What is the Cy 2022 Medicare Physician Fee Schedule (PFS)?

CMS issued the CY 2022 Medicare Physician Fee Schedule (PFS) final rule that updates payment policies, payment rates, and other provisions for services. See a summary of key provisions, effective on or after January 1, 2022:

What is the Medicare physician fee schedule (MPFS)?

Medicare Physician Fee Schedules (MPFS) Medicare Part B pays for physician services based on the Medicare Physician Fee Schedule (MPFS), which lists the more than 7,400 unique covered services and their payment rates.

How do I Find my Medicare physician fee schedule?

If you requested these payments, learn how and when we’ll recoup them. To start your search, go to the Medicare Physician Fee Schedule Look-up Tool. To read more about the MPFS search tool, go to the MLN® booklet, How to Use The Searchable Medicare Physician Fee Schedule Booklet (PDF) .

When does the Medicare physician fee schedule final rule go into effect?

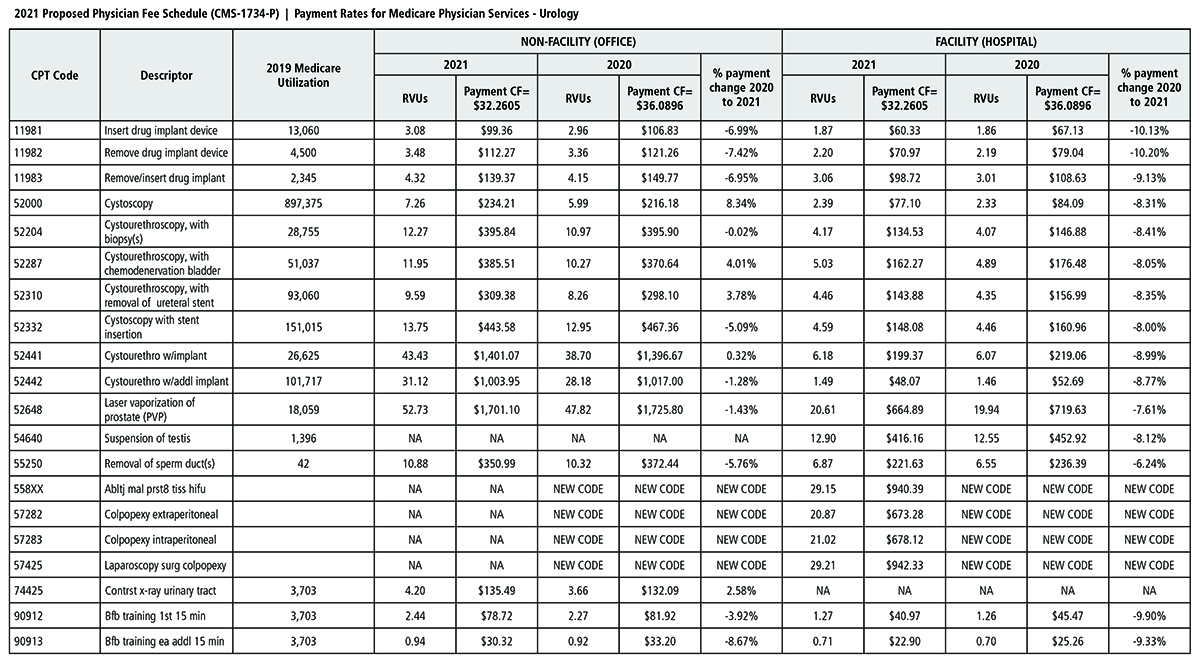

CY 2021 Physician Fee Schedule Final Rule The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

When is the Medicare Physician Fee Schedule 2020?

When will Medicare start charging for PFS 2022?

What is the MPFS conversion factor for 2021?

What is the calendar year 2021 PFS?

What is the CY 2021 rule?

When will CMS issue a correction notice for 2021?

What is the 2020 PFS rule?

See 4 more

About this website

Where can I find Medicare fee schedules?

To start your search, go to the Medicare Physician Fee Schedule Look-up Tool. To read more about the MPFS search tool, go to the MLN® booklet, How to Use The Searchable Medicare Physician Fee Schedule Booklet (PDF) .

Has the 2022 Medicare fee schedule been released?

In implementing S. 610, the Centers for Medicare & Medicaid Services (CMS) released an updated 2022 Medicare physician fee schedule conversion factor (i.e., the amount Medicare pays per relative value unit) of $34.6062.

What is the Medicare fee for 2022?

(Your state will pay the standard premium amount of $170.10 in 2022.) If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard Part B premium and an income-related monthly adjustment amount.

What is the current Medicare reimbursement rate?

roughly 80 percent"According to the Centers for Medicare & Medicaid Services (CMS), Medicare's reimbursement rate on average is roughly 80 percent of the total bill."

What are the Medicare changes for 2022?

In 2022, Original Medicare costs will increase across the board, but average Medicare Advantage premiums will be lower. Other changes include more plans that cap insulin costs, improved access to mental health care and Medicare Advantage for ESRD patients for coverage starting in 2022.

What are the cuts to Medicare in 2022?

Congress passed the American Rescue Plan Act of 2021 (ARPA) which included additional COVID-19 relief triggering PAYGO and imposing a 4 percent cut to all Medicare payment. Without Congressional intervention, the statutory PAYGO cut of 4 percent will go into effect on January 1, 2022.

How much will Medicare premiums increase in 2022?

California Health Advocates > Prescription Drugs - Blog > Why Did Medicare's Part B Premium Rise 14.5% in 2022? If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022.

Is Medicare Part B going up 2022?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $164.90 in 2023, a decrease of $5.20 from $170.10 in 2022. This follows an increase of $21.60 in the 2022 premium, largely due to the cost of a new Alzheimer's drug.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Did Medicare reimbursement go down in 2022?

Scheduled Payment Reductions to 2022 Medicare Physician Fee Schedule. Absent congressional action, a 9.75% cut was scheduled to take effect Jan. 1, 2022. *Congress has reduced 3% of the scheduled 3.75% cut to the Medicare Physician fee schedule conversion factor.

Do Medicare Advantage plans use the Medicare fee schedule?

Unlike Original Medicare, there is no definite rule about how APRNs are paid in MA. Plans may use the Fee Schedule as a reference, but they are not required to do so.

How does the reimbursement work with Medicare?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

Did Medicare reimbursement go down in 2022?

Scheduled Payment Reductions to 2022 Medicare Physician Fee Schedule. Absent congressional action, a 9.75% cut was scheduled to take effect Jan. 1, 2022. *Congress has reduced 3% of the scheduled 3.75% cut to the Medicare Physician fee schedule conversion factor.

How often is the Medicare physician fee schedule Mpfs updated?

annuallyMPFS payment is determined by the fee associated with a specific Current Procedural Terminology (CPT) code and is adjusted by geographic location. The fee schedule is updated annually by the Centers for Medicare and Medicaid Services (CMS) with new rates going into effect January 1 of each year.

Who is eligible for Medicare Part B reimbursement?

How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

Does Medicare pay for 99349?

Medicare considers home visits (99341-99345, 99347-99350) as long as it meets Evaluation & Management guidelines and is within your states' scope of practice. A home visit cannot be billed by a physician unless the physician was actually present in the beneficiary's home.

Physician Fee Schedule Look-Up Tool | CMS

Flu Shots. Get payment, coverage, billing, & coding information for the 2022-2023 season. You can now check eligibility (PDF) for the flu shot. We give information from claims billed in the last 18 months: CPT or HCPCS codes; Dates of service; NPIs who administered the shots

Calendar Year (CY) 2022 Medicare Physician Fee Schedule Proposed Rule

On July 13, 2021, the Centers for Medicare & Medicaid Services (CMS) issued a proposed rule that announces and solicits public comments on proposed policy changes for Medicare payments under the Physician Fee Schedule (PFS), and other Medicare Part B issues, on or after January 1, 2022.

2022 Medicare Physician Fee Schedules (MPFS)

By continuing, you agree to follow our policies to protect your identity. This means you won’t share your user ID, password, or other identity credentials. It also means you won’t use a computer program to bypass our CAPTCHA security check.

Fee Schedule Lookup - NGSMEDICARE

Fee Schedule Assistance. The fee schedule assistance page provides access to information about fee schedule definitions and acronyms.. National Fee Schedules. Access the CMS website to view and download the following national fee schedules:. Ambulance Fee Schedule; Ambulatory Surgical Center (ASC) Payment; Clinical Laboratory Fee Schedule

Fee schedule data files - fcso.com

This website provides information and news about the Medicare program for health care professionals only.All communication and issues regarding your Medicare benefits are handled directly by Medicare and not through this website. For the most comprehensive experience, we encourage you to visit Medicare.gov or call 1-800-MEDICARE. In the event your provider fails to submit your Medicare claim ...

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

What is the MPFS conversion factor for 2021?

CMS has recalculated the MPFS payment rates and conversion factor to reflect these changes. The revised MPFS conversion factor for CY 2021 is 34.8931. The revised payment rates are available in the Downloads section of the CY 2021 Physician Fee Schedule final rule (CMS-1734-F) webpage.

What is the calendar year 2021 PFS?

The calendar year (CY) 2021 PFS proposed rule is one of several proposed rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When will CMS issue a correction notice for 2021?

On January 19, 2021, CMS issued a correction notice to the Calendar Year 2021 PFS Final Rule published on December 28, 2020, and a subsequent correcting amendment on February 16, 2021. On March 18, 2021, CMS issued an additional correction notice to the Calendar Year 2021 PFS Final Rule. These notices can be viewed at the following link:

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When are MPFS fees due for 2020?

The CY 2020 MPFS fees have been updated by the Further Consolidated Appropriations Act of 2020. The fees are valid January 1, 2020 through December 31, 2020

What is limiting charge 2021?

2021. If you have elected to be a participant during 2021, the limiting charges indicated on the report will not pertain to your practice. The non-participating fee schedule amounts and limiting charges do not apply to services or supplies unless they are paid under the physician fee schedule.

What is Medicare Part B?

Medicare Part B pays for physician services based on the Medicare Physician Fee Schedule (MPFS), which lists the more than 7,400 unique covered services and their payment rates. Physicians' services include office visits, surgical procedures, anesthesia services and a range of other diagnostic and therapeutic services.

What is a non-facility practice expense?

The higher non-facility practice expense RVUs are generally used to calculate payments for services performed in a physician's office and for services furnished to a patient in the patient's home; facility; or institution other than a hospital, skilled nursing facility (SNF), or ambulatory surgical center (ASC). For these services, the physician typically bears the cost of resources, such as labor, medical supplies and medical equipment associated with the physician's service.

Do you have to accept assignment for Medicare?

Some practitioners who provide services under the Medicare program are required to accept assignment for all Medicare claims for their services. This means that they must accept the Medicare allowed charge amount as payment in full for their practitioner services. The beneficiary's liability is limited to any applicable deductible plus the 20 percent coinsurance. The following practitioners must accept assignment for all Medicare covered services they furnish, and carriers do not send a participation enrollment package to these practitioners. The non-participating fee schedule amounts and limiting charges do not apply to services rendered by:

Is facility based fee a separate RVU?

The facility-based fees are linked to their own separate RVUs independent of the non-facility fee RVUs. This differs from the former site-of-service fee reductions, which were based simply on a percentage reduction of the full fee rather than a separate RVU.

Do limiting charges apply to Medicare?

If you have elected to be a participant during 2020, the limiting charges indicated on the report will not pertain to your practice. The non-participating fee schedule amounts and limiting charges do not apply to services or supplies unless they are paid under the physician fee schedule. Limiting charge applies to unassigned claims by non-participating providers. All services provided to Medicare beneficiaries are subject to audit and documentation requirements.

When are MPFS fees due for 2020?

The CY 2020 MPFS fees have been updated by the Further Consolidated Appropriations Act of 2020. The fees are valid January 1, 2020 through December 31, 2020

What is the beneficiary's liability for Medicare?

The beneficiary's liability is limited to any applicable deductible plus the 20 percent coinsurance. The following practitioners must accept assignment for all Medicare covered services they furnish, and carriers do not send a participation enrollment package to these practitioners.

What is Medicare Part B?

Medicare Part B pays for physician services based on the Medicare Physician Fee Schedule (MPFS), which lists the more than 7,400 unique covered services and their payment rates. Physicians' services include office visits, surgical procedures, anesthesia services and a range of other diagnostic and therapeutic services.

What is a non-facility practice expense?

The higher non-facility practice expense RVUs are generally used to calculate payments for services performed in a physician's office and for services furnished to a patient in the patient's home; facility; or institution other than a hospital, skilled nursing facility (SNF), or ambulatory surgical center (ASC). For these services, the physician typically bears the cost of resources, such as labor, medical supplies and medical equipment associated with the physician's service.

Do you have to accept assignment for Medicare?

Some practitioners who provide services under the Medicare program are required to accept assignment for all Medicare claims for their services. This means that they must accept the Medicare allowed charge amount as payment in full for their practitioner services. The beneficiary's liability is limited to any applicable deductible plus the 20 percent coinsurance. The following practitioners must accept assignment for all Medicare covered services they furnish, and carriers do not send a participation enrollment package to these practitioners. The non-participating fee schedule amounts and limiting charges do not apply to services rendered by:

Is facility based fee a separate RVU?

The facility-based fees are linked to their own separate RVUs independent of the non-facility fee RVUs. This differs from the former site-of-service fee reductions, which were based simply on a percentage reduction of the full fee rather than a separate RVU.

Do limiting charges apply to Medicare?

If you have elected to be a participant during 2020, the limiting charges indicated on the report will not pertain to your practice. The non-participating fee schedule amounts and limiting charges do not apply to services or supplies unless they are paid under the physician fee schedule. Limiting charge applies to unassigned claims by non-participating providers. All services provided to Medicare beneficiaries are subject to audit and documentation requirements.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

What is the MPFS conversion factor for 2021?

CMS has recalculated the MPFS payment rates and conversion factor to reflect these changes. The revised MPFS conversion factor for CY 2021 is 34.8931. The revised payment rates are available in the Downloads section of the CY 2021 Physician Fee Schedule final rule (CMS-1734-F) webpage.

What is the calendar year 2021 PFS?

The calendar year (CY) 2021 PFS proposed rule is one of several proposed rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When will CMS issue a correction notice for 2021?

On January 19, 2021, CMS issued a correction notice to the Calendar Year 2021 PFS Final Rule published on December 28, 2020, and a subsequent correcting amendment on February 16, 2021. On March 18, 2021, CMS issued an additional correction notice to the Calendar Year 2021 PFS Final Rule. These notices can be viewed at the following link:

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.