pay a copay for any medications. Note: You may be in priority group 1 if we've rated your service-connected disability at 50% or more disabling, if we've determined that you can't work because of your service-connected disability (called unemployable), or if you've received the Medal of Honor.

How much do VA prescriptions cost?

Effective February 27, 201730-day or less supply for Tier 1 (Preferred Generics) Medications for certain Veterans:$530-day or less supply for Tier 2 (Non-Preferred Generics & some OTCs) Medications for certain Veterans:$830-day or less supply for Tier 3 (Brand Name) Medications for certain Veterans:$11

What is VA fee basis?

The VA Fee Basis medical program provides payment authorization for eligible Veterans to obtain routine medical treatment services through non-VA health care providers.

Does the VA get reimbursed by Medicare?

You can have both Medicare and Veterans Affairs (VA) benefits, but Medicare and VA benefits do not work together. Medicare does not pay for any care that you receive at a VA facility. In order for your VA coverage to cover your care, you must generally receive health care services at a VA facility.

Why is the VA charging me for medication?

If you have private insurance, the VA will bill your insurance company for the cost of drugs prescribed to treat non-service connected conditions. If you cannot pay, the VA will not withhold your medications, you can work out a payment plan or apply for a waiver.

Can the VA negotiate drug prices?

In addition, VA has access to significant discounts defined by law, and can then negotiate further for lower prices. These discount prices are not available to Medicare Part D plans.

How do I get my VA fee waived?

According to VA lending guidelines, you may be exempt from the VA funding fee if: You receive VA disability compensation for a disability related to your military service. You're eligible to receive disability income for a service-related disability, but instead receive retirement or active-duty pay.

What percentage of VA funding fee is waived?

10 percentThe VA Funding Fee helps cover those losses and keeps the program available so future generations of military homebuyers can capitalize on this incredible program. But borrowers and homeowners with a disability rating of at least 10 percent are exempt from paying the VA Funding Fee.

Is the VA funding fee worth it?

But even though the VA Funding Fee can make purchasing or refinancing a home slightly more expensive, the benefits of VA loans can often outweigh the initial costs, making a VA home loan worth considering.

What happens to my VA disability when I turn 65?

Even after veterans reach full retirement age, VA's disability payments continue at the same level. By contrast, the income that people receive after they retire (from Social Security or private pensions) usually is less than their earnings from wages and salary before retirement.

How much Social Security does a 100 disabled veteran get?

The average SSDI benefit in September 2022 was $1,363 a month. VA disability compensation is determined by the rating the agency assigns to your condition. In 2022 payments for a veteran with no spouse or children can range from $152.64 per month for a 10 percent disability to $3,332.06 for a 100 percent disability.

Do spouses of 100% disabled veterans get benefits?

Did you know that the spouses of living disabled wartime veterans can also receive financial benefits? The nice thing about the financial benefits for spouses of former service members with a 100% service-connected disability is that you do not have to apply. Disability pay is separate from military retirement pay.

Does the VA pay for prescription drugs?

Enrollment in the VA health care system provides a prescription drug benefit that has been determined to be as good as the benefit provided under a Medicare prescription drug plan. As a result VA enrollment provides “creditable coverage” for Medicare Part D purposes.

Can VA prescriptions be filled at any pharmacy?

Otherwise, VA is not authorized to fill prescriptions written by non-VA providers. If a non-VA provider has prescribed a medication, a VA physician may elect to re-write the prescription(s) providing the veteran is enrolled in the VA's healthcare system and receiving treatment at that facility.

Does the VA give prescriptions?

The VA pharmacy service provides prescription benefits to veterans enrolled in the VA health care system.

Will the VA pay for prescriptions from non-VA doctors?

VA cannot fill prescriptions that are written by private physicians. Will the VA pay for a prescription filled at a non-VA pharmacy? No. VA is not responsible for payment of outside physician's fees or medication.

Physician Fee Schedule Look-Up Tool | CMS

Flu Shots. Get payment, coverage, billing, & coding information for the 2022-2023 season. You can now check eligibility (PDF) for the flu shot. We give information from claims billed in the last 18 months: CPT or HCPCS codes; Dates of service; NPIs who administered the shots

Payer Rates and Charges - Community Care - Veterans Affairs

Payer Rates and Charges. Reasonable Charges are based on amounts that third parties pay for the same services furnished by private-sector health care providers in the same geographic area.

Physician Fee Schedule | CMS

Calendar Year 2023 Proposed Rule. CY 2022 Physician Fee Schedule Update. CMS issued the CY 2022 Medicare Physician Fee Schedule (PFS) final rule that updates payment policies, payment rates, and other provisions for services. See a summary of key provisions, effective on or after January 1, 2022: Revises telehealth services under the Consolidated Appropriations Act, 2021; allows use of audio ...

Virginia Medical Fee Schedules

Effective 01/01/2022: 2022 Medical Fee Schedules 2022 MFS Ground Rules Effective 01/01/2020: 2020 Medical Fee Schedules 2020 MFS Ground Rules The Medical Fee Services Department will establish and maintain medical fee schedule quality standards for the Virginia Workers’ Compensation Commission. The department will provide direction, training and information to the public on

Fee schedules | Department of Veterans' Affairs

Fee schedules. If you are a health provider we may pay you to treat our clients and their dependants. Our schedule of fees lists what we will pay you.

Provider Claims Quick Reference Guide - TriWest

We would like to show you a description here but the site won’t allow us.

What is VA funding fee?

The VA funding fee is a government fee applied to many VA purchase and refinance loans. Here we take a deep dive into why this fee exists, how much it costs and who is exempt from paying.

What is the VA funding fee for cash out refinance?

Unless otherwise exempt, the VA funding fee for borrowers using the VA streamline refinance (IRRRL) is 0.5 percent regardless of service history or prior usage. The funding fee for a Cash-Out refinance is similar to a VA purchase loan, except borrowers cannot lower the VA funding fee by making a down payment or using equity.

What is the VA funding fee for the VA IRRRL?

Unless otherwise exempt, the VA funding fee for borrowers using the VA streamline refinance (IRRRL) is 0.5% regardless of service history or prior usage.

What are the benefits of VA?

Those exempt from paying the VA funding fee include: 1 Veterans who receive compensation for service-connected disabilities 2 Veterans who would receive disability compensation if they didn't receive retirement pay 3 Veterans rated as eligible to receive compensation based on a pre-discharge exam or review 4 Veterans who can but are not receiving compensation because they're on active duty 5 Purple Heart recipients 6 Surviving spouses who are eligible for a VA loan

How much down payment do you need to pay for VA loan?

Though not required, both first-time and subsequent purchasers can decrease the funding fee with a minimum 5% down payment.

What happens if two veterans contribute to a VA loan?

If two veterans contribute entitlement, but one of them is exempt from paying the funding fee, the funding fee on their loan is cut in half. If the same set of veterans seek a VA loan, but the exempt veteran is not contributing entitlement, their loan would carry the full funding fee. Last, VA loan assumptions come with a 0.5 percent funding fee.

Can you get a VA loan with two veterans?

When two veterans with VA loan entitlement get a loan together, the funding fee is still in play. But it can wind up working a bit differently in these relatively uncommon cases. A primary consideration is who's contributing VA loan entitlement .

What is VA funding fee?

The VA funding fee is a one-time payment that the Veteran, service member, or survivor pays on a VA-backed or VA direct home loan. This fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance.

What is the VA loan number?

If you think you're eligible for a refund, please call your VA regional loan center at 877-827-3702. We’re here Monday through Friday, 8:00 a.m. to 6:00 p.m. ET.

Can you add VA funding fee to refinance?

You should know that adding the VA funding fee and other loan costs to your loan could lead to you owing more money than the fair market value of the home. This could reduce the benefit of refinancing since your payment wouldn’t be as low as you may want it to be.

Does the VA funding fee change based on down payment?

Note: The VA funding fee rate for this loan doesn’t change based on your down payment amount or whether you’ve used the VA home loan program in the past.

Do you pay the first time funding fee on a VA home loan?

Note: If you only used a VA-backed or VA direct home loan to purchase a manufactured home in the past, you’ll still pay the first-time funding fee.

Who is a dependent spouse of a veteran?

The surviving spouse of a Veteran who died in service or from a service-connected disability, or who was totally disabled, and you're receiving Dependency and Indemnity Compensation (DIC), or

Do you have to pay the VA funding fee on a manufactured home?

If you used a VA-backed or VA direct home loan to purchase a manufactured home, you only need to pay the first-time use funding fee.

Payer Rates and Charges

Reasonable Charges are based on amounts that third parties pay for the same services furnished by private-sector health care providers in the same geographic area. In the past, VA used average cost-based, per diem rates for billing insurers.

Third Party Pharmacy Prescription Administrative Charge

Average national administrative cost for prescriptions for CY 2014 through CY 2020 can be viewed at Average Administrative Cost for Prescriptions.

When will copayments start again in 2021?

As of October 1, 2021 , we’re starting to collect copayments again for medical care and pharmacy services. We continue to offer options for financial hardship assistance.

What is VA claim exam?

VA claim exams (also called compensation and pension, or C&P, exams) Care related to a VA-rated service-connected disability. Care for cancer of head or neck caused by nose or throat radium treatments received while in the military. Individual or group programs to help you quit smoking or lose weight.

What is the service connected rating for free medications?

If you have a service-connected rating of 40% or less and your income falls at or below the national income limits for receiving free medications, you may want to provide your income information to us to determine if you qualify for free medications.

Do you have to pay a copay for outpatient care?

You won't need to pay a copay for outpatient care.

Do veterans have to pay copays in 2021?

Effective January 1, 2021. Note: Some Veterans don't have to pay copays (they're "exempt") due to their disability rating, income level, or special eligibility factors. Learn how we determine whether you'll pay copays.

Is the VA dental schedule public?

VA’ s dental schedule is not publicly available due to the terms of VA’s contract for compiling a dental services fee schedule. Reimbursement rates are subject to change annually and more often if required.

Is Alaska VA fee schedule an exception?

Alaska VA Fee Schedule and methodology is an exception. Alaska providers, please review the specific information below for care rendered in the state of Alaska.

Is VA a secondary payer?

VA may be a secondary payer for unauthorized emergent claims under 38 U.S.C. §1725 when balances due after primary payment are not tied to a copayment. When a third party has paid on the claim and non-copayment balances remain, VA will pay the difference between 70% of the CMS rate and the amount paid by the third party. If the difference between 70% of the CMS rate and the amount paid by the third party would result in no payment by VA, VA will pay the lesser of the (1) billed charges after the third-party payment or (2) 70% of the CMS rate.

Does Alaska pay VA for non-physician services?

Physician and non- physician professional services approved through a Veterans Care Agreement (VCA) and rendered in Alaska will be paid by VA at the lesser of (1) billed charges or (2) Non-CCN VCA R5 Alaska Professional Fee schedule.

Is Alaska a fee state for veterans?

Certain services provided to Veterans in the community in the state of Alaska are subject to specific fee schedules. These account for the unique cost of providing care in that geographic area.

Does the VA pay for emergent care?

§1725, if eligibility criteria is met and the Veteran is personally liable for the payment of the care. To be eligible for VA primary payment, any and all third-party payment must be exhausted.

Does the VA publish fee schedules?

VA publishes fee schedules annually and may publish additional updates as appropriate. To get the latest updates on VA community care and the latest fee schedule rates, please sign up for VA Provider Advisor newsletter.

VA Appraisal Fee Schedules and Timeliness Requirements

Fee and Timeliness Announcement

- Due to the unprecedented demand for appraisal services, some market areas have seen dramatic increases in appraisal fees. VA is aware of this and considers some fees and timeliness to be a temporary reaction caused by market demand. As a result, VA has increased appraisal fees and extended timeliness requirements in some markets facing a high demand for appraisal services…

High Demand Counties

- Several counties across the nation have be identified as High Demand Counties, counties in which the increased demand for appraisal services has created shortage of available appraisers. While VA considers this to be a temporary market fluctuation, appraisal fees have been increasedin these counties to reflect the increased demand in this seller’s market. *The fees and timeliness i…

Liquidation Appraisal

- Appraisers are no longer authorizedto charge an additional $50 above the fee indicated in the table. Liquidation appraisal timeliness is the same as typical assignments in the geographical area.

Cancelled Assignments

- Lenders must notify the assigned VA appraiser and the VA office of jurisdiction when an order has been cancelled. Notification is to be made via email – notes in WebLGY are not sufficient notification to VA that an assignment has been cancelled. VA allows appraisers to charge for time and work completed according to the following schedule: 1. Work completed after assignment a…

Additional Fees

- Requests for mileage fees must be approved by the Regional Loan Center (RLC) prior to the appraiser starting the appraisal. Authorized mileage fees will be charged at the rate allowed by the General Services Administration (GSA) or a flat rate approval based on unusual circumstances (i.e., weather conditions, unpassable roads, the need to use off road vehicles etc.). To determin…

Payments

- Lenders and other appraisal requestors should note that VA Form 26-1805, VA Request for Determination of Reasonable Value (Real Estate), states “On receipt of ‘Notice of Value’ or upon advice from the Department of Veterans Affairs that a ‘Notice of Value’ will not be issued, we agree to forward to the appraiser the approved fee which we are holding for this purpose.” If a p…