2022

- January Jan. 1 — New Year’s Day — Federal Reserve closed | All banks closed ...

- February Feb. 2 — Groundhog Day ...

- March Mar. 2, 9, 16, 23, 30 — Semi-weekly payroll taxes for payrolls issued Wednesday - Friday (Due one week after the payroll is issued.) ...

- April ...

Full Answer

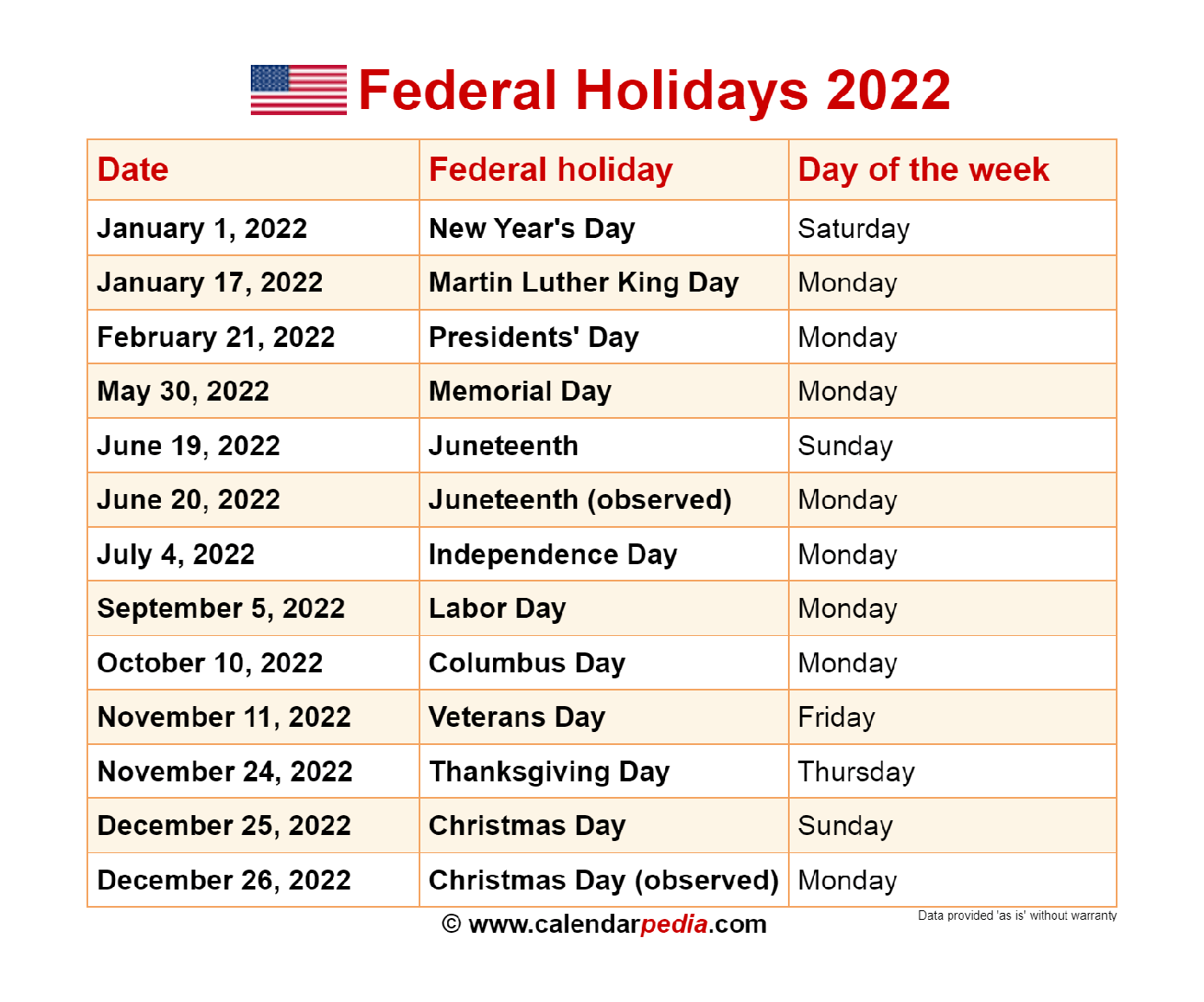

What days are considered federal holidays?

“Four Federal legal holidays are identified in 5 U.S.C. 6103(a) by a specific date: New Year’s Day, January 1; Independence Day, July 4; Veterans Day, November 11; and Christmas Day, December 25. When one of these holidays (July 4, for example) falls on a Saturday, Federal offices and other entities might observe the holiday on the preceding Friday (July 3).

What is the Federal Government General Schedule?

The General Schedule. The General Schedule (GS) is the predominant pay scale for federal employees, especially employees in professional, technical, administrative or clerical positions. The system consists of 15 grades, from GS-1, the lowest level, to GS-15, the highest level. There are also 10 steps within each grade.

What is the number of federal holidays?

Federal Holidays With the enactment of S. 475 and the creation of the Juneteenth National Independence Day, the United States now has 12 permanent federal holidays, codified at 5 U.S.C. §6103. They are, in the order they appear in the calendar, New Year’s Day, Martin Luther King Jr.’s Birthday, Inauguration Day (every four

What are all the federal holidays?

What’s a federal holiday?

- New Year’s Day: January 1

- Martin Luther King, Jr. ...

- President’s Day (George Washington’s Birthday): third Monday of February

- Memorial Day: last Monday in May

- Juneteenth: June 19

- Independence Day: July 4

- Labor Day: first Monday in September

- Indigenous Peoples’ Day (also observed as Columbus Day): second Monday in October

- Veterans Day: November 11

When do you have to deposit unemployment tax?

What does "submit" mean in Wagepoint?

Do states follow the W-2 deadline?

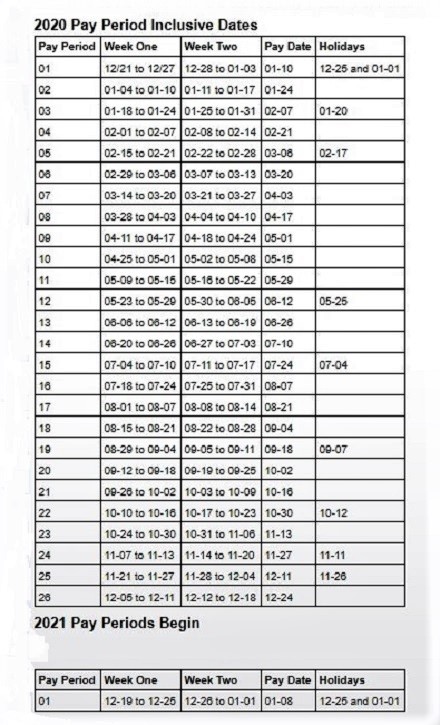

What are the pay periods for 2022?

Unlike last year, 2022 will have the usual 26 pay periods for those being paid bi-weekly. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while others are paid weekly receiving up to 52 paychecks in a given year.

What is the payroll schedule?

What is a payroll schedule? A payroll schedule determines the length of your pay period and how often you pay your employees. The most common payroll schedules are weekly, biweekly, semimonthly, and monthly. Your payroll schedule is dependent upon a few factors, including state laws and regulations.

How many times will I get paid in 2022 biweekly?

26 paychecksEmployees receive 26 paychecks per year with a biweekly pay schedule.

Is there 27 pay periods in 2022?

For 2022, the leave year began Jan. 1, 2022 (Pay Period 02-22) and ends Jan. 13, 2023 (Pay Period 02-23) for a total of 27 pay periods. Therefore, employees may earn one additional pay period's worth of annual leave during the 2022 leave year as compared to the typical 26 pay period leave year.

What is the most common payroll schedule?

Biweekly payroll This schedule is popular for hourly employees. Often employers will select a biweekly payroll schedule with a week in arrears. This means they pay their employees for a given pay period one week after the pay period has ended.

What is a monthly payroll cycle?

Monthly payroll pays employees on a specific date each month, typically the first or last day, although payday can be set to mid-month. The biggest positive of using monthly payroll is that is the easiest to calculate and has the lowest processing cost.

What months have 3 pay periods in 2022 biweekly?

2022 Three Paycheck Months If your first paycheck of 2022 is Friday, January 7, your three paycheck months are April and September. If your first paycheck of 2022 is Friday, January 14, your three paycheck months are July and December.

Do 3 paycheck months make a difference?

Though your annual salary remains the same, your take-home income changes with the third paycheck. Those extra funds will help you get out of debt faster and save you money in interest and fees down the road.

What month do we get paid 3 times 2022?

If your first paycheck in 2022 is scheduled for Friday, January 7, your three-paycheck months will be April and September. If your first paycheck in 2022 is Friday, January 14, your three-paycheck months are July and December.

What years have 27 biweekly pay periods?

The number of pay weeks in a year is normally fixed when it comes to biweekly or weekly paychecks. However, in some years, such as 2021, there are 27 biweekly pay periods. This is because January first was a Friday, resulting in a total of 53 Fridays in 2021.

Is it possible to have 27 pay periods in a year?

Thanks to the mathematical nature of a 365-day calendar year, and biweekly pay periods, every now and then there are 27, instead of 26 pay periods, in a single year. However, depending on what payroll service your agency utilizes, it's not the same year for all agencies.

How many pay periods if paid 15th and 30th?

That would be equivalent to 24 paychecks in a year or, if 5 days are accounted for separately, 25 paychecks in a year. Consistency of payday: Employees who get paid on a 2-month payroll schedule shall receive paychecks on a specific day of the month and not on a specific day of the week.

What are the types of payroll?

4 types of payroll systems (+ pros & cons)In-House Payroll. In-House payroll is most suitable for small companies with a limited number of employees, who have consistent work hours from week to week. ... Bookkeepers/CPA managed payroll. ... Agency managed payroll. ... Software managed payroll.

Is it better to get paid every week or biweekly?

Generally speaking, employees prefer getting paid more frequently because it's the best alignment of work and earnings. Hourly employees, in particular, prefer getting paychecks weekly. Weekly payroll better matches an hourly employee's cash flow needs.

When should payroll be done?

On average, employees receive their paychecks within five days of the pay period end date.

Why is a payroll calendar important?

In payroll, it is all about the dates. For employers and HR, this means deciding on a payroll schedule to dictate how frequent to pay employees. Once a payroll schedule is decided, it becomes easier to set up a payroll calendar to facilitate timely salary disbursements.

2022 Payroll Schedule Basic - United States Department of the Interior

s m t w t f s s m t w t f s s m t w t f s s m t w t f s 1 1 1 2 1 2 14 1 2 3 4 5 6 7 8 3 4 5 6 7 8 9 8 3 4 5 6 7 8 9 2 3 4 5 6 7 8 21 9 10 11 12 13 14 15 2 10 11 12 ...

2022 Holiday and Pay Calendars

The 2022 Payroll Processing Schedule, 2022 Holiday & Pay Calendar and 2022 Pay Period Schedule with Pay Dates are now available from the Bureau of Commonwealth Payroll Operations and can be found by accessing the appropriate link below.

2022 Biweekly Payroll Calendar Template

Biweekly pay periods are the most common among private employers. That’s why we’re providing a biweekly payroll calendar to help you keep track of pay periods.

2022 payroll tax calendar + deadlines and requirements | OnPay

January 15, 2022 payroll tax payments. What’s due: If you make monthly payroll tax payments, your deposit for December is due.. These funds are required to be paid via electronic funds transfer to the IRS and include federal income tax withheld and both the employer and employee portion of Social Security and Medicare taxes. They are paid either monthly or semi-weekly and you must determine ...

Payroll Schedule Calendars | U.S. Department of the Interior

Payroll Schedule Calendars for employees of agencies who receive payroll services from the Interior Business Center

When do you have to deposit unemployment tax?

Federal employment and unemployment tax deposits must be made on a business day, Monday to Friday. If a deposit is required on a Saturday, Sunday or legal holiday, you must make your deposit by the close of the following business day.

What does "submit" mean in Wagepoint?

Clicking 'submit' means you're authorizing Wagepoint to send you a year-end checklist. You can unsubscribe at any time by clicking the ‘unsubscribe’ link in any email or by contacting Wagepoint.

Do states follow the W-2 deadline?

Note: Certain states follow the federal W-2 deadlines while others have different schedules. If you are handling your end-of-year manually, you will need to verify the dates for the states in which you operate/pay employees through the appropriate state websites.

When do you have to deposit unemployment tax?

Federal employment and unemployment tax deposits must be made on a business day, Monday to Friday. If a deposit is required on a Saturday, Sunday or legal holiday, you must make your deposit by the close of the following business day.

What does "submit" mean in Wagepoint?

Clicking 'submit' means you're authorizing Wagepoint to send you a year-end checklist. You can unsubscribe at any time by clicking the ‘unsubscribe’ link in any email or by contacting Wagepoint.

Do states follow the W-2 deadline?

Note: Certain states follow the federal W-2 deadlines while others have different schedules. If you are handling your end-of-year manually, you will need to verify the dates for the states in which you operate/pay employees through the appropriate state websites.

January

- Jan. 1 — New Year’s Day — Federal Reserve closed | All banks closed 1. Note: For federal holidays with bank closures, allow at least one extra business day for direct deposit. Federal employment and unemployment tax deposits must be made on a business day, Monday to Friday. If a deposit is required on a Saturday, Sunday or legal holiday, you must make your deposit by t…

February

- Feb. 2 — Groundhog Day Feb. 2, 9, 16, 23 — Semi-weekly payroll taxes for payrolls issued Wednesday - Friday (Due one week after the payroll is issued.) Feb. 4, 11, 18, 25 — Semi-weekly payroll taxes for payrolls issued Saturday – Tuesday (Due one week after the payroll is issued.) Feb. 10 — Filing deadline: 1. Tipped incomereports due Feb. 14 — Valentine’s Day Feb. 15 — P…

March

- Mar. 2, 9, 16, 23, 30 — Semi-weekly payroll taxes for payrolls issued Wednesday - Friday (Due one week after the payroll is issued.) Mar. 4, 11, 18, 25 — Semi-weekly payroll taxes for payrolls issued Saturday - Tuesday (Due one week after the payroll is issued.) Mar. 10 — Filing deadline: 1. Tipped incomereports due Mar. 15 — Payment deadline: 1. M...

April

- Apr. 1, 8, 15, 22, 29 — Semi-weekly payroll taxes for payrolls issued Saturday - Tuesday (Due one week after the payroll is issued.) Apr. 6, 13, 20, 27 — Semi-weekly payroll taxes for payrolls issued Wednesday - Friday (Due one week after the payroll is issued.) Apr. 11 — Filing deadline: 1. Tipped incomereports due Apr. 15 — Payment deadline: 1. Monthly depositor payroll tax depo…

May

- May 2 — Quarterly filing deadline: 1. Form 941 Employer’s QUARTERLY Federal Tax Return May 4, 11, 18, 25 — Semi-weekly payroll Taxes for payrolls issued Wednesday - Friday (Due one week after the payroll is issued.) May 5 — Cinco de Mayo May 6, 13, 20, 27 — Semi-weekly payroll taxes for payrolls issued Saturday - Tuesday (Due one week after the payroll is issued.) May 8 …

June

- Jun. 1, 8, 15, 22, 29 — Semi-weekly payroll taxes for payrolls issued Wednesday - Friday (Due one week after the payroll is issued.) Jun. 3, 10, 17, 24 — Semi-weekly payroll taxes for payrolls issued Saturday - Tuesday (Due one week after the payroll is issued.) Jun. 10 — Filing deadline: 1. Tipped incomereports due Jun. 15 — Payment deadline: 1. Monthly depositor payroll tax depo…

July

- Jul. 1, 8, 15, 22, 29 — Semi-weekly payroll taxes for payrolls issued Saturday - Tuesday (Due one week after the payroll is issued.) Jul. 4 — Independence Day — Federal Reserve closed | All banks closed 1. Note: For federal holidays with bank closures, allow at least one extra business day for direct deposit. Federal employment and unemployment tax deposits must be made on a …

August

- Aug. 1 — Quarterly filing deadline: 1. Form 941 Employer’s QUARTERLY Federal Tax Return Aug. 3, 10, 17, 24, 31 — Semi-weekly payroll taxes for payrolls issued Wednesday - Friday (Due one week after the payroll is issued.) Aug. 5, 12, 19, 26 — Semi-weekly payroll taxes for payrolls issued Saturday - Tuesday (Due one week after the payroll is issued.) Aug. 10 — Filing deadline…

September

- Sep. 2, 9, 16, 23, 30 — Semi-weekly payroll taxes for payrolls issued Saturday - Tuesday (Due one week after the payroll is issued.) Sep. 7, 14, 21, 28 — Semi-weekly payroll taxes for payrolls issued Wednesday - Friday (Due one week after the payroll is issued.) Sep. 5 — Labor Day — Federal Reserve closed | All banks closed 1. Note: For federal holidays with bank closures, allo…

October

- Oct. 5, 12, 19, 26 — Semi-weekly payroll taxes for payrolls issued Wednesday - Friday (Due one week after the payroll is issued.) Oct. 7, 14, 21, 28 — Semi-weekly payroll taxes for payrolls issued Saturday - Tuesday (Due one week after the payroll is issued.) Oct. 10 — Columbus Day | Indigenous People’s Day ME, NM, SD — Federal Reserve closed | All banks closed 1. Note: Fo…